ETFs Are A Convenient Yet Very Dangerous Tool For Investors

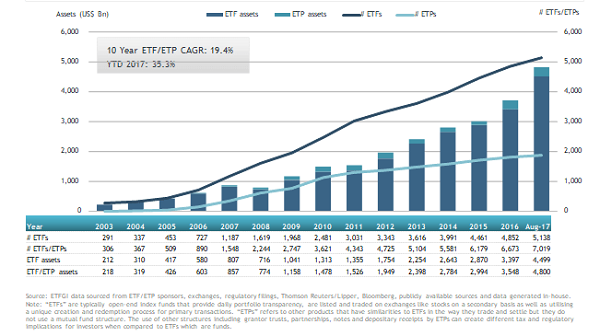

Here’s the least original statement of 2017: There are a lot of different ETFs. There are:

Here’s the least original statement of 2017: There are a lot of different ETFs. There are:

- Equity ETFs

- International ETFs

- Fixed income ETFs

- Currency ETFs

- Commodity ETFs

- Volatility ETFs

There are more… plus leveraged and inverse versions of most of these leveraged and inverse versions of most of these.

ETFs have made it possible for everyday investors to invest like George Soros. Except most everyday investors inevitably do a much worse job than George Soros!

Still, it is lots of fun. It is just probably not in the best interests of your retirement savings.

Just Because You Can, Doesn’t Mean You Should

ETFs give people the ability to do lots of different things. ETF innovators have managed to securitize just about anything.

I think we reached the last frontier in August when a LIBOR ETF was announced (it is leveraged, naturally). So you can trade LIBOR, you can trade a basket of junior silver miners, you can trade double inverse volatility, you can trade the shape of the yield curve, and you can trade Indonesia.

But I’ll bet you that the people who are investing in Indonesia have not done a lot of work on Indonesia.

And I’ll bet you there are people speculating on the yield curve who have not done a lot of work on the yield curve.

Moral of the story: Just because you can do these things, doesn’t mean you should.

One thing a lot of investors don’t realize is that professional investors put an awful amount of time and effort into research.

I do a fair amount of research in the course of writing newsletters. And sometimes, I will meet with a portfolio manager who is working on the same trade.

That portfolio manager will have had a team of analysts working on it for months. So when he ends up buying that Indonesia ETF, he has done all the work, and he is pretty freakin’ sure.

Many investors haven’t done the work. They don’t have the time (they work day jobs), and they don’t have the scale (they don’t have a team of analysts working with them, with access to all the market data in the world).

Nobody likes to think of themselves as the patsy at the poker table. But you can’t compete with the pros.

Despite What I’ve Said, ETFs Are Your Friend

I am no financial Luddite. I think the ETF is one of the top five financial innovations of the last 100 years! Giving people access to stuff they never had access to before is a great development.

Thirty years ago, you couldn’t buy Indonesia at all. Probably the only way to buy Indonesia was to be Mr. Big Time Portfolio Manager and access foreign markets through a big broker like Goldman Sachs.

So I would never be so paternalistic as to suggest that people should be prevented from trading this stuff for their own good. No. What I am saying is:

- Macro trading is a lot of work.

- You probably don’t have time to do the work.

- So you should be realistic about your expectations.

If you accept that and still really want to be a dedicated ETF investor, then here’s what you need to do.

Determine your asset allocation, and pick some broad-based, low-cost ETFs, keeping concentration and correlation in mind. Try to avoid making radical changes to the portfolio unless absolutely necessary. And think long term: 5–10 years, not 1–2 years.

Note: This article was contributed to ValueWalk.com by Mauldin Economics.

Category: ETFs