5% Dividends, $0 In Tax: Here’s How

There are, as I write this, 3 high-yielding funds giving investors over 5% in dividend income. Plus they pay out every month, tax-free.

There are, as I write this, 3 high-yielding funds giving investors over 5% in dividend income. Plus they pay out every month, tax-free.

All 3 sold off at the end of 2017. And I’m watching one group of investors who are waiting to buy back in when a “time limit” I’ll explain in a moment expires in the next few weeks.

That makes now a good time to buy. Because when this “deadline” comes and goes, I expect all 3 of these funds to rise.

Before I show you these funds, I want to give you the inside scoop on this unique situation.

“A Tempest in a Teapot”

In 2017, a lot of uncertainty loomed over municipal bonds—the assets that give Americans this tax-free income—due in no small part to confusion in Washington. Tax reform legislation was slowly getting hammered out, and a lot of investors worried that this was going to wreak havoc for so-called “munis.”

But, as I wrote in early December, this was a tempest in a teapot. The details are complicated, but the bottom line is that the most important types of municipal bonds will retain their tax-free status. What’s more, too many investors are hooked on getting an income stream the taxman can’t touch—meaning demand for these bonds won’t go away anytime soon.

Nonetheless, I said December would be a weak month for municipal bonds, because, honestly, December is almost always sluggish for munis.

That’s because the tax-focused investors who buy munis are the same kinds of folks who sell assets at a loss for the tax writeoffs—and most of that tax-loss harvesting (as it’s called) occurs during the last month of the year.

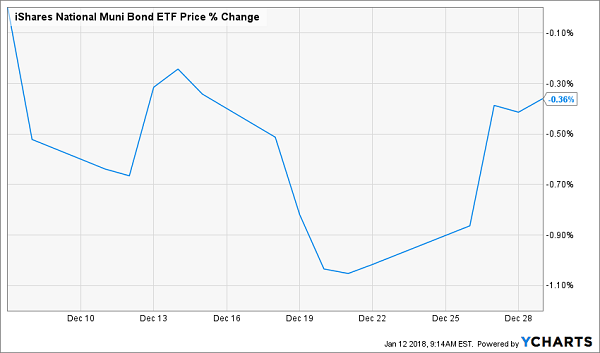

So it was no surprise that munis saw a bit of a dip in the last few weeks of December, as you can see from this chart of the iShares National Muni Bond ETF (MUB):

2017: Out Like a Lamb for Munis

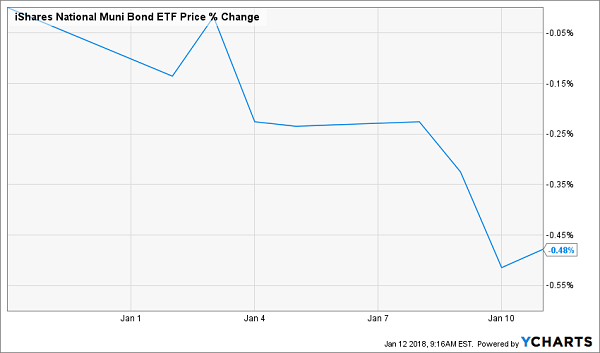

While that pullback is what you’d expect from tax-focused investors, municipal bonds aren’t recovering in January. In fact, they’ve fallen further:

No Recovery for Tax-Free Bonds

At first glance, this might look worrisome—but it’s nothing to fret about.

Why?

Because this January pullback stems from a tax law known as the “wash sale rule.” It simply says that an investor can’t claim a loss on the sale of a security and then buy it back instantly; he or she must wait 30 days before doing so. This means that a lot of muni investors who sold at the end of 2017 are waiting to buy back, so an uptick in municipal bonds is coming, and perhaps even by next month.

Secondly, we’ve seen a pullback in municipal bond buying in those states where cold weather has been particularly intense. New York, New Jersey, Wisconsin and Illinois have seen some pretty big fund withdrawals from their muni bond markets. This is all because investors are worried that the big freeze also froze economic activity, lowering revenues that will inevitably hit municipal bond solvency.

This is a big, emotional response to a tiny non-issue. We saw similar cold weather at the start of 2014, and that had no long-term impact on cold-weather states’ municipal bonds or those states’ tax revenues. This is a silly selloff.

And that means the serious investors should come in and buy with both hands.

So which muni funds are set to lead the way?

Let’s start with the kind of fund you should avoid.

Steer Clear of This Popular Muni Bond Fund in ’18…

The PIMCO CA Municipal Income Fund (PCQ) is a perfectly respectable California-only municipal income fund managed by one of the best bond managers in the world: PIMCO, whose legendary bond picking turned it from a small Newport Beach startup to an international heavyweight with $2 trillion in assets under management.

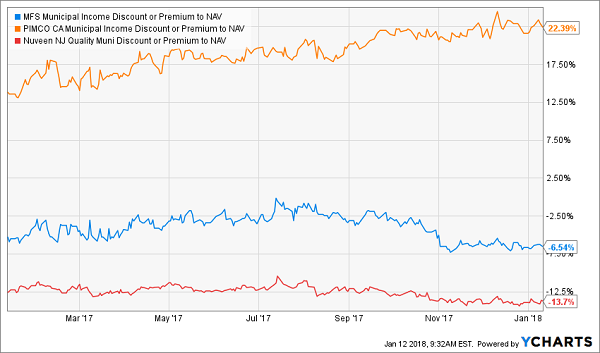

Yet PCQ isn’t worth buying now, because it’s expensive, trading at a massive 22.6% premium to net asset value (NAV). That means you’ll pay $1.226 for every dollar the portfolio is worth—this is a fund for suckers who love overpaying!

But PCQ’s 5.3% tax-free dividend yield is nice—so let’s beat it with a fund selling at a 6.4% discount to its NAV.

…and Put These 3 High-Yielders on Your List Instead

That’s right—a higher dividend income stream and a portfolio that’s being sold for less than its true market value. That’s what you get with the MFS Municipal Income Fund (MFM), which yields 5.5% and has been out-earning its dividend for a long time, making that income stream sustainable for many years to come.

Another important thing about MFM: over the last year, it has protected its NAV, despite a tough year for municipal bonds, by choosing holdings carefully, while PCQ’s NAV has been going down.

MFM Protects Shareholders’ Assets

MFM isn’t the only fund that looks poised to gain as munis come back into fashion, though.

Take a look at the Nuveen NJ Quality Municipal Income Fund (NXJ). Despite having one of the highest total returns among municipal bond–focused closed-end funds, NXJ trades at the biggest discount of any muni CEF—a full 13.8%.

NXJ: Big Gains at a Discount

But NXJ is covering its 5.1% dividends through the tax-free income on its munis, and it’s growing its NAV, too.

The market doesn’t care—investors are selling this fund off because it’s been a bit chilly in New Jersey. But they’ll change their minds soon.

Finally, another underappreciated muni fund with a big dividend is the Nuveen AMT-Free Quality Muni Income Fund (NEA), which looks for top-quality municipal bonds from across the US to add to its portfolio while also ensuring that taxpayers are exempt from the alternative minimum tax on the income they get from the fund.

NEA’s tax-free yield is 5%, and it’s out-earned its dividend for years—which is why its annualized return is a bit higher, at 5.2% over the last decade. It’s also protected its NAV through good and bad times, including the 2007–09 Great Recession, so you know it plays good enough defense to survive tough times while providing a reliable income stream.

3 Ways to Safely Bank 8% Dividends

Most of the stocks you read about in the mainstream media that pay 5% or better are train wrecks. They have big stated yields for the wrong reason – namely, because their prices have been axed in half or worse over the past year!

Instead, I’d rather look in corners of the income world that aren’t combed over as regularly. There are three in particular that I like today. You won’t hear about them on CNBC, or read about them in the Wall Street Journal, because they don’t buy advertising like Fidelity and other firms.

Their relative obscurity is great news for us 8% dividend seekers.

Play #1: Closed-End Funds

If you feel trapped “grinding out” dividend income with classic 3% payers (like dividend aristocrats), you can double or even triple your payouts immediately by moving to closed-end funds, or CEFs. In fact, you can often make the switch without actually switching investments.

I’ll discuss my favorite CEFs in a minute.

Play #2: Preferred Shares

Not familiar with preferred shares? You’re not alone – most investors only consider “common” shares of stock when they look for income.

But preferreds are a great way to earn 7% and even 8% yields from the same blue chips that only pay 2% or 3% on their “common shares.”

I’ll explain preferreds – and my favorite tickers to buy – after we finish our high yield hat trick.

Play #3: Recession-Proof REITs

The IRS lets real estate investment trusts, or REITs, avoid paying income taxes if they pay out most of their earnings to shareholders. As a result these firms tend to collect rent checks, pay their bills and send most of the rest to us as a dividend. It’s a sweet deal.

Not all REITs are buys today, however – landlords with exposure to retail space should be avoided.

That’s easy enough to do. I prefer to focus on REITs that operate in recession-proof industries only. I want to receive my rent check powered dividends no matter what happens in the broader economy.

Now let’s discuss how you can get a hold of my complete “8% No Withdrawal Portfolio” research today, along with stock names, tickers and buy prices. Click here and I’ll share the specifics – and all of my research – with you right now.

Category: Closed-End Funds (CEFs)