These Fat 9% To 24% ETF Yields Are Traps

I told you that the Infracap MLP ETF (AMZA) was a dog. Well, the fund just cut its dividend by 37%.

I told you that the Infracap MLP ETF (AMZA) was a dog. Well, the fund just cut its dividend by 37%.

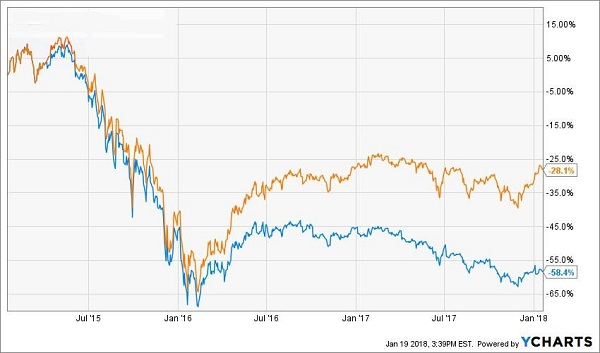

This is one of the biggest ETF payout cuts in recent memory, and it’s a gut punch to shareholders who rode out massive underperformance for the income tradeoff. That payout mattered. Just look at the difference between price returns and total returns in the chart below:

Just because a yield is wrapped in a fancy ETF wrapping doesn’t mean it’s safe.

This ETF dividend slash could be the first of several. So let’s talk about three ETFs – which pay between about 9% and 24% – whose dividends are far from secure.

UBS ETRACS Linked to the Wells Fargo Business Development Company Index ETN (BDCS)

Dividend Yield: 8.7%

Business development companies (BDCs) are one of the sweetest-paying areas of the market, typically delivering high dividends as a result of their structure. Specifically, BDCs are like real estate investment trusts (REITs) in that they’re required to pay out 90% or more of their taxable income as dividends in exchange for massive corporate tax breaks.

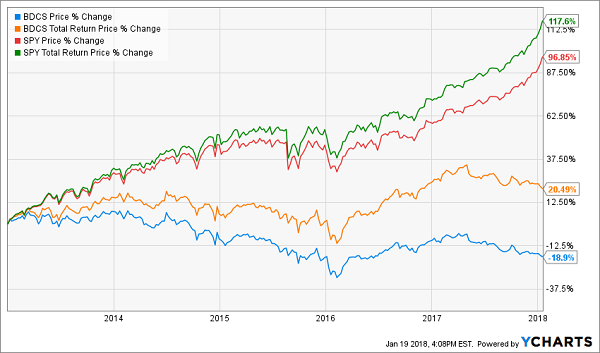

The good news: Those yields have expanded into very high single digits over the past four years or so. The bad news: That’s because of price declines, not dividend growth.

Many players in the BDC space have merely treaded water with their payouts for quite some time. But the past couple of years have been particularly painful. Here’s a quick look at what the UBS ETRACS Linked to the Wells Fargo Business Development Company Index ETN’s (BDCS) five largest holdings have done since 2016:

- One – Main Street Capital Corporation (MAIN) – has raised its dividend.

- One – Ares Capital Corporation (ARCC) – has kept its dividend level.

- Three have cut their dividends.

The overall effect hasn’t been terribly dramatic. BDCS’ nominal distribution is off just 4% from 2013 levels. But considering the fund has lost 19% on a price basis since the start of 2013, and its 20% total return over that time is woefully underperforming the S&P 500, BDCS investors need every basis point of income they can get.

Or they can invest in the handful of promising names in the BDC industry.

iShares Mortgage Real Estate Capped ETF (REM)

Dividend Yield: 10%

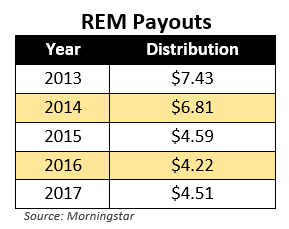

All that said, the BDC space looks downright stable and sturdy compared to the dividend volatility we’ve seen in the mortgage REIT space. Here’s a quick look at the five-year distribution history of the iShares Mortgage Real Estate Capped ETF (REM):

As you can see, 2017’s level did tick higher, but it remains slightly less than 2015 levels and almost 40% below its 2013 distribution!

That’s not to predict that REM’s distribution will be another 40% lower come 2021. But mREITs’ performance and payouts should remain under pressure in a rising-rate environment, as the income from mortgages they hold is increasingly less than what they need to borrow to purchase more.

Will one or two mREIT champions stand out from the rest? It’s possible. But consider that 30% of REM is concentrated in two stocks: Annaly Capital (NLY), which hasn’t seen a dividend increase since 2014, and AGNC Investment (AGNC), which has cut its payouts several times in the past five years. Any positive performances lower down the portfolio have been simply drowned out, and that will continue to be the case going forward.

InfraCap MLP ETF (AMZA)

Dividend Yield: 24%

The pain may not be over for these shareholders.

Back to the pièce de résistance that sparked this whole discussion: the InfraCap MLP ETF (AMZA), an MLP fund that recently announced it will hack its payout by a whopping 37%:

From the press release:

The InfraCap MLP ETF (NYSE:AMZA) has announced that it is adopting a monthly dividend policy, replacing its traditional quarterly schedule, which had been in place since the fund’s 2014 inception.

The next dividend is scheduled to be declared on February 20th and paid on February 28th. Dividends are planned, but not guaranteed, for each subsequent month. The anticipated monthly dividend rate is $0.11 per share ($1.32 per share on an annualized basis). This action is being taken in order to align AMZA’s distributions to shareholders more closely with its distributable cash flow.

This young fund (2014 inception), while not heavy in assets at $645 million, still held some allure among income investors a lot of allure among income investors for its relatively stable and high distribution, helped in part by the use of leverage, much like closed-end funds employ.

AMZA came to life at an unfortunate time, however, as the energy-price crash of 2014 hammered MLP prices. And InfraCap’s product really took it on the chin, grossly underperforming the Alerian MLP ETF (AMLP).

The underperformance was bad enough, but now, patient investors are having the fund’s one saving grace – its massive distribution – cut significantly because AMZA simply can’t make the math work. That distribution makes quite the difference, too – literally 26.5 percentage points of difference in just a few years.

And that 24% yield? It’s something of a mirage, though even based on the new lower payout, AMZA still offers a mouth-watering 16%. But anyone looking at this more “realistic” yield now must consider it with a shovelful of salt.

3 Ways to Safely Bank 8% Dividends

As you can see, many stocks and even funds that pay out high-single-digit yields are train wrecks or, at best, significantly flawed. They have big stated yields for the wrong reason – namely, because their prices have been axed in half or worse over the past year!

Instead, I’d rather look in corners of the income world that aren’t combed over as regularly. There are three in particular that I like today. You won’t hear about them on CNBC, or read about them in the Wall Street Journal, because they don’t buy advertising like Fidelity and other firms.

Their relative obscurity is great news for us 8% dividend seekers.

Play #1: Closed-End Funds

If you feel trapped “grinding out” dividend income with classic 3% payers (like dividend aristocrats), you can double or even triple your payouts immediately by moving to closed-end funds, or CEFs. In fact, you can often make the switch without actually switching investments.

I’ll discuss my favorite CEFs in a minute.

Play #2: Preferred Shares

Not familiar with preferred shares? You’re not alone – most investors only consider “common” shares of stock when they look for income.

But preferreds are a great way to earn 7% and even 8% yields from the same blue chips that only pay 2% or 3% on their “common shares.”

I’ll explain preferreds – and my favorite tickers to buy – after we finish our high yield hat trick.

Play #3: Recession-Proof REITs

The IRS lets real estate investment trusts, or REITs, avoid paying income taxes if they pay out most of their earnings to shareholders. As a result these firms tend to collect rent checks, pay their bills and send most of the rest to us as a dividend. It’s a sweet deal.

Not all REITs are buys today, however – landlords with exposure to retail space should be avoided.

That’s easy enough to do. I prefer to focus on REITs that operate in recession-proof industries only. I want to receive my rent check powered dividends no matter what happens in the broader economy.

Now let’s discuss how you can get a hold of my complete “8% No Withdrawal Portfolio” research today, along with stock names, tickers and buy prices. Click here and I’ll share the specifics – and all of my research – with you right now.

Category: ETFs