Here’s Why Your Index Funds And Bonds Won’t Keep Up Over The Next Decade

Now that we have started the 2019 fourth quarter, my thoughts have turned to the new year and new decade starting in 2020. The current stock market bull market started a decade ago (in March 2009) and the average return for the last 10 years has been 40% above the long term average. Investors who believe the stock and bond bull markets of the previous 10 years will continue into the next decade may be deluding themselves.

Now that we have started the 2019 fourth quarter, my thoughts have turned to the new year and new decade starting in 2020. The current stock market bull market started a decade ago (in March 2009) and the average return for the last 10 years has been 40% above the long term average. Investors who believe the stock and bond bull markets of the previous 10 years will continue into the next decade may be deluding themselves.

I am most worried about those who have most of their retirement wealth tied up in an IRA or 401(k), invested in exchange traded funds (ETFs) because they are “low costs”. I think there is a strong possibility for this strategy to also be “low returns” over the next decade. Let’s discuss a few points that may have investors overconfident about their portfolios in the 2020’s.

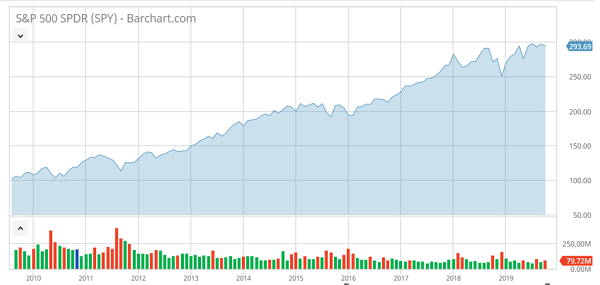

As of August 31, the average annualized return for the SPDR S&P 500 ETF (SPY) for the last 10 years was 13.29%. That’s from the bottom of the last bear market to what is currently a market near record highs. That’s a compounding return, so money invested in SPY in mid-2009 has more than tripled in value.

That 13.29% average is 40% higher than SPY’s average annual return of 9.44% since it launched in 1994. A reversion to the mean over the next decade to get the 20-year return back to average would require low single digit returns through the 2020’s. More importantly I have read a number of studies that when the market is starting from a near record level the returns going forward have been much lower than the long term averages.

The low stock market return years may already have started. Look at the 10-year chart for the SPY and you will see the ETF’s value has grown very little since the start of 2018. Since that peak in January 2018, the SPY share price is up just 4%. You can add in a couple percent per year from dividend income.

My point is, think about how you will reach your investment goals if the next decade has stock market returns on average of 2% to 4%?

Bond investing looks even more problematic than the stock market.

The 2019 drop in interest rates has produced a bull market for bond prices. The problem is that yields don’t have much room left to fall and plenty of headroom to go higher. Rising rates means falling bond prices and declining bond fund share prices. If you look at the longer term, a bond fund will end up with average returns close to the prevailing yield when the shares were purchased.

For example, the Vanguard Total Bond Market ETF (BND) has returned 10.42% over the last year (through 9/30/19) but has a 10-year average return of 3.65%. With current bond yields on average currently right at 2%, I would not expect a bond fund to do much better than 2% a year for the next decade.

To me this information about the stock and bond markets is scary stuff and I work for and with my subscribers to develop investment plans that should generate cash yields and income and not be dependent on capital appreciation to hit their 2030 investment goals. It is possible to generate 6% income yields or higher (a lot higher with some strategies), but you won’t find those yields in the world of “low cost” ETFs and index funds.

In my Dividend Hunter service, I have a recommended list of conservative dividend stocks with an average yield of 6.5%. I also give out a list of high yield stocks, with a double digit average yield and provide some fixed income investments that yield a lot more than the 2% you would get from a fund like BND.

Here are a couple of investment ideas that illustrate how much better you can do with an income focused strategy.

The Reaves Utility Income Fund (UTG) is a utilities and infrastructure closed-end fund that has paid a dividend every month since it launched in 2004 and has steadily increased the monthly rate.

UTG shares currently yield right at 6.0%.

The InfraCap REIT Preferred ETF (PFFR) is an actively managed ETF that owns preferred stock shares issued by companies organized as real estate investment trusts (REITs).

This fund is more conservative than the broader preferred stock universe, which is more conservative than dividend paying common stocks.

PFFR pays monthly dividends and yields 5.7%.

$25k = $28,762 in annual income for life

With one simple strategy, you’ll be able to take $25k from your 401(k) or IRA and turn it into tens of thousands of dollars in income every single year. You will only find the strategy FREE when you click here.

Category: Index ETFs