5 ETFs That Let You Invest In Gold

Gold can be useful as a short-term hedge or a route to quick profits. Here are five ways to dive into the yellow metal.

Gold can be useful as a short-term hedge or a route to quick profits. Here are five ways to dive into the yellow metal.

You’ll find no shortage of people who think you shouldn’t invest in gold.

Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) CEO and investment legend Warren Buffett famously slammed our love of the yellow metal in 1998, pointing out that “anyone watching from Mars would be scratching their head.”

Wharton finance professor Jeremy Siegel laid out the case in numbers, showing in Stocks for the Long Run how a $1 investment in stocks in 1802 turned into $750,000 by 2006 … but a similar investment in gold had yielded just $1.95 over the same period of time.

It makes sense. Gold doesn’t generate profits, it doesn’t pay a dividend … it just is. It’s more a currency than anything else. So why expect it to slowly gain value over time?

But that doesn’t mean your portfolio should be scraped clean of the shiny element. On the contrary. While you shouldn’t invest in gold for the long run, gold can be used for short-term protection and quick profits on swing trades.

The following five exchange-traded funds (ETFs) allow you to invest in gold in various ways — directly, indirectly or with a shot of nitroglycerin.

ETFs to Invest in Gold: iShares Gold Trust (ETF) (IAU)

Expenses: 0.25%

The iShares Gold Trust (ETF) (NYSEARCA:IAU) is one of the most basic ways to invest in gold. That’s because it … well, it actually represents an investment in gold.

iShares’ IAU isn’t your typical ETF. It’s backed by real, physical gold stored in vaults (currently more than 7 million ounces), with each share of IAU representing roughly 1/100th an ounce of gold. Thus, this fund fairly accurately tracks the price of the yellow metal.

The IAU is not only the second most popular physical gold ETF, but the second most popular commodity ETF period, at $9.4 billion in assets under management. But that puts it considerably behind the SPDR Gold Shares (ETF) (NYSEARCA:GLD) on both fronts, with the GLD amassing roughly $36 billion in AUM.

But that doesn’t make IAU the best choice for individual investors like you and me.

While the SPDR Gold Shares charge 15 basis points more in annual expenses, it’s still the most popular gold ETF among big traders and institutional investors because each unit represents 1/10th of an ounce of gold (so, 10x the value of an IAU unit), which ultimately makes it a more efficient way for them to buy. State Street, GLD’s provider, explains:

“Because investors need to buy roughly 10 times as many shares of IAU as GLD shares for similar gold exposure, costs related to bid-ask spreads and commissions are 10 times as much on IAU than on GLD, when those fees are paid on a per-share basis.”

In short, if you’re trading gold frequently, or you plan on buying in bulk, SPDR’s offering might make more sense. But if you’re a smaller individual investor and are just looking to make the occasional buy, IAU is a much more attractive choice thanks to its far-cheaper expenses.

ETFs to Invest in Gold: VanEck Vectors Gold Miners ETF (GDX)

Expenses: 0.51%

Another way to invest in gold is to buy shares in the companies that actually dig the metal out of the ground.

Gold mining companies are extremely dependent on the price of metal for obvious reasons. The actual operation of producing gold — from the mining itself to taxes, refining, etc. — has a certain cost that varies from miner to miner, depending on how efficient they are. If gold prices are below this “all-in sustaining cost,” a miner is losing money … but anything above this line is pure profits!

The VanEck Vectors Gold Miners ETF (NYSEARCA:GDX), which holds 51 stocks in the gold mining industry, is the premier fund in this space at about $8.5 billion in assets. Like many market cap-weighted industry ETFs, GDX is somewhat lopsided — top holdings Barrick Gold Corp (USA)(NYSE:ABX) and Newmont Mining Corp (NYSE:NEM) each make up roughly 10% of the fund’s weight — but overall, it’s still an honest representation of the space.

While funds like IAU and GLD are clearly more direct ways of buying gold, funds like the GDX can be a slightly more lucrative way of betting on the metal. That’s because gold miners tend to swing even harder than the price of gold itself, especially in prolonged upturns. Just be careful — the opposite is true, with prolonged downturns in gold wreaking greater havoc in mining funds like GDX.

ETFs to Invest in Gold: VanEck Vectors Junior Gold Miners ETF (GDXJ)

Expenses: 0.52%

Another step up this ladder are so-called junior miners, which don’t even extract gold from the ground.

These companies lay all of the groundwork — they find properties that potentially could have gold deposits, study and test the resources, and even help bring the sites to production-readiness … then after that, they can sell the deposit, partner up with a major miner, or in some cases even sell out to a larger mining company.

The flip side is that the risk is more considerable, as these are exploration companies without proven reserves. A junior miner not only runs the risk of outright failure, pouring money into a site that ends up being worth little, but it also boasts the same sensitivity to gold prices, as that will help determine the worth of any resources it finds.

The VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ) is the second-largest mining ETF (behind the provider’s own GDX) and the most popular way to invest in junior miners.

As a fund, GDXJ is actually more diverse than GDX, boasting 74 holdings and less single-stock risk, with top holdings Gold Fields Limited (ADR) (NYSE:GFI) and Pan American Silver Corp. (USA)(NASDAQ:PAAS) weighted at 4.4% and 4.2%, respectively.

But as an industry, junior miners tend to be even more volatile and sensitive to the price of gold than GDX. Thus, consider GDXJ an even more leveraged way to invest in gold … and take the appropriate precautions.

ETFs to Invest in Gold: Direxion Daily Junior Gold Miners Index Bull and Bear 3x Shares (JNUG)

Expenses: 1.25%

If you really want to go whole hog and squeeze as much return out of gold as possible, look no further than the Direxion Daily Junior Gold Miners Index Bull and Bear 3x Shares (NYSEARCA:JNUG).

After all, if junior mining companies already are a leveraged way to trade gold, you can’t get much more supercharged than a 3x (the current maximum amount of leverage in U.S. ETFs) junior miners fund.

JNUG is designed to provide triple the daily performance (sans fees and expenses) of the MVIS Global Junior Gold Miners Index — the same index that powers the GDXJ. It does so by actually holding units of GDXJ, but also utilizing various swaps and other financial engineering.

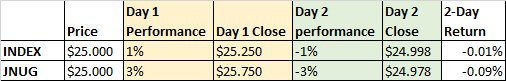

The keyword to keep in mind is “daily” performance. If JNUG’s tracking index goes up 1% in a day, the ETF theoretically should return 3%. But look what happens after just two days in which the index goes up 1%, then goes down 1%:

This “wiggle” is even more exaggerated over time, so a long-term investment in JNUG isn’t going to add up to a perfectly 3x return of GDXJ … for better or worse.

Consider that in July, GDXJ had an up-and-down month that resulted in a 0.7% gain; JNUG actually finished the month just 5 basis points higher, underperforming the unleveraged ETF. On the flip side, Direxion’s 3x ETF has returned 52% over the past month of trading — more than triple the VanEck junior miner ETF’s roughly 16% return in the same time frame. And don’t forget that losses are magnified, too, with JNUG falling 36% to GDXJ’s 13% in April.

In short: JNUG can be a great way to make boffo profits on a short-term trade, but don’t stay in it for long, and only buy it with money you can afford to lose.

ETFs to Invest in Gold: Credit Suisse X-Links Gold Shares Covered Call ETN (GLDI)

Expenses: 0.65%

For today’s final pick, we’ll actually throttle the risk factor back a bit.

The Credit Suisse X-Links Gold Shares Covered Call ETN (NASDAQ:GLDI) is an exchange-traded note that utilizes a popular options strategy: selling covered calls.

The strategy goes like this: You sell call options against a stock you hold, which gives someone else the right (but not the obligation) to buy a certain amount of that stock for a predetermined price. You receive cash (called a “premium”) for selling those calls. If the stock climbs above that strike price by the option’s expiration date, the buyer can exercise the call and purchase your stock, but you still keep the premium. If the stock stays below that strike price through expiration, you keep both your stock andthe premium!

Covered calls essentially generate income by a stock staying flat or declining, making it a popular hedge for when an investor believes a holding has limited near-term upside.

The GLDI is precisely such a play, going long the GLD gold ETF, then selling covered calls against it on a monthly basis, using options that are about 3% “out of the money” and collecting a premium for the trouble.

The upside? It pays out a considerable monthly dividend with the premiums it collects, with GLDI boasting a 7% yield at the moment, though this figure frequently makes its way into the teens. That helps this X-Links fund outperform GLD when the metal swoons.

The downside? Because high enough gains result in shares being called away, covered calls essentially cap your upside. Thus, GLDI tends to underperform the GLD (even including those hefty dividends) in bull runs for gold.

Kyle Woodley is the Managing Editor of InvestorPlace.com. As of this writing, he did not hold a position in any of the aforementioned securities.

See Also From InvestorPlace:

- 10 High-Yield Dividend Investments to Set and Forget

- 7 Dividend Stocks Whose Payouts Could Double in 3 Years

- The 10 Best Dividend Funds to Buy Now

Category: Commodity ETFs