3 ETFs To Buy For An Escape From The Market Turmoil

Source: Shutterstock

Traders seeking safety should check out the XLU, IYR and TLT ETFs

When it comes to picking stocks to buy, it’s getting scary out there … just in time for Halloween. How appropriate. The number of hobgoblins haunting investors is surging. We’ll get to those in a moment, but first, while some might be considering buying stocks now, there are several ETFs to buy that offer safety amid the market madness. And that’s what I intend to focus on today.

Historically they’ve offered much less volatility than the broader market, with some of them rising, while the S&P 500 was falling. That’s what the cool cats call negative correlation.

As for the themes of investors’ current nightmares, well take your pick. There’s the terrible ISM manufacturing data that points to a recession. The interminable trade war. Seasonality winds that blow bearish this time of year. And, finally, a political circus.

Sometimes said specters remain far off and powerless. Other times they turn real and topple the market. Right now is one of those “other times.”

So, let’s take a closer look at three safe ETFs to buy.

Safe ETFs to Buy: iShares Barclays 20+ Yr Treasury Bond (TLT)

Click to Enlarge / Source: ThinkorSwim

The first ideal safe haven for investors right now is a bond exchange-traded fund that is very much in a bull market right now. Specifically, the iShares Barclays 20+ Yr Treasury Bond (NASDAQ:TLT) has rallied this week while stocks have plunged. Falling interest rates and recessionary fears are the mother’s milk that powers bond bull markets. And, well, we have both in spades at this stage of the business cycle.

Strength in TLT isn’t new. It has been surging all year long and currently boasts an 18.6% gain. And that’s not even counting dividends. Its dividend yield is 2.08% and is paid out in monthly allotments.

With a price rising above the 20-day, 50-day and 200-day moving averages, it’s impossible not to like TLT’s prospects moving forward.

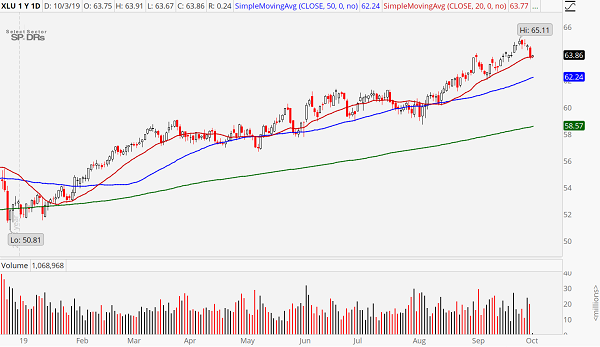

Utilities Sector (XLU)

Click to Enlarge / Source: ThinkorSwim

If you’re intent on sticking with the stock market, then defensive sectors like utilities are worth consideration. The bullish forces powering the Utilities SPDR (NYSEARCA:XLU) to a year-to-date gain of 21% are identical to the winds pushing bonds higher. Namely, falling interest rates and recession fears.

XLU is one of the top dividend-paying sectors in the market. Despite its meteoric rise this year, it still offers a smile-inducing yield of 3.08%, paid in 49 cent quarterly increments.

The Federal Reserve is expected to cut rates at least once and potentially twice by the end of the year. In either case, income seekers are going to see the already paltry yields in savings accounts, and bonds shrink even further. This eventuality is, no doubt, one of the strongest forces driving XLU to such significant gains for 2019.

This week’s pullback is providing a timely drop for lower-risk entries.

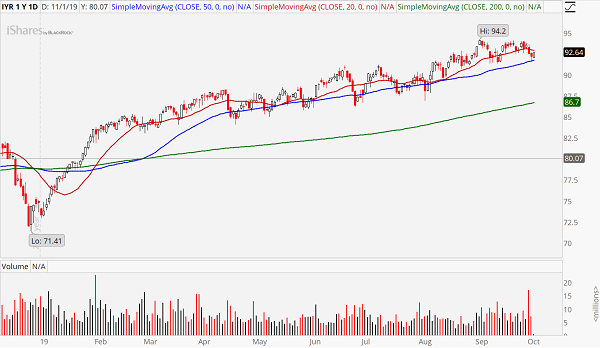

iShares US Real Estate ETF (IYR)

Click to Enlarge / Source: ThinkorSwim

Mortgage rates pulled an about-face last November and have been pushing lower ever since. And that is boding well for real estate-related investments like the iShares US Real Estate ETF (NYSEARCA:IYR). Of course, its 2.87% dividend yield doesn’t hurt matters either.

Currently, shareholders are paid 66 cents in quarterly allotments.

IYR has been following in the footsteps of XLU and TLT all year long and currently up 24% for 2019. The drivers of all three assets are the same. Falling rates and a weakening economy fuel both defensive sectors and bonds. That’s the story. Like XLU, the real estate ETF is giving you a nice pullback this week toward its rising 50-day moving average.

This is as good an entry as any we’ve seen over the past six months.

As of this writing, Tyler Craig didn’t hold any positions in any of the aforementioned securities.

See Also From InvestorPlace:

- 5 of the Best Leveraged ETFs for Short-Term Traders

- 8 Stocks to Buy Offering Both Dividends and Growth

- 10 Stocks to Buy for October

Category: ETFs