A 10.4% Dividend With Huge Gains Ahead (Contrarians Only)

If these whipsawing oil markets are making you dizzy, you’re far from alone.

If these whipsawing oil markets are making you dizzy, you’re far from alone.

But this isn’t the time for worry—it’s time to tap oil’s woes for 7%+ dividends and upside!

And, as you’ve probably guessed, I’ve got the perfect funds all lined up for you—3 of them, to be precise. One of these contrarian buys yields 10.4%! And each of these 3 expertly run bargains also gives you some much-needed downside protection, too.

But before we get to them, let’s talk about what’s actually going on with crude these days.

You probably noticed that oil was on a roll from the middle of 2017 until a few weeks ago, when it plunged back to earth.

Oil Takes a Header

That’s a huge collapse—even for a volatile commodity like oil. So what happened?

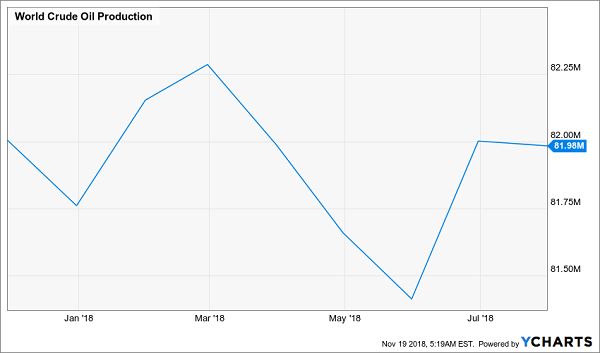

Some people point to overproduction. And it’s true that global output has gone up after falling in April—but the numbers have been so volatile that it’s hard to draw many conclusions, and production is basically flat from a year ago:

Overproduction? The Numbers Say No

Also note that world oil-production data is currently only available through July—but most estimates suggest output hasn’t changed much in the last few weeks, despite attempts by Russia and Saudi Arabia to shutter wells and kickstart prices.

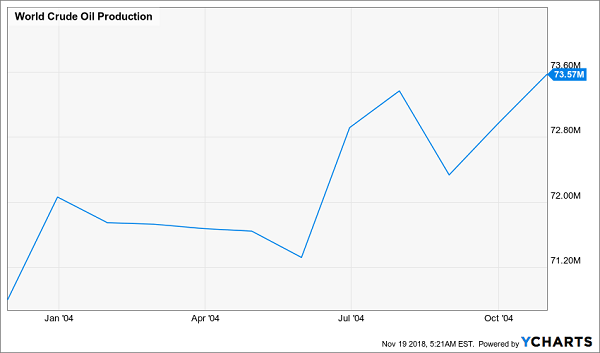

That’s thanks to American crude, which has destroyed OPEC’s ability to manipulate markets. Just look at 2004, before the fracking revolution got going and OPEC still dominated oil. That was a period of economic growth similar to 2018, and the cartel steadily guided production higher in response:

OPEC’s Former Power

With OPEC’s power essentially hobbled, Saudi Arabia and the rest of the cartel can’t impact prices like they used to by cutting output, which makes oil prices harder to predict.

What about demand, then?

Oil consumption has risen 1.5% from a year ago throughout 2018, according to the International Energy Agency, which also says there’s no evidence demand will decline anytime soon. That’s good news for oil’s future; it also means the recent price volatility isn’t a sign of an imminent collapse in demand that will destroy the commodity’s value.

So how should we think about oil, then?

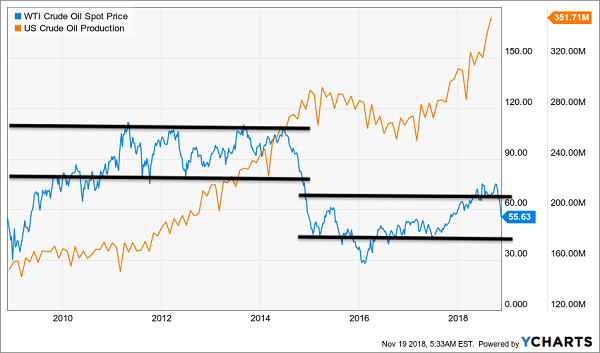

On the one hand, OPEC can’t create artificial scarcity to inflate bubbles, which theoretically keeps a lid on prices. But on the other hand, steady demand means oil prices have a solid floor they likely won’t go below. If this theory is right, we should assume that, since US oil production has skyrocketed, there’s a new range for oil prices that’s lower than back when US oil production was half what it is today.

And that’s exactly what the numbers tell us.

Oil’s New Normal

Before American crude production was really pumping, oil was in an obvious range of $70 to $100, even though world economic growth was sluggish following the subprime mortgage crisis. Then, after the 2014 oil crash, crude reset to a new (and tighter) range of about $45 to $65. It’s only when oil rose above that a couple times in recent months that it fell really hard.

This, then, seems to be our answer.

Oil’s recent crash wasn’t a result of production or supply, but of oil traders getting overzealous and not understanding how the market’s new dynamics work.

So what now?

Today, oil prices are at $55, which is in the middle of the new range for oil, suggesting oil futures are fairly valued. That would suggest you could invest in crude right now—but you might want to wait a little longer.

That is, unless you can find something ridiculously oversold because speculators are betting on future oil declines. The good news is that you can—while also scoring some big dividends for your trouble.

3 Ridiculously Cheap Energy Funds Paying Up to 10.4%

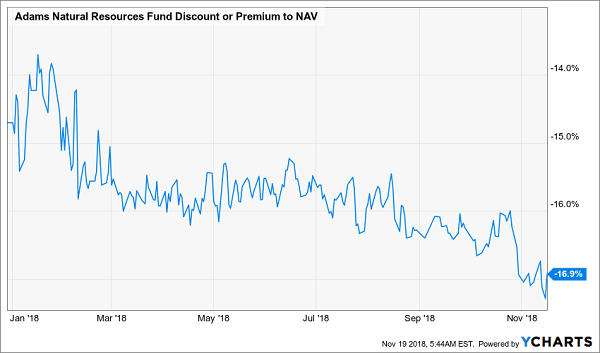

Let’s start with the Adams Natural Resources Fund (PEO), one of the oldest closed-end funds (CEFs) out there. Founded in 1929, this fund has survived a lot of turbulence thanks to its managers’ prudent value-investing approach.

PEO’s dividend is relatively small as CEFs go, at 6.6%, but the best part is that the recent oil selloff has resulted in the fund’s market price trading at a ridiculous discount to the value of its holdings (referred to as net asset value, or NAV):

A Huge Sale Appears

This is the lowest PEO has been priced since early 2016, and if you’d bought then, you’d have gotten a total return of 20.3% in less than 3 years, regardless of oil’s fluctuations.

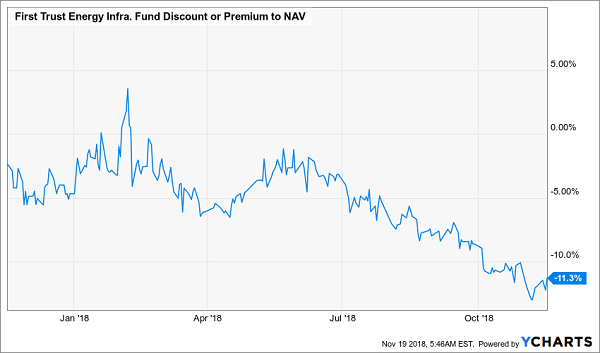

A more daring option would be the First Trust Energy Infrastructure Fund (FIF), with a similar huge slide in its discount to NAV:

Another Huge Sale

On top of the 8.8% yield this fund pays out, you get the opportunity to cash in on a likely 30%+ total return, just like the one investors got the last time the discount was this wide, in early 2016.

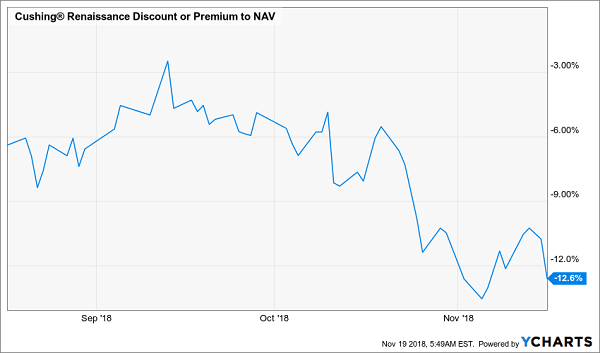

The third option is the big one: a 10.4% yield with the Cushing Renaissance Fund (SZC), which now trades at a 12.6% discount, near where it was in early 2016, as well:

A 10.4% Dividend at an Incredible Bargain

SZC’s return since the last time its discount was this low, in early 2016: a nice 62.5%. That makes now a good time to buy, before history repeats.

Brett Owens’ 8% No-Withdrawal Portfolio

My colleague Brett Owens has created an “8% No-Withdrawal Portfolio” that generates steady income and impressive capital gains.

Brett’s system could hand you $40,000 a year on every $500,000 invested with under-appreciated income plays like:

- Closed-End Funds (CEFs)- We’ll share our top three CEF picks with you, each of which pay a monthly dividend. Many of these trade at a discount to net asset value; but unlike Oxford Square, actually can afford to pay their dividends.

- Preferred Stock- Brett lets you know two of the best active managers in this space to invest alongside with.

- Recession-Proof REITs- discover two REITs that actually benefit from higher interest rates; rather than being crippled by the Fed.

That’s 7 contrarian investment picks just to get started. Click here for instant access to the full 8%, No-Withdrawal portfolio.

Category: Closed-End Funds (CEFs)