A Big Win For Solar Energy ETFs

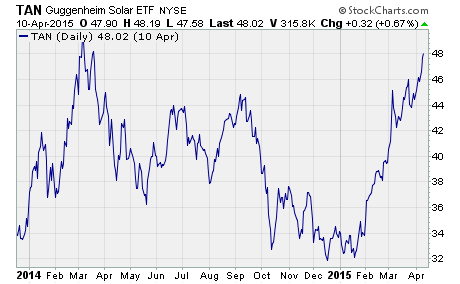

Right now, the solar energy ETF from Guggenheim is soaring higher.

Right now, the solar energy ETF from Guggenheim is soaring higher.

Subscribers to Sector ETF Trader are now up 44% since I recommending buying Guggenheim Solar ETF $TAN.

Why I recommended buying Solar Energy ETFs

I recommended buying TAN in December of 2013.

Here’s why…

The solar industry went through a painful adjustment period in 2012. But the industry turned a corner in 2013.

Production and demand came back into balance. The stronger players that survived the downturn had seen their stocks come soaring back.

In fact, the lower prices for solar forced companies to innovate and reduce their costs in order to survive. The result is solar power is now much more competitive with traditional sources of energy.

What’s more, the lower cost of solar systems, along with easier financing options, created a boom in US residential installations. And global installations were forecast to grow 18% in 2014 to more than 40 gigawatts (GW).

In other words, the stage was set for another period of strong growth.

A crazy chart for Solar Energy ETFs

At first, TAN took off as I expected. But solar energy stocks fell out of favor with investors by mid-2014. And the drop in oil prices led many to believe that demand for solar power would be reduced.

As a result, TAN suffered through a period of stagnation in the second half of 2014.

But I saw the underlying fundamentals for the solar industry remained strong.

And then some dramatic developments began to take place in the solar industry in 2014.

Now TAN is racing higher again…

What’s next for Solar Energy ETFs?

Needless to say, subscribers to Sector ETF Trader are enjoying some nice profits on this trade.

Take a look at this if you’re new to investing in solar ETFs.

Which sector ETF will be the next Solar Energy ETF?

Identifying industries with positive macroeconomic themes is a critical part of the Sector ETF Trader strategy. And we certainly found a big winner with Solar Energy ETFs.

Sector ETF Trader identifies high-return potential ETFs based on a number of macro, fundamental, and technical indicators. These indicators offer you the opportunity to participate in some very large moves in a relatively short amount of time.

And because it focuses on ETFs, you get the advantages of both stocks and mutual funds, without the problems of high fees and over-concentration.

Rather than taking a ‘shotgun’ approach to the market, I use a time-tested system like a scalpel to carve out those ‘hidden gems’ with the greatest chance of spectacular profits.

Tuesday April 21st, is the next critical trade date, so take action now to avoid missing out. Click this link to find out more about this easy method to identifying the most profitable penny stocks around!

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs