Is There A Currency Hedged ETF Worth Buying?

One of the fastest growing segments of the ETF industry are Currency Hedged ETFs.

One of the fastest growing segments of the ETF industry are Currency Hedged ETFs.

And for good reason…

Investing in stocks outside of the US is a great way to diversify your portfolio and find opportunities to grow your portfolio.

However, the returns US investors make on their overseas investments can be impacted by fluctuations in currency exchange rates.

When the US Dollar is strengthening against other currencies, it is a headwind for foreign investments. The returns you make on the investment are worth less when they are converted back into dollars.

And when the US Dollar is weakening against other currencies, it provides a tailwind for foreign investments. Your invest returns will be worth more when they are converted into dollars.

Foreign exchange rates are notoriously volatile and subject to manipulation by the central banks and governments.

What’s a Currency Hedged ETF?

Currency Hedged ETFs give investors a way to invest in foreign stocks without worrying about the impact of foreign exchange rates.

Simply put, these ETFs minimize currency risk.

Who Should Buy a Currency Hedged ETF?

Do you know how to hedge against currency risks in your portfolio? If not, then a currency hedged ETF could be right for you.

These ETFs are prepackaged in a way that most investors don’t have the ability to structure on their own. They give investors exposure to foreign stocks and hedge against currency volatility with one simple trade.

These are the types of strategies that big institutional traders and hedge funds use all the time to boost their investment returns. Now, they’re available to everyone.

Currency Hedged ETFs Come in Many Forms

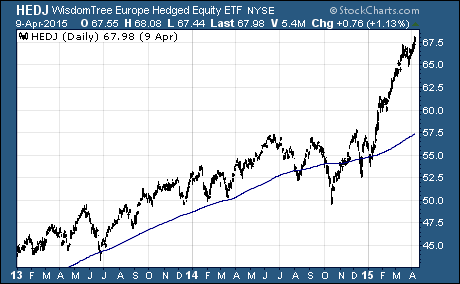

One of the most popular currency hedged ETFs is the Wisdom Tree Europe Hedged Equity Fund $HEDJ. It has more than $18.5 billion in assets under management.

Another is the WisdomeTree Japan Hedged Equity Fund $DXJ with $16.5 billion in assets.

Not surprisingly, the success of these funds has triggered the launch of many new currency hedged ETFs from providers like iShares and Deutsche.

Here’s how you can find more Currency Hedged ETFs.

One thing to keep in mind is that currency hedging ETFs come with a bigger expense ratio than plain vanilla ETFs. But in markets where currency exchange rates are volatile, the additional returns can far outweigh the additional expense.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Foreign Market ETFs