5 International ETFs Worth Adding To Your Portfolio

Many investors focus heavily on individual security selection, but proper asset allocation is where you get most of the bang for your buck.

Many investors focus heavily on individual security selection, but proper asset allocation is where you get most of the bang for your buck.

There’s almost always a decent value to be found somewhere in the world. And many asset classes tend to revert to their mean- if one country outperforms another country over the course of a decade, then it’s often the opposite case next decade. This is why diversification is so critical.

Right now, the cyclically-adjusted price-to-earnings (CAPE) ratio of the S&P 500 is over 30. The average book value multiple of the S&P 500 increased more than 50%, from 2x to over 3x, in just the last five years. The ratio of total U.S. market capitalization to GDP is about 135%.

All of these metrics compared to historical norms suggest that the U.S. stock market is overvalued by 25% or more. This isn’t necessarily irrational overvaluation either, because a historically long period of extremely low interest rates have left investors with very little choice other than to pile into equities if they want decent returns. Interest-bearing investments have been hard to hold for a while with such low interest rates.

And investors are indeed piling into the market. NYSE margin debt is at an all-time inflation-adjusted high. The chart in that link shows that investors tend to enthusiastically load up on margin debt during market tops, and fearfully de-leverage themselves during market bottoms, which is the opposite of what rational behavior would be.

The world’s most successful investors of course tend to do the opposite; they get cautious when the market is highly valued. Warren Buffett has tripled his cash position over the last four years to $100 billion. Seth Klarman, one of the most successful hedge fund managers ever, is currently holding 42% cash and is giving billions back to investors because he can’t find as many good values as he would like right now.

International ETFs are Cheap

By just about every metric, the U.S. stock market is one of the most expensive in the world.

This is partially justified due to our large technology sector and our highly diversified and robust economy, but only to a certain extent. Now that we’re more than 8 years into the third-longest U.S. economic expansion in U.S. history, it’s important to be cautious.

Fortunately, some international markets are cheaper, and have already gone through significant corrections.

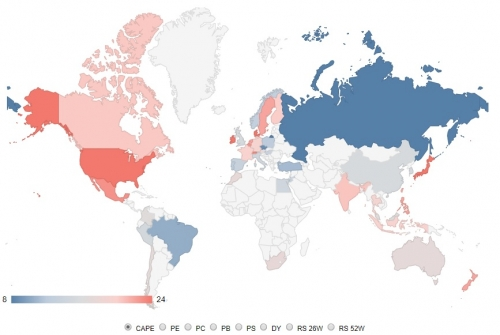

Here’s a color-coded chart of the various market valuations in the world:

Source: Star Capital

While I still hold considerable exposure to U.S. equities, I’ve been increasing my international exposure over the last few months to diversify away from the American stock market and into more reasonably-valued and higher-yielding foreign markets.

5 International ETFs Worth Buying

Low cost index funds provide plenty of easy ways to invest globally, and here are five that I consider some of the most useful for diversification. I don’t necessarily recommend buying all five; it depends what your current investments are, and most likely a subset of these can help you round out your diversification by quite a bit.

Vanguard Total International Stock ETF (VXUS)

- Expense Ratio: 0.11%

- Current P/E Ratio: 15.5

- Top 3 Countries: Japan, UK, Canada

If you could only buy one international ETF, this would be one of the top contenders.

With exposure to developed and emerging markets for a very cheap cost, it’s a one-stop shop for international exposure.

The only real downside of the fund is that a full 17% of it is invested in Japan, which has a declining population and has had a 30-year bear market. It’s one of the few markets where long-term investing hasn’t worked out; the market is lower today than it was in 1989. That’s one reason I’m not a fan of pure market capitalized weighting in international funds; the result is a heavy concentration in the largest countries rather than more even diversification across the world.

Fortunately, owning another foreign ETF or two can help balance that problem out.

iShares International Select Dividend ETF (IDV)

- Expense Ratio: 0.50%

- Current P/E Ratio: 13.5

- Top 3 Countries: UK, Australia, France

I always like to own one international dividend ETF, partially because I like the regular income, but mainly because adding a dividend metric to the selection criteria drastically changes the countries the ETF is weighted in. This helps balance out pure market capitalization weighted funds.

For example, foreign ETFs with a dividend requirement tend to have very little exposure to Japan, while foreign ETFs that are weighted purely by market capitalization tend to have Japan as by far their largest holding. By owning both a regular foreign ETF and a dividend foreign ETF, you can have a more even balance across major countries with less concentration in any given country.

The biggest downside for dividend ETFs is that they usually have higher expense ratios. The good news, though, is that IDV offers a dividend yield of nearly 4%.

Vanguard International High Yield ETF (VYMI)

- Expense Ratio: 0.32%

- Current P/E Ratio: 14.1

- Top 3 Countries: UK, Switzerland, Australia

Another good international dividend ETF is this high-yielder from Vanguard.

It holds over 900 companies and yields over 3%, yet still manages to have a fairly low expense ratio due to Vanguard’s inherent competitive cost advantages.

Vanguard FTSE Emerging Markets ETF (VWO)

- Expense Ratio: 0.14%

- Current P/E Ratio: 15.1

- Top 3 Countries: China, Taiwan, India

Emerging markets usually have higher volatility than stocks from developed markets, but give strong returns over time. Over the last decade, emerging markets started off highly valued and due to reversion to the mean, they’ve had rather flat performance for a decade straight while the U.S. market has surged upward.

But now that they’re at reasonable valuations, I’m bullish on emerging markets over the next decade.

The biggest drawback to broad emerging markets funds is that, due to weighting by market capitalization, they tend to concentrate heavily in China. This particular fund has 30% exposure to China, and another 15% and 12% to Taiwan and India respectively.

iShares MSCI Brazil Capped ETF (BRZ)

- Expense Ratio: 0.63%

- Current P/E Ratio: 14.5

- Top 3 Countries: Just Brazil

The downside of individual country ETFs is that their expense ratios are a bit higher, but on certain occasions it can be worth it. And I believe this may be one of those occasions.

As described above, emerging markets funds tend to concentrate heavily in Asia, and specifically China, and have very little exposure to South America. Single country ETFs like this one for Brazil can help balance that out.

Depending on how you measure it, Brazil is somewhere between the 7th and 9th largest economy in the world. But the Vanguard emerging market index fund only has 8% exposure to it, and the broad Vanguard total international market index fund has less than 2% exposure to it.

Between 2014 and 2017, Brazil had its worst recession in national history, which it just now appears to be emerging from. Valuations are low, the dividend yield is decent, and I believe there is considerable upside potential over the next decade if you can stomach the volatility.

Bringing It All Together

Personally, I own a developed market index fund in my primary retirement account, which is the only international option available from my employer. It’s heavily focused in Japan and doesn’t have any emerging markets exposure.

So, in my other accounts, I balance that out by owning an international dividend ETF, an emerging markets ETF, and a couple single country ETFs.

The best international ETFs for you will depend on what your other holdings are, and what you feel comfortable with. The main things to check are:

- How much foreign exposure do you have in total?

- Is your foreign exposure more concentrated than you realize?

- What is your ratio between developed and emerging markets?

Answering those questions can help you select the right funds for you. When possible, pick the funds with the lowest expense ratios that meet your needs, and try to avoid having too much overlap between funds.

Disclosure: As of this writing the author holds shares of IDV and BRZ, and a variety of other international stocks and funds.

Note: This article originally appeared at Modest Money. The author of the article is Lyn Alden. Lyn is an engineer and investor with a graduate degree in engineering management, and much of her career has been in technical procurement, project management, and budget planning. She has over a decade of investment experience with a focus on income-producing assets.

Category: Foreign Market ETFs