A 1-Click Way To Beat the Market This Summer

The stock market has just started recovering from its early-February lows—and there are 3 ridiculously cheap funds set to jump even higher while paying massive dividends.

The stock market has just started recovering from its early-February lows—and there are 3 ridiculously cheap funds set to jump even higher while paying massive dividends.

Before I show them to you, let’s talk a bit about why the market is set to go higher.

Right now, the SPDR S&P 500 ETF (SPY) is up 4.8% for 2018, but more importantly, it’s still off its 2018 high, reached in early January—and it’s only started to show signs of consistent recovery from February’s low in the last few weeks:

A Steadying Market

There are a lot of reasons for this, but the most important happened in April—just at the start of the upward move in stocks in the chart above. That’s when first-quarter earnings season began, and S&P 500 companies reported 24.9% higher profits, on average, the highest first-quarter growth in history. Earnings are poised to rise at a similar rate in the second quarter.

Those profits are driving the economy higher, too. Forecasts for American GDP growth have been upgraded at several major banks around the world—including the Federal Reserve. At the start of June, for example, the World Bank upped its growth expectations to 2.7% for 2018, a big jump from previous estimates—and most analysts agree on what’s driving this growth: jobs, consumer confidence and higher wages.

So if Americans are earning more, spending more and getting jobs more easily, we should expect American companies to benefit. But which companies will be the biggest winners?

Instead of picking them one by one, let’s look at a few funds that not only choose stocks well, thanks to smart strategies, but also pay out above-average dividends to investors from the capital gains these funds earn.

Pick #1: Playing Big Tech for Big Gains

The first fund playing this economic growth right is Source Capital (SOR), which has put a quarter of its assets in big tech companies like Oracle (ORCL), United Technologies (UTX) and Microsoft (MSFT)—three stocks that alone account for 13% of the fund’s assets. Those holdings are up 18.9% in the last year, but we’ve only seen tech begin to recover from its early 2018 weakness—setting us up for more gains ahead.

More importantly, SOR trades cheap, which means you get these stocks at a discount. That’s because SOR is a closed-end fund (CEF), a type of fund that often trades at market prices above its net asset value (or NAV), another name for the liquidation value of its portfolio.

But right now, SOR’s market price is 11% lower than its liquidation value, so you’re getting these stocks for 89% of what you’d pay if you got them through an index fund like the Invesco QQQ Trust (QQQ), or if you bought them one by one.

This is free money!

Pick #2: Tech and Big Income

There is a downside: SOR’s dividend yield is just 2.1%, which is extremely low for a tech CEF. If you want more income and top-performing tech stocks, the BlackRock Science and Technology Trust (BST) might be for you. It yields 4.5%.

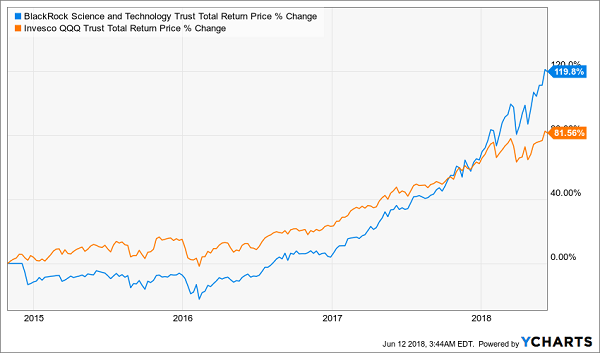

I’ve written about BST a lot before (most recently in March) because it really is a star. Just look at its total return versus QQQ:

Outperforming the Market—With Income!

BST has a dividend yield over 5 times higher than that of QQQ and it’s still able to outperform the index fund by a huge and growing margin.

How does it do it?

The answer may surprise you: management. BST’s managers have consistently picked winning stocks that outrun the well-known stalwarts of the tech world.

What this means is that, beyond the FAANG stocks you’d expect (those account for 25% of BST’s portfolio), the fund’s managers have shrewdly picked and timed purchases in breakout names like top holdings Alibaba (BABA), up 47.5% in the last year; Salesforce.com (CRM), up 53.5%; and Tencent (0070), up 53.6%.

That strong track record comes at a price, though; thanks to its market-beating returns, BST has attracted a high valuation and currently trades at a 7.8% premium to NAV. But the fund’s managers have earned that pricing thanks to their market acumen and high payouts—which mean the premium might go up even more in the coming months.

Pick #3: Greater Income, Greater Safety

If 4.5% still isn’t enough of a dividend yield, or if you want to avoid paying a premium and you want to go beyond tech, I have just the fund for you: the Eaton Vance Tax-Advantaged Dividend Income Fund (EVT), which trades at a 1% discount to NAV and pays a huge 7.5% dividend yield.

EVT has given investors a solid 14.9% total return over the last year, and its 3.4% total return for 2018 so far is pretty close to that of the S&P 500.

That’s not surprising; EVT’s biggest holdings are popular S&P 500 names like JPMorgan Chase (JPM) and Johnson & Johnson (JNJ). This fund is very balanced, with about 10% or less of its assets in sectors such as tech, industrials, healthcare, energy, utilities and real estate.

Its biggest exposure is to the financial sector, which is up 19.8% in the last year and set to keep going higher thanks to the booming economy. Also, financial firms benefit from higher interest rates, so this is a savvy play on the Fed’s plans to raise rates this year and beyond.

Earn 12% Annual Returns For Life!

Robust dividend growth separates the winners from the losers.

Low dividend growth goes hand-in-hand with slow and no growth – and even eventual decay. Hitch your wagon to the supposedly “safe” blue chips that most financial pundits shill for, and you’ll quickly be looking for part-time work a few years into your retirement.

If you want to retire fully funded and worry-free, it’ll take more – a lot more. In fact, it’ll take 12% in safe, annual returns.

That sounds impossible, but it’s not. It takes a special kind of portfolio that offers high current yield, and dividend growth, and the potential for double-digit capital gains in some years. But after months of research and weeding out numerous “ticking yield bombs,” I’ve identified a handful of stocks and funds that check all those boxes.

These stock picks will each reap at least 12% in annual returns – the magic number you need to meet to ensure the worry-free retirement you’ve labored so hard for decades to reach.

My “12% for Life” portfolio ditches pundit favorites such as Exxon Mobil, Coca-Cola or General Mills – yes, the same General Mills that has lost a quarter of its value this year! – and relies on these kind of picks instead:

- One stock that has juiced its dividend 800%-plus in just four years, and has at least another decade of double-digit growth ahead of it!

- A high-growth, high-yield “double threat” stock that threw off 252% gains the last time it was this cheap.

- A 9%-plus payer that hikes its payout multiple times a year, and is on track to double its payout by 2021!

Let me show you the way to double-digit returns that you can actually depend on. Click here and I’ll GIVE you three special reports that show you how to earn 12% for life. You’ll receive the names, tickers, buy prices and full analysis for seven stocks with wealth-building potential – completely FREE!

Category: Closed-End Funds (CEFs)