Investor Evolution

We as human being continue to evolve. We learn things and we try to adjust to those things to make our life better.

We as human being continue to evolve. We learn things and we try to adjust to those things to make our life better.

We learn about the dangers of certain types of foods and avoid them and the health benefits of others and try to consume them. Note that I said try because it doesn’t always work out that way.

As a matter of fact, we evolve in practically everything from music to clothes and even people we associate with.

The same goes for investing. We may start out with an investment philosophy which we think will make us rich. We may lose money, and we may learn from that. This is investor evolution.

I’ve found that since I began investing more than a decade ago, I’ve evolved tremendously. What I thought could turn my portfolio from a few hundred bucks to hundreds of thousands turned out to be dead wrong.

And with investing, there comes a point where we are somewhat settled in our ways. And here I’m saying somewhat because there we should never fully settle or become too comfortable. Settling results in the risk of becoming lazy and an unwillingness to learn about new or changes in products, services or even industries, all representing possible investment opportunities.

Buying Hot Stocks

When I first started investing, it was in a very cliché sense. That is, I’d read money articles online about the hottest tech, retail, energy stocks, buy them before the earnings report, and sell them a few days later. Sometimes it worked, (i.e. generated a profit) and other times it didn’t. This strategy required a lot of time, energy and produced tons of stress. I learned quickly that it was not sustainable for me.

If there was a position where I a had an unrealized loss, I would usually take it towards the end of the year and subsequently claim it on my taxes to offset gains. But I thought to myself, why buy risk-based stocks that are more susceptible to losses in the first place?

Evolution Conservative And Mature Stocks

From “hot”, risky, penny, volatile, or whatever you want to call them types of stocks, I quickly and thankfully moved onto a more conservative approach: dividend-paying stocks. Some I’ve owned on and off and some I continue to hold today are Microsoft, Apple, Northrop Grumman, Proctor & Gamble, General Mills, and others.

This second dividend-focused strategy was definitely better than my first. Here I learned that you need to be patient when investing in the stock market and making a quick buck can come with a lot of risk and stress. I felt that I’d evolved.

In the process, I learned more about dividends and how they can be used to double down and buy more of the same or different stocks to build up a portfolio.

Evolution To Index Funds And ETFs

Over the past two to three years, I’ve moved on from dividend stocks to a different strategy.

I’ve strangely come to realize that I can spend less time and energy managing my investments through simply buying index funds and ETFs. And with this comes my latest stage in investor evolution.

Reconstructing my portfolio with index funds and ETFs has allowed me to break away from constantly checking up on individual companies I own to see, really if anything bad were to happen. If something good happens like a dividend increase, that’s great. But the pain of a loss would be more significant than the joy of a gain.

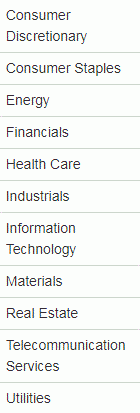

For example, in a very basic scenario, if I had a portfolio of single stock positions spread evenly across 11 sectors (below), I could suffer a 9% loss on a $100,000 portfolio: v$100,000 portfolios divided by 11 sectors = $9,090 or 9%.

Source: Vanguard

Less Managing, More Relaxing

Why did I move to this stage? We may think we fully understand how a company works, the risks it faces and the potential for growth by running a few ratios, looking at past performance, management and so forth. But we can’t be 100% sure, or even 90% or maybe even 75%.

Most of us don’t know what’s going on in the day to day of a large organization, what the CEO or board is exactly thinking or what their honest opinion may be of the trajectory for their organization.

Thinking we know more than we do could be dangerous. This is why I believe it’s important to stay diversified and continue to follow a consistent diversification strategy.

Even though I’ve moved onto funds from stocks, I still want the dividend income that stocks offer. And this can be achieved with high-income funds. For example, as I continue to evolve in my strategy within index funds and ETFs, I’ve found iShares International Select Dividend ETF – IDV. It allows exposure to the international market and a dividend yield of almost 5%!

As I mentioned earlier, I still own a few single stocks. Instead of becoming completely passive, this gives me a reason to stay interested as an investor. It almost forces me to keep up to date with the evolution of their products and services, which is exciting for me personally.

Evolving Taught Me To Stay Humble

There is so much that I don’t know and I’m comfortable with that. Jack Bogle, founder of The Vanguard Group which is widely known for offering low-cost index funds says that we should never think we know more than the market. He also says investing is all about ensuring balance.

With index funds and ETFs, achieve balance and diversification is achieved instantly once you buy a total S&P or total market fund.

Note: This article originally appeared at Simple Money Man.

Category: ETFs