7 Of The Best ETFs To Buy For A Rock-Solid Portfolio

Source: Shutterstock

These are among the best ETFs for both growth and income

The U.S. economy and markets are providing a collection of tailwinds for specific industries and investments. And it is resulting in a buoyant general stock market that has the S&P 500 Index up 11.25% year-to-date.

But rather than just betting on the general stock market, I have a collection of market segments that will help you construct a better overall portfolio for growth and income, all with less risk and better-balanced returns for the year.

Specifically, I’m talking about a few key exchange-traded funds (ETFs) to buy. With that said, let’s dive into the best ETFs to buy for specific sectors.

Source: Bloomberg

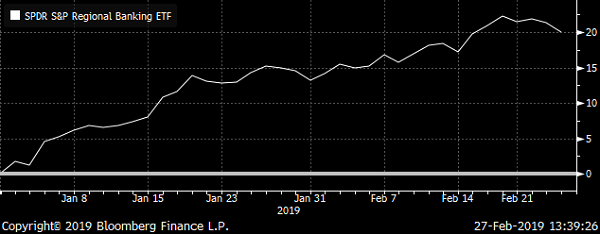

Banks

I’ll start with one of the most stellar market segments that you’ve probably been ignoring: regional banks. Mention regional banks and many investors will yawn and look away, but this is not only one of the best performing segments of the stock market, but also one of the cheapest values right now. Here’s the lead, the regional bank stocks embodied in the KBW Regional Bank Index as synthetically represented in the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) has generated a YTD return of 20.88%.

That’s of course more than twice the S&P Index and there is more to come. Banks have been hobbled by legislative and administrative regulation over the past decade following the financial crisis of 2007-2008. The result has been that banking became a treacherous business resulting in the high-cost of loan origination as well as other consumer and business bank products. But last year saw a series of legislative reforms as well as administrative changes to provide relief for banks — particularly for regional and smaller banks.

In addition, with the Federal Reserve Bank’s Open Market Committee (FOMC) working to guide interest rates to more normalized levels, banks have begun to have breathing room to better price deposits and loans resulting in higher net interest margins.

Then there is the Tax Cuts & Jobs Act of 2017 (TCJA), which has resulted in improving net profitability for domestic banks.

The stock market didn’t really care until now. But since many of the quality banks in the KRE ETF are still valued at either discounts or smaller premiums of book value than traditionally valued, banks are still very good value.

Source: Bloomberg

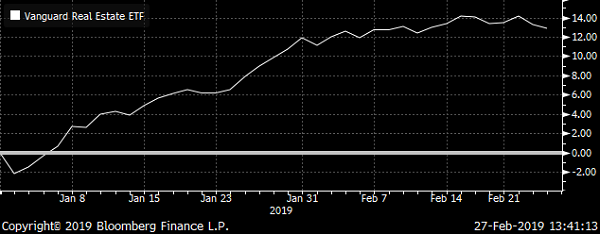

REITs

Next up is another market segment that’s done better than the S&P 500 for the year while continuing to provide better performance over last year as well. Real estate investment trusts (REITs) continue to benefit from the stronger U.S. economy, which fosters demand for properties and supports rising lease income. The result is that REITs are being recognized for their underlying good assets on top of the higher yields offered.

One of the best REIT ETFs to buy is the Vanguard Real Estate ETF (NYSEARCA:VNQ). This ETF has exposure to some of the best REITs in the U.S. market. The YTD return is running at 11.87%. Moreover, REITs, much like banks noted above are still valued at a lower price-to-book ratio than tradition levels pre-2007. Add in the additional benefit of the TCJA providing individual investors with a 20% deduction of taxable income from REIT dividends and the REIT space looks even more lucrative.

Source: Bloomberg

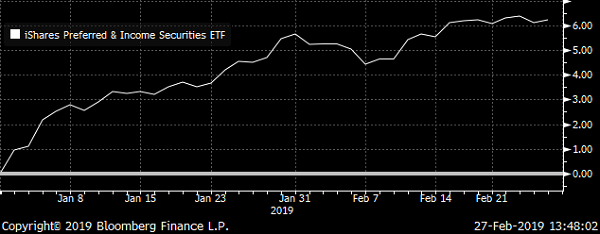

Preferred Stock

Similar to the other investment segments above, preferred stock is another overlooked sector of the market. Preferred stock provides a bond-like investment with higher established dividend yields that can be depended upon for income in any portfolio. And they also provide a good backstop for portfolios when, not just if, the general common stock market takes a pause or worse.

Preferred stocks are faring well so far this year. And one of the easiest means for “synthetically” investing is in the iShares Preferred & Income Securities ETF (NASDAQ:PFF). The ETF has turned in a YTD return of 6.20%. And it offers a nice dividend yield currently running at 5.61%.

Source: Bloomberg

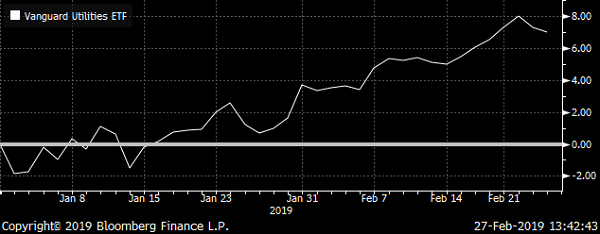

Utilities

Utilities also provided a good alternative to the general stock market’s downturns last year. And so far this year, utilities continue to perform well. Utilities are typically structured between regulated and unregulated business units. The regulated businesses provide core local essential services with rate charges and margins set by local public utility commissions (PUCs). This provides dependable profits that form the base for reliable dividends making utilities good hedges for vacillating general stock markets.

The unregulated businesses are typically ancillary activities on a national or global scale often involving power generation and transmission or pipeline operations. It is this side of the utilities that provides companies and their shareholders with further growth opportunities as well as higher dividend distributions.

One of the best ETFs to invest in the utilities segment is the Vanguard Utilities ETF (NYSEARCA:VPU). The ETF has a YTD return of 7.02% and provides exposure to a great collection of utilities with regulated and unregulated business units. In addition, it also generates and pays a nice dividend along the way currently yielding 3.22%.

Source: Bloomberg

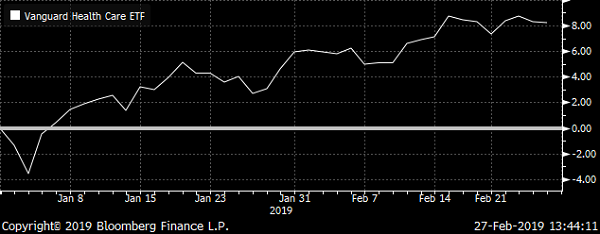

Healthcare

The U.S. is a nation that is aging and becoming ever less healthy. This isn’t a good mix for one of the leading economies of the planet. In a recent study by the U.S. Department of Commerce and the U.S. Census, by 2035, which is not that far away, it is projected that 78 million folks will be 65 years or older. And by that same year, those at or under the age of 18 years will be 76 million.

This will be a significant change in the demographics of the nation, which has traditionally been a younger nation with more healthy and able folks to produce more for the economy.

And it gets worse when it comes to the health of the overall population whether old or young. The Mayo Clinic recently released its extensive study of the health of the population and is saying that 3% or less is living a healthy lifestyle. This is not surprising as all that it takes is to take a stroll around many neighborhoods around the nation and do some people watching. We are a nation of fatter people that don’t look like they could run up a flight of stairs let alone walk up one.

The U.S. Center for Disease Control (CDC) just released a study and survey that indicates that 36.50% of the U.S. population is obese. This sets up the nation for more diabetes and all of the ancillary health effects of that disease. And then there is heart health and its complications. And if you’re obese, slipping and falling is easier to do resulting in more injury risks.

Add in a high poverty rate which can lead to further health challenges for young and old and other factors showing health troubles, including infant mortality and the nation doesn’t look too healthy.

And of course, last year we saw that life expectancy in the U.S. population stopped seeing improvements with some segments dropping in life years still to come. And as we know, the end of the line is where healthcare really ramps up to keep those alive a bit longer.

No wonder that healthcare spending is big in the U.S. and climbing quickly. According to the U.S. Centers for Medicare and Medicaid Services (CMS), healthcare spending increased in 2017 by 3.90% to $3.9 trillion or $10,739 per person. This represents 17.90% of the then gross domestic product of the U.S. (GDP).

And it is getting worse. The CMS projects that spending between 2017 through 2016 will continue to rise by an average annual rate of 5.50%, reaching $5.7 trillion. And given projections for GDP for the period, that would come closer to 20% of the overall economy.

Now this isn’t good news for the U.S. population, but it does provide for a silver lining for us as investors as investing in health is a good source for income and gains, even though they come from the increasingly ill of the economy.

One of the best ways to get general exposure to the healthcare market is through the Vanguard Health Care ETF (NYSEARCA:VHT). This ETF has generated a YTD return of 8.11% and provides for well-diversified exposure to the leading healthcare stocks in the U.S. market.

Source: Bloomberg

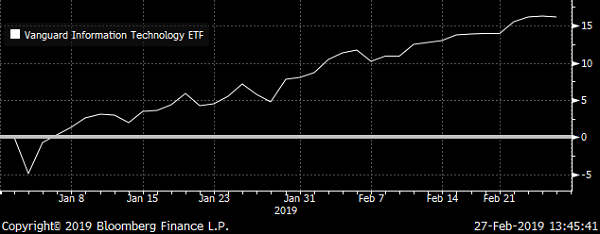

Information Technology

Information technology continues to be one of the more exciting market segments that is easy to grab the attention of individual investors. After all, who doesn’t like the latest new gotta-have gadgets whether in hand-held devices or the latest apps. This segment has plenty of companies that grab headlines and consumers’ interest year in and year out.

But one of the bigger stories isn’t just about the next new-new thing, but rather the new way of making profits. More technology companies are moving away from depending on unit sales of gizmos and apps and more toward subscription sales. This is resulting in the rise of recurring income, which is not only more reliable than one-off unit sales, but it also provides the ability for technology companies to build-up their technology empires with more certainty.

The result is that the companies in this space that have been successfully shifting to recurring income are driving more profits and better performing shares. That was the case last year in the segment generating positive returns, but also so far this year.

The easy way to invest in the best of the information technology segment is in the Vanguard Information Technology ETF (NYSEARCA:VGT). This ETF has generated a YTD return of a whopping 15.98% and given the demand for the underlying products and services including for cloud computing and the emergence of fifth-generation wireless communications (5G), this segment and the ETF should remain in the green for the year.

Source: Bloomberg

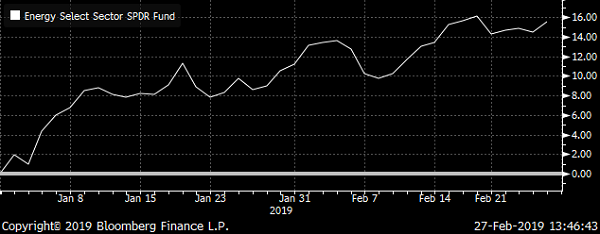

Oil & Gas

Oil and gas remain a lucrative market as the U.S. continues to emerge as the world’s leading producer of the petrol patch. Global demand remains robust for crude oil and refined products and natural gas particularly in more easily transportable liquified natural gas (LNG) is driving profits for U.S. companies.

In addition, the softer pricing, particularly for crude oil, prior to last year provided the incentive for producers to increase their field exploration and production (E&P) efficiencies. This, in turn, is providing for profitability, even at lower crude oil and natural gas prices.

And one of the limitations for U.S. companies has been the lack of additional capacities in pipeline and marine terminal facilities for both oil and gas. But thankfully to the current administration, approvals have spurred additional and expanded lines and facilities providing for more deliverable petrol for more cashflows for U.S. companies.

And then we have the Organization of Petroleum Producing Countries plus Russia (OPEC+). OPEC+ has come through with production limits which is also aiding petrol prices and operating margins for U.S. petroleum companies.

The best ETF to invest in this segment is the Energy Select Sector SPDR ETF (NYSEARCA:XLE). This ETF has exposure to the up, down and midstream petrol companies. And it has generated a great YTD return of 15.29% with many inside the market segment still valued at lower levels of underlying book and trailing sales. Add in the dividend yield of 3.22%, and it makes for another in my collection of best ETFs for growth and income.

Neil George is the editor of Profitable Investing and does not have any holdings in the securities mentioned above.

See Also From InvestorPlace:

- 5 Big-Yield REITs to Check Out Now

- 3 Chinese ETFs to Buy Now

- 3 Under-the-Radar Cannabis Stocks to Buy

Category: Sector ETFs