4 Stocks Safe From The Fed’s Next Move

Operating in a long-term bull market that doesn’t look over yet, these four stocks represent great buys for the investor looking for safety and returns. Add these stocks to your portfolio and you’ll never worry about what the Fed will do next.

Operating in a long-term bull market that doesn’t look over yet, these four stocks represent great buys for the investor looking for safety and returns. Add these stocks to your portfolio and you’ll never worry about what the Fed will do next.

Many experienced investors’ antennae were twitching in alert earlier this year as Wall Street came to an almost universal consensus. Consensus views are notorious for often being wrong.

The consensus was that inflation was coming back thanks to President Trump and that the great multi-decade bond bull market was finished.

The talking heads on the business channels were coming out of the woodwork trying to one-up each other with forecasts for higher rates. Some even said the yield on the benchmark 10-year U.S. Treasury was headed to 6%.

But a confluence of events has come together to prove the pundits know little. These events have sent investors back into bonds, sending rates lower again.

The 10-year Treasury yield is down from 2.60% to the 2.20% range. And in fact, last week saw the sharpest weekly rally in the Treasury bond market since January 2016.

Events Driving Rates Lower

There are several reasons for the rally…

First, we have geopolitics.

Fears over what could possibly happen next in Syria and North Korea have sent investors into the traditional safe havens such as U.S. Treasuries and gold, I might add.

The U.S. military dropped the most powerful bomb in its arsenal outside of a nuclear bomb on ISIS tunnels in Afghanistan. The bomb is called the GBU-43/B Massive Ordnance Air Blast (MOAB) and its nickname is the “mother of all bombs”.

Some think such bombs may be used on North Korean missile and nuclear sites.

Next, we have President Trump saying very strongly that he wants both a weak U.S. dollar and low interest rates. He dropped a not-so-subtle hint that he may keep Janet Yellen as Fed chair if low interest rates are on her menu.

And March economic statistics point to the Fed not raising rates in any great hurry.

U.S. producer price inflation showed its first actual decline since August and core U.S. consumer price inflation fell to its lowest level since late 2015. The drop in core consumer prices was the first monthly decline since January 2010.

Finally, we have the Federal Reserve itself.

A number of Fed officials have stated that it is looking to reduce its bloated $4.2 trillion balance sheet. It will do so by reinvesting the proceeds of maturing bonds back into the bond market.

This method will not raise market interest rates, as would selling bonds in the open market.

Importantly, several Fed officials have said that while shrinking the Fed balance sheet, the Fed would slow the pace of its interest rate rises. This dovetails nicely with Trump’s hope for continued low rates.

What It Means

Add all of these events up and what does it mean for investors?

It means that interest rates are not going up in any great hurry. Ignore the pundits that say the 30+ year bull market in bonds is over.

In fact, at the moment, the trend for rates is lower once again. The 10-year U.S. Treasury yield may be headed back down toward 2%.

That will bode well for bond funds since bond prices rise as yields fall. It also reinforces our message that high dividend yielding stocks are a pretty good place to be.

Interesting Investments

When looking for bond investments, keep one pertinent fact in mind: the longer the maturity, the higher the risk, but the higher the reward.

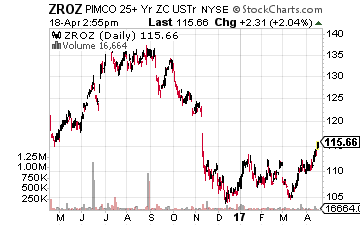

For example, the Pimco 25+Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (NYSE: ZROZ) is up 5.77% year-to-date. But is down nearly 10% over the past year and down about 20% from its 52-week high.

For example, the Pimco 25+Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (NYSE: ZROZ) is up 5.77% year-to-date. But is down nearly 10% over the past year and down about 20% from its 52-week high.

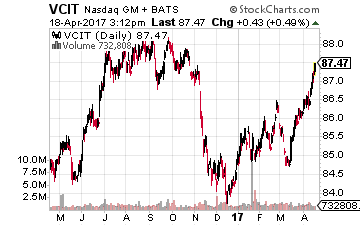

A better choice is to shorten the maturity a bit and go outside of the risk scale a bit with the Vanguard Intermediate-Term Corporate Bond ETF (Nasdaq: VCIT).

A better choice is to shorten the maturity a bit and go outside of the risk scale a bit with the Vanguard Intermediate-Term Corporate Bond ETF (Nasdaq: VCIT).

This fund invests in high-grade corporate bonds with a dollar-weighted average maturity of 5 to 10 years. Currently, the average effective maturity is 7.3 years and the yield to maturity is 3.3%. Its expenses ratio is a minuscule 0.07%.

This ETF is up 1.67% year-to-date. And it held its own during the bond market selloff right after the election (remember that Wall Street consensus trade?), showing little overall change over the past year.

Other bond ETFs are down substantially in the same time period.

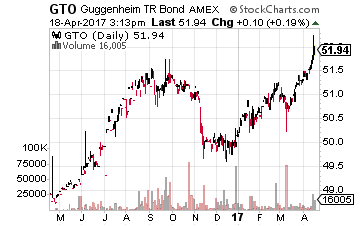

Perhaps an even better bond ETF is the fund run by bond ‘savant’, Scott Minerd – the Guggenheim Total Return Bond ETF (NYSE: GTO) with an expense ratio of 0.50%.

Perhaps an even better bond ETF is the fund run by bond ‘savant’, Scott Minerd – the Guggenheim Total Return Bond ETF (NYSE: GTO) with an expense ratio of 0.50%.

It offers a multi-sector approach and has all sorts of bonds in its portfolio: Treasuries, agency bonds, investment grade bonds, high yield bonds, bank loans and preferred stocks. The effective duration is 4.8 years and the weighted average yield to maturity is 3.78%.

This ETF has gained nearly 2.5% year-to-date and is up just over 2% over the past 52 weeks.

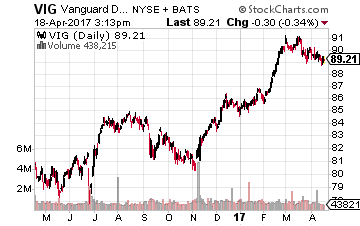

For those of you that want to stick to stocks, there is the Vanguard Dividend Appreciation ETF (NYSE: VIG). It tracks an index of stock of companies that have a track record of increasing dividends over time and has an expense ratio of a mere 0.09%.

For those of you that want to stick to stocks, there is the Vanguard Dividend Appreciation ETF (NYSE: VIG). It tracks an index of stock of companies that have a track record of increasing dividends over time and has an expense ratio of a mere 0.09%.

Its portfolio is a who’s who of U.S. blue chip stocks and yields 2.16%. The fund gained 4.17% year-to-date and 9.6% over the past 52 weeks.

These and similar ETFs should gain even further as the bond bull continues further down the road, despite pundits’ forecasts.

As I mentioned above, I believe that high-yield stocks are also a great place to be invested in right now. If you’re an investor in retirement or about to be retired I strongly recommend you check out my colleague Tim Plaehn’s investment newsletter, The Dividend Hunter.

Here’s what he has to say about it:

Avoiding the wrong kind of high-yield stock is equally if not more important than investing in the right kinds. I have made my career by helping guide investors into the right kind of income stocks that are appropriate choices for developing an income stream that they can live on as well as helping avoid potential disasters in their portfolios.

After following my guidance for a couple of months I always get email from my subscribers saying that they have stopped worrying about the daily gyrations of the stock market. Instead, they earn consistent returns, paid in the form of cash. With the right guidance, it really is that easy. All you have to do is buy shares in the stocks that I recommend and watch as they deposit money into your brokerage account multiple times a month.

Right now, there are over 20 high-yield stocks available through my Monthly Dividend Paycheck Calendar, a system for generating a recurring monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

The next critical date is Thursday, April 27th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $1,791.70 in payouts by May 17th, but only if you’re on the list before April 27th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Note: The author of this article is Tony Daltorio.

Category: Bond ETFs