Buy This 25% Yield Stock For High Yield And Compound Growth

With its current 25% yield, the InfraCap MLP ETF (NYSE: AMZA) is either one of the most intriguing or scary investments available to income focused investors. Or both! The AMZA share price has been in a two-month decline, and investors are again asking if the big dividend is sustainable, or will it be reduced? In spite of the steep share price drop, the AMZA dividend sustainability continues to improve.

With its current 25% yield, the InfraCap MLP ETF (NYSE: AMZA) is either one of the most intriguing or scary investments available to income focused investors. Or both! The AMZA share price has been in a two-month decline, and investors are again asking if the big dividend is sustainable, or will it be reduced? In spite of the steep share price drop, the AMZA dividend sustainability continues to improve.

AMZA is an exchange-traded fund, commonly called an ETF. It is a fund that owns a portfolio of securities and not a company that has business operations. As an ETF, the share value is determined by the value of the fund holdings divided by the number of shares. This is an important consideration, because if the managers ever decide to reduce the dividend rate, it will not affect the share value. This is an important difference – even advantage for AMZA shareholders – from shares of a specific company, where a dividend cut often leads to a big share price decline.

The InfraCap MLP ETF owns the same master limited partnership (MLPs) that are tracked by the Alerian MLP Infrastructure Index (NYSE: AMZI). The InfraCap difference is that the fund is actively managed and can choose to weight the MLP holdings different than the market cap weighting used by the Alerian Index. The AMZA share price is down because the MLP sector is down, as you can see on this 6-month chart of the index.

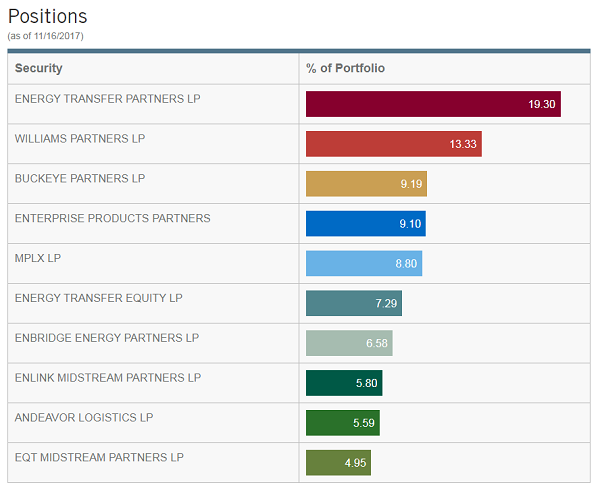

According to the fund managers, the money to pay the current dividend comes about 50% from the distributions paid by the MLPs owned by the fund and the other half from sold option premiums. They noted the dividend is currently being covered by these cash sources. If the dividend was not being earned, the dividend would be reduced. It would not affect the share net asset value. There is no reason for the managers to pay destructive return of capital to maintain the dividend. Even though MLP values are down, fundamentals in the sector are improving. After two years of flat distribution payments from some of the larger MLPs in the AMZA portfolio, those distributions are again starting to grow. This means AMZA will need less options premium income to support the dividend. Put another way, every quarter it becomes easier for the AMZA managers to earn and cover the dividend. Growing distributions from the holdings will eventually lead to share price appreciation for AMZA. Here are the top holdings of the fund as of November 15, 2017:

Now the recent distribution announcements from these energy infrastructure companies:

- Energy Transfer Partners LP (NYSE: ETP) just increased its distribution by 2.7%. The ETP distribution has grown by 10% over the last year. Current yield: 13.6%

- Williams Partners LP (NYSE: WPZ) announced the same dividend as last quarter. Yield: 6.8%

- Buckeye Partners, LP (NYSE: BPL) paid the same dividend as the previous quarter. The payout is up 3.1% over the last year. Yield: 10.6%

- Enterprise Product Partners LP (NYSE: EPD) increased its distribution by 0.6% over the second quarter and the payout is up 4.3% over the last year. Yield: 7.0%

- MPLX LP (NYSE: MPLX) just announced a 4.4% distribution increase. The payout is up 14% over the last year. MPLX yields 6.8%

- Energy Transfer Equity LP (NYSE: ETE) increased its dividend by 3.5%. This is the first increase in two years. Yield: 7.1%

- Enbridge Energy Partners, L.P. (NYSE: EEP) paid the same distribution this quarter as last. The EEP distribution was reduced three quarters ago by 40%. Current yield: 10.1%

- EnLink Midstream Partners LP (NYSE: ENLK) has paid the same distribution rate for the last nine quarters. Yield: 10.4%

- Andeavor Logistics Partners LP (NYSE: ANDX) increased its distribution by 1.4% this quarter and the payout is up 12.6% over the last year. Yield: 8.8%

- EQT Midstream Partners LP (NYSE: EQM) paid a 4.8% higher distribution for the quarter, and the payout is up 20% over the last year. Yield: 5.8%.

All but two of the top holdings have grown distributions paid over the last year. It is hard to believe that an MLP tracking ETF can pay a 25% dividend yield, but the math works. It is possible that the dividend may be reduced, but that will only happen if the managers cannot generate enough cash flow to pay the dividend. Currently the MLP and options markets are letting them earn the dividend.

I recommend AMZA as an investment in compound growth. The MLP sector is sound and will recover. In the meantime, reinvesting a 5% to 6% dividend every quarter means that shares owned, and quarterly income will grow by 25% plus per year.

I make it a point to always recommend at least a portion of the dividends earned from AMZA be reinvested into more shares. Right now, this ETF is a tremendous opportunity for income or growth focused investors looking for a balance of high yield and dividend growth.

How to Collect $1,340 in Extra Monthly Income

I’ve just released updated details on a new system for collecting $1,340 in extra monthly income… for the rest of your life. It’s called the Monthly Dividend Paycheck Calendar because if you follow it you’ll collect dividend paychecks every month. And in certain months you can collect up to 6, 7, even 12 paychecks. You need to be enrolled in the next few days in order to make sure you’re on the list of the first payouts and don’t miss your first $1,340 in extra monthly income. Click here to start.

Category: ETFs