Owning The Top Preferred Stock For High-Yield And Safety

Preferred stock shares can be viewed as a hybrid of common stock shares and corporate bonds. Preferred shares pay a fixed dividend rate, similar to bond interest. Technically preferred shares are equity like common shares. The preference feature is that preferred dividends must be paid before any dividends can be paid on a company’s common stock shares. While fixed in rate, preferred share dividends are more secure than common stock dividends. Investors are drawn to preferred stocks because of the higher level of safety combined with yields that are typically higher than from corporate bonds.

Preferred stock shares can be viewed as a hybrid of common stock shares and corporate bonds. Preferred shares pay a fixed dividend rate, similar to bond interest. Technically preferred shares are equity like common shares. The preference feature is that preferred dividends must be paid before any dividends can be paid on a company’s common stock shares. While fixed in rate, preferred share dividends are more secure than common stock dividends. Investors are drawn to preferred stocks because of the higher level of safety combined with yields that are typically higher than from corporate bonds.

For a corporation, preferred stock sits between bonds and common stock in the capital structure. Unlike with bondholders, failing to pay a dividend to preferred shareholders does not mean a company is in default. In the event of bankruptcy, bond holders would have the highest claim on corporate assets, followed by preferred shareholders and then common stock investors get whatever is left.

Preferred shares are usually issued with a fixed dividend rate. They usually don’t have a maturity date, but most preferred shares are callable after a certain number of years. The fixed dividends and priority over common shares for dividend payments make preferred stocks more like investments in very long-term bonds. The details of an individual preferred stock can be intricate, with features such as cumulative dividends, convertibility, and the call provisions. The largest issuers of preferred stock are companies in the finance sector such as banks and insurance companies. Analyzing individual preferred stocks is a complex task. My recommendation to invest in this asset class is through an exchange traded fund (ETF).

The InfraCap REIT Preferred ETF Difference

Management at InfraCap Funds and Infrastructure Capital Advisors has developed a different approach to develop a preferred stock fund. The InfraCap REIT Preferred ETF (NYSE: PFFR) only holds preferred shares issued by equity real estate investment trusts. REIT issued preferred shares offer advantages compared to traditional preferred securities, such as those issued by banks and insurance companies.

Management at InfraCap Funds and Infrastructure Capital Advisors has developed a different approach to develop a preferred stock fund. The InfraCap REIT Preferred ETF (NYSE: PFFR) only holds preferred shares issued by equity real estate investment trusts. REIT issued preferred shares offer advantages compared to traditional preferred securities, such as those issued by banks and insurance companies.

- REITs are typically less leveraged, as they often have lower levels of corporate debt.

- The nature of revenue streams – property lease payments – associated with REITs are generally more predictable.

- REITs may offer greater transparency as to the financial health of the issuer.

- The assets of REITs are real property so would have value to be claimed by preferred shareholders in the event of a corporate dissolution.

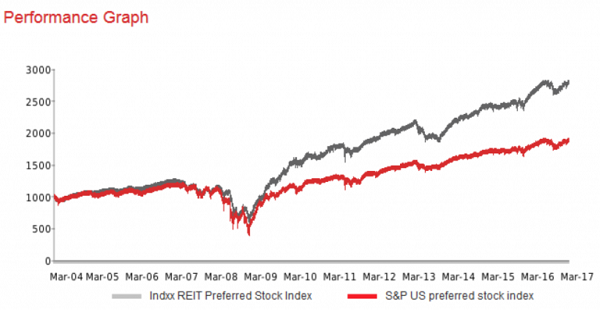

The financial crisis revealed the weaknesses in the safety of the banking and finance sectors. Since that time, the REIT preferred shares have strongly outperformed the traditional preferred stock investments.

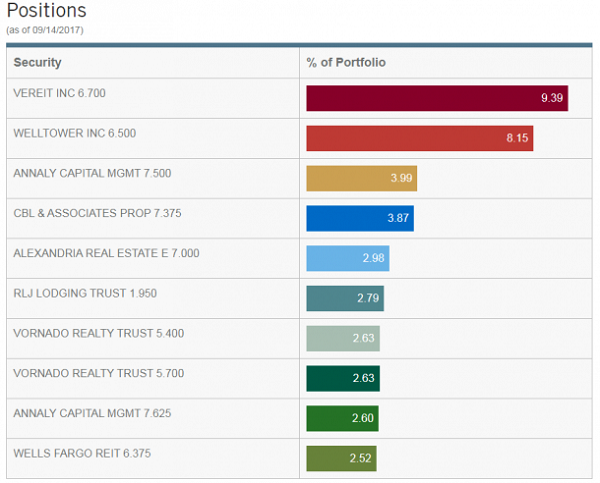

Infrastructure Capital Advisors has contracted with Indxx LLC to develop and maintain Indxx REIT Preferred Stock Index. PFFR will hold preferred stock securities to match the index results. As of September 14, here are the top 10 holdings in the index and PFFR:

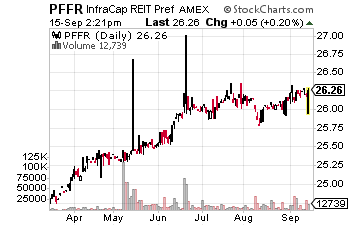

PFFR is a very new ETF, which launched in February 2017. The fund launched with $2.5 million in assets and has already grown to $20 million. The fund started out paying monthly dividends, but has switched to quarterly payments to even out the dividend amounts. The first quarterly dividend was paid on July 31. The next dividend will be paid in October.

Preferred stocks are interest rate sensitive investments. If long-term rates increase, the PFFR share value will fall. Currently there is not yet any sign that rates at the long end of the yield curve are poised to quickly move higher. View PFFR as another piece of a total dividend income portfolio. Its strengths are highly secure dividend payments, an attractive 5.5% yield and a share price that is not closely correlated to REIT common stock prices.

PFFR is the type of holding that should be at the core of any serious income investor’s portfolio and one like those in my Monthly Dividend Paycheck Calendar system… a system that helps you catch up quickly if you don’t think you’ve saved enough for retirement and if used correctly, gives you dividend payments every month, just like your bills come in.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Monday, September 25th, so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $3,073 in payouts by September 25th, but only if you’re on the list before September 25th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: ETFs