The “Smart CEF Money” Is Buying These 8%+ Yields

Closed-end fund (CEF) investors regularly go crazy. Their bouts with investment insanity often present us contrarian income hunters with 8%+ yields. And big price upside to boot.

Closed-end fund (CEF) investors regularly go crazy. Their bouts with investment insanity often present us contrarian income hunters with 8%+ yields. And big price upside to boot.

But be careful, because these first-level types can be as greedy as they are fearful. It’s important to fade both of their emotional extremes for dividend security and price gains.

Today the mood amongst CEF investors is generally upbeat. Which means there are more “sells” than usual in a sector that should generally be greeted with a bit of skepticism (more on this in a minute).

However there are a few compelling buys today that are a retiree’s dream – 8% yields with, say, 30% price upside. We’ll get to those in a moment. First, let’s make sure you don’t own any overpriced funds.

Step 1: Never Pay a Premium

CEFs, unlike their mutual fund cousins, have fixed share counts. This makes their prices subject to the animal spirit whims of the market – for better or for worse.

As usual, despair is our friend. When CEF investors throw in the towel, the funds they discard can see their shares trade at discounts to their net asset value (NAV). This is basically “free money” for us.

If a fund trades at a 10% discount to its NAV, it means we’re able to buy its underlying assets for just 90 cents on the dollar. That’s exactly the type of “discount to intrinsic value” that many successful stock market investors strive for.

Plus, savvy managers have ways they can force their own discount window to shut again. Such as buying back their own cheap shares.

On the other hand, when CEF investors get greedy, they actually pay premiums for funds. Bad idea!

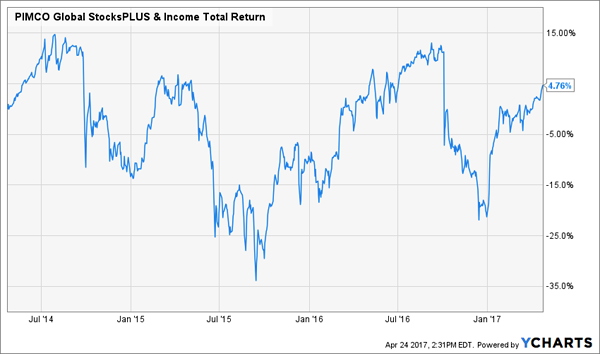

PIMCO’s Global StocksPLUS & Income Fund (PGP) has traded at a nosebleed 69% premium for the last three years as investors flocked to its high (9.8%) yield and 5-star Morningstar rating. A 69% premium means buyers paid (and are still paying!) $1.69 for just $1 in assets.

How’d that overpay work out? Not well, with the fund returning just 4.8% over the entire three-year period:

PGP Goes Nowhere as Investors Overpay

Which reminds me…

Step 2: Ignore Morningstar Ratings

I’ve found them to be worthless when selecting CEF investments. And they can actually do an investor more harm than good.

The problem with Morningstar’s system is that it (as the firm admits) is 100% backward looking. That may play in the mutual fund industry, but it’s not particularly relevant to CEFs.

Take the Nuveen Preferred Securities Income Fund (JPS), one of my favorite vehicles for buying preferred shares for high yield. I’m not sure what the Nuveen managers did to annoy Morningstar, but it earned JPS a harsh two-star rating.

Well, whatever – that’s our gain. This “No Withdrawal” Portfolio favorite has crushed its overpriced five-star counterpart of late while paying 8% dividends in cash:

Two Stars Crushes Five Stars

Step 3: Follow the “Smart CEF Money”

Most CEFs underperform their gaudy yields. Their prices decline faster than their investors bank dividends – leaving total returns lighter than advertised.

Too bad most of these managers aren’t as careless with their own money!

It’s rare to see any fixed income manager put his or her own money on the line at all, unfortunately. According to Barron’s, out of 558 closed-end funds, nearly half (269) have no insider ownership whatsoever. And only 70 have insider ownership above $500,000.

It’s perhaps no surprise that PGP – which is managed by one of the savviest bond firms on the planet (PIMCO) – hasn’t attracted any insider money since 2011. With the fund commanding an irrational premium, its managers are investing elsewhere.

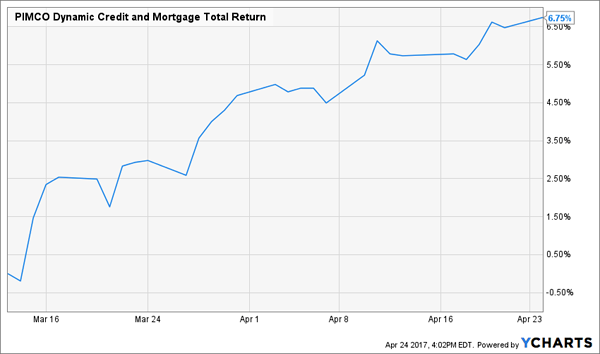

PIMCO CEO Emmanuel Roman isn’t straying far, however. As I pointed out last month, he bought 95,000 shares in his PIMCO Dynamic Credit Income Fund (PCI) for his personal account in early March. PCI paid a 9.4% yield and traded at a 3.6% discount to NAV at the time.

The big boss has already been rewarded for his $2 million purchase. He’s up 6.75% – a cool $135,000 – in just 45 days!

The “Smart CEF Money” Banks $135,000 in 45 Days

Step 4 (Bonus): Buy as Rates Rise

Finally, here’s a little-known secret:

Higher rates don’t really hurt CEFs.

The theory scares people because it sounds true. Closed-ends have the benefit of borrowing money at Libor to leverage up their returns. Libor is tied closely to the Fed funds rate. So, the thinking goes, higher Fed rates will end the “cheap money” party that benefits CEFs.

Unfortunately this lazy conclusion is wrong. In June 2004, Fed chair Alan Greenspan began boosting rates from then-historic lows. Over a two-year period, he increased the federal funds rate from 1% to 5.25%. A dizzying pace by today’s standards.

How’d CEFs perform? These three prominent funds all outperformed the S&P 500 during Greenspan’s aforementioned run!

Higher Rates No Problem for Top CEFs 2004-06

And here are two more blue chip CEFs that moved up along with Libor last hike cycle:

Muni and Infrastructure CEFs Did Well, Too

Let’s put things in perspective. Back then, Greenspan started at 1%. Today, after 15 months of leisurely rate boosts and banter, just now at 1%.

With rates once again ticking up this week, it’s the perfect time to follow the “smart CEF money” and buy the best funds at a renewed discount. Most of them are cheaper today than they were last Friday – for no relevant reason.

I recommend three in particular. They all pay 8%+ yields (so that you can live off their dividends alone) while enjoying 15% price upside or better. Click here and I’ll share their names, tickers and buy prices – along with more favorites to stash in your own “No Withdrawal” Portfolio.

Category: Closed-End Funds (CEFs)