The 10 Best Index Funds for 2017, 2018, 2019…

Investors of all stripes can agree that these index funds can work for everyone

Investors of all stripes can agree that these index funds can work for everyone

Index funds are responsible for saving investors like you and me untold billions of dollars in fees over the past couple decades. They’ve also spared us countless headaches. (I don’t know about you, but I’m glad I don’t have to pick specific stocks to get exposure to utilities or play the growth in India’s middle class.) And the best index funds … well, they’ve made us a lot of money, which is the point of it all.

But index funds are also contributing to an issue that could blow up in our faces.

The push into index funds has intensified to the point that some experts believe it’s not only driving the market higher, but it’s causing a valuation bubble. In short, if you buy into any fund (index or not), the fund must invest that money into more stocks — and all that buying is distorting valuations. The danger, then, is that when that bubble pops, many supposedly safe index funds will feel the pain worse than other parts of the market.

The lesson here is that the best index funds to buy for 2017 — and for the foreseeable future — aren’t all going to look the same.

Some top index fund picks will be so buy-and-hold-oriented that you won’t need to worry about the bubble popping in a year or two or three because you plan on holding for 20 years, maybe 30. Some of the best picks for next year will only be worth buying into for tactical trades of a week or two at a time. The best index funds for 2017? More like the best ones for mid-April!

So the following is a list of the best index funds for everyone — from long-term retirement-minded investors to click-happy day traders. And this includes a few funds that I either hold currently or have traded in the past.

In no particular order …

The Best Index Funds to Buy for 2017: iShares Core S&P 500 ETF (IVV)

Type: Large-Cap Equity

Expenses: 0.04%, or $4 annually for every $10,000 invested.

Every year, I take a look at the best index funds for investors, and the Vanguard S&P 500 ETF (NYSEARCA:VOO) is always at the top of my list. The argument is typically the same, and consists of two parts:

- The S&P 500 Index is one of the best chances you have at solid investment performance. That’s because most equity funds fail to beat the market, most hedge funds fail to beat the market, and, to quote Innovative Advisory Group, “individual investors as a group have no idea what they are doing.” So if beating the market is so darned hard, just invest “in the market” and get the market’s actual return. The VOO and two other exchange-traded funds allow you to do that.

- The VOO is the cheapest way to invest in the S&P 500.

But that second point has changed.

Earlier this year, the Department of Labor green-lit a new set of fiduciary rules that will require financial advisers to make recommendations for retirement holdings that are actually in the client’s best interest. (Crazy, I know.) In trying to position itself for advisers suddenly enticed to suggest the lowest-cost offerings, iShares parent BlackRock, Inc. (NYSE:BLK) lowered the fees on 15 of its Core-branded ETFs, including the S&P 500-tracking iShares Core S&P 500 ETF (NYSEARCA:IVV).

Previously, the IVV charged 7 basis points — better than the SPDR S&P 500 ETF’s(NYSEARCA:SPY) 9.45 bps, but still above VOO’s 5 bps. Now, though, IVV falls closest to the cellar at just 4 basis points in annual fees. Thus, the recommendation stands. Buy the market for as cheap as you can — and right now, that’s the IVV.

And that note of caution? If the valuation bubble does pop, the S&P 500 and its components very well could be hit harder than many other blue-chip stocks outside the index. If you only have a few years left in your investment horizon, you should acknowledge this and invest (and monitor) accordingly. If your investment horizon is measured in decades, buy and never look back.

The Best Index Funds to Buy for 2017: iShares Core S&P Mid-Cap ETF (IJH)

Type: Mid-Cap Equity

Expenses: 0.07%

As I just said, it’s difficult to beat the market. But the iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH) is awfully, awfully darn good at it. From a total performance perspective, the IJH has beaten the IVV in every meaningful time period, from one month to 15 years.

And yet, very few people talk about the IJH, just as very few people talk about the companies that make it tick, such as veterinary supplier Idexx Laboratories, Inc. (NASDAQ:IDXX) and plant-based food and beverage producer WhiteWave Foods Co (NYSE:WWAV).

So … what’s the deal?

Mid-cap companies are frequently referred to as the market’s “sweet spot.” That’s because, as Hennessy Funds describes in a recent whitepaper (PDF), they typically feature much more robust long-term growth potential than their large-cap brethren, but more financial stability, access to capital and managerial experience than their small-cap counterparts. The result:

“Using standard deviation as a statistical measure of historical volatility, investors in mid-cap stocks have consistently been rewarded with lower risk relative to small-cap investors over the 1, 3, 5, 10, 15 and 20 years ended December 31, 2015. While mid-caps have historically exhibited higher standard deviation than large-caps, investors were compensated for this higher volatility with higher returns for the 10, 15 and 20 year periods.”

Ben Johnson, CFA, director of global ETF research for Morningstar, points out that “an investment in a dedicated mid-cap fund reduces the likelihood of overlap with existing large-cap allocations and stands to improve overall portfolio diversification.”

In other words, IJH is an outstanding fund, but don’t consider it an S&P 500 replacement — consider it an S&P 500 complement.

Invest in both.

The Best Index Funds to Buy for 2017: SPDR S&P Bank ETF (KBE)

Type: Industry (Banking)

Expenses: 0.35%

This list will include a few Trump plays. First and foremost among them is the SPDR S&P Bank ETF (NYSEARCA:KBE).

Bank stocks logged silly gains starting almost immediately after Donald Trump was declared the victor in the 2016 U.S. presidential election. One-month performances in stocks like Bank of America Corp (NYSE:BAC, +30%) and JPMorgan Chase & Co. (NYSE:JPM, +20%) led the broad Financial Select Sector SPDR Fund (NYSEARCA:XLF) to a 17% gain since the election.

The belief is that Trump will tear down Wall Street regulations, creating an environment that’s much more conducive to bank profits than it is right now. That was confirmed in late November, when Trump confirmed Steve Mnuchin as his pick for Treasury Department secretary, and Mnuchin was quick to say that “(stripping) back parts of Dodd-Frank that prevent banks from lending” was top on his list of priorities.

Mnuchin said something else telling — namely, that regional banks were the “engine of growth to small- and medium-sized businesses.” I got a call from Chris Johnson of JRG Investment Group after that, and he quipped, “It’s like he stared into the camera and winked at every regional bank and said, ‘You’re going to make money again.’”

While XLF does hold banks, it also holds insurers and other types of financials. KBE is a more focused collection of more than 60 banks, including national brands like Bank of America to smaller regionals like Montana-based Glacier Bancorp, Inc. (NASDAQ:GBCI), which is less than $3 billion by market cap. These stocks will not only benefit from any anti-regulation action from the new Trump administration, but also future interest rate hikes — including the likely ramp-up after December’s Fed meeting.

The Best Index Funds to Buy for 2017: PowerShares Aerospace & Defense Portfolio (PPA)

Type: Sector (Defense)

Expenses: 0.64%

Another Trump play worth the while is defense stocks. Yes, most pundits thought defense plays would do well under either Clinton or Trump, but the consensus seems to see the president-elect as the more defense-friendly choice.

The PowerShares Aerospace & Defense Portfolio (NYSEARCA:PPA) is one of two ideal ways to play the defense space broadly. The other is the iShares U.S. Aerospace & Defense ETF (NYSEARCA:ITA), and frankly, I think it’s a toss-up between the pair. It just depends on what you’re looking for.

Both are heavy in many of the same stocks, such as Boeing Co (NYSE:BA) and United Technologies Corporation (NYSE:UTX). The price advantage goes to the iShares fund, which is cheaper by 20 basis points. However, PPA is a better choice if you’re looking for more diversification — slightly less of its weight is in its top 10 holdings than ITA, and it also features 51 holdings to ITA’s 37.

The PowerShares ETF also hasn’t run as hotly as iShares’ fund. The ITA is up 41% since the February bottom versus about 38% for PPA, and the former is up just a hair more since the election.

It’s a small difference, but an important one. Defense stocks are clobbering the market this year, including more than doubling the S&P 500 since Trump got elected. This isn’t a hidden trade. Frankly, I think new money should consider waiting for the next sizable market dip to knock some of the froth off before buying either of these ETFs.

But defense will rule for at least the next four years. Thus, PPA and ITA will too.

The Best Index Funds to Buy for 2017: Global X SuperDividend Emerging Markets ETF (SDEM)

Type: Emerging-Market Dividend

Expenses: 0.65%

The next four funds are dedicated yield plays, and we’re starting with a pretty young (and aggressive) ETF — the Global X SuperDividend Emerging Markets ETF (NYSEARCA:SDEM). But there are a few sound theories that could make this one of the best international plays of 2017.

Trump is widely considered to be a net negative for emerging markets because of his anti-trade, pro-U.S. rhetoric. But as Paul J. Lim and Carolyn Bigda at Fortune point out, the recent reactionary drought in EM stocks has brought their price-to-earnings ratios “30% below their long-term average.” Plus, if Trump ends up being mostly talk on this front, that fear will abate, taking pressure off emerging markets.

The duo point out a number of other drivers, including …

- Stimulated U.S. economic growth would benefit emerging markets who export to the West.

- Commodity price pressure has eased, helping the many materials plays in EMs.

- Higher oil prices should reduce the number of loan defaults in oil and gas, which will lift some of the worries about emerging markets’ financial companies.

All of that stands to benefit the SDEM, which boasts materials (23%) and financials (15%) as its two heaviest sectors, and invests heavily in commodity-focused markets including Brazil and Russia.

SDEM does pose a bit of risk by intentionally investing in some of the highest yielders across a number of emerging markets — as we all know, dividends can suggest financial stability, but excessively high dividends can be a symptom of troubled companies.

But Global X views the high dividends as another factor of value (the reason yields are high is because the stocks are underappreciated), and it does mitigate this risk by equally weighting its 50 holdings upon every rebalancing. So right now, the largest weight in the fund is Indian miner Vedanata Ltd (ADR) (NYSE:VEDL) at just less than 4% of the fund.

SDEM’s monthly dividend yields 4.9% based on the past 12 monthly payouts, but if future payouts look anything like recent ones, you’re looking at closer to 4%. That’s still excellent for an emerging-markets fund, and icing on the cake if the potential for an EM rebound is realized.

The Best Index Funds to Buy for 2017: PowerShares S&P 500 High Dividend Low Volatility Portfolio (SPHD)

Type: U.S. Dividend

Expenses: 0.3%

If you’re looking for dividend stocks without quite so much risk, the PowerShares S&P 500 High Dividend Low Volatility Portfolio(NYSEARCA:SPHD) is literally designed to provide you with just that.

The SPHD is another 50-stock portfolio that seeks out dividends not in risky emerging markets, but in the most stable high-yield blue chips the S&P 500 has to offer. To do this, the index takes the 75 highest-yielding constituents of the index, with a maximum of 10 stocks in any one particular sector, then takes the 50 stocks with the lowest 12-month volatility from the group.

The result is a mostly boring group of stocks that’s heavy in utilities (17%), industrials (15%) and real estate (13%). What’s interesting there is that information technology is a fairly heavy weight at 12% of the fund. The fund also uses a modified market cap-weighting scheme that provides a ton of balance. Even top holdings CME Group Inc (NASDAQ:CME) and General Motors Company (NYSE:GM) are just barely 3% of the fund apiece.

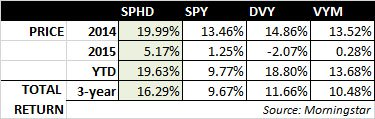

This PowerShares ETF doesn’t have a ton of market history, having come to life in late 2012. But what is remarkable about SPHD is just how dominant it has been over the past few years.

The main purpose of a fund like SPHD is to create even returns and strong income — something more in line of protection against a down market. But it has even managed to clobber SPY (and numerous dividend ETFs) amid a rip-roaring rally.

SPHD is young, but it looks like one of the best index funds on the market.

The Best Index Funds to Buy for 2017: SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

Type: Junk Bond

Expenses: 0.4%

In late 2014, I picked the SPDR Bloomberg Barclays High-Yield Bond ETF (NYSEARCA:JNK) as one of the best index funds to buy for 2015, and JNK responded by dropping 13% that year, and recovering to “only” 6% declines as of this writing. On a total return basis, however, JNK has actually returned 5.5%.

That reflects the general idea behind buying JNK — even in difficult times for junk bonds, a heavy yield can do a lot to offset capital losses, and then some.

Through the flagging months of 2016, investors soured on numerous yield plays as a knee-jerk reaction to the idea that the Federal Reserve would almost certainly will raise rates in December — and likely continue to push rates higher in 2017. But Invesco recently released a report showing that high-yield bonds like those held in JNK actually perform well in rising-rate environments (PDF). It starts:

“Since 1987, there have been 16 quarters where yields on the 5-year Treasury note rose by 70 basis points or more. During 11 of those quarters high yield bonds demonstrated positive returns; during the five quarters where high yield bond returns were not positive, the asset class rebounded the following quarter.”

There’s a number of reasons for this, such as an expanding economy normally being a boon for corporate debt service (lowering default rates), a lower relative duration rate of junk bonds and the boosting of returns via prepayment penalties by companies anxious to reduce or eliminate their debt before rates increase.

Meanwhile, near-zero rates have helped keep down the rates on junk bonds, so right now JNK is yielding nearly 6% despite offering some of its lowest nominal payouts since inception in late 2007. Expect that to rise along with interest rates in coming years, which will provide outstanding annual returns from income alone to anyone with a long investment horizon.

The Best Index Funds to Buy for 2017: VanEck Vectors Preferred Securities ex Financials ETF (PFXF)

Type: Preferred Stock

Expenses: 0.41%*

Another less-ballyhooed asset geared toward high income is preferred stocks. They’re called “preferred” because the dividends on them actually take preference over common stock dividends. Preferreds must be paid before commons are, and in the case of a suspension, many preferred stocks demand that the company pay all missed dividends in arrears before resuming dividends to common shares.

And the “stocks” part of the moniker is a little misleading too, because they actually have a lot in common with bonds:

- While common stock technically is equity, it typically doesn’t include voting rights (like bonds).

- Also, rather than a dividend that may fluctuate from payout to payout like a stock, preferreds have one fixed, usually high, payout amount that’s assigned when the stock is issued (like bonds).

- While common stock technically can register capital gains and losses, they tend to trade close to the par value assigned at issuance, which often is $25. So they might trade at a little discount, or a little premium, but they don’t fluctuate a lot. In other words: They have low volatility.

While I have long been (and still am) invested in the iShares U.S. Preferred Stock ETF(NYSEARCA:PFF), my recommendation is the VanEck Vectors Preferred Securities ex Financials ETF (NYSEARCA:PFXF).

The PFXF was one of a few ex-financials funds that came to life in the wake of the 2007-09 financial crisis and bear market. So it differs mightily from most preferred stock funds which are heavy in banks and other financial stocks. Instead, PFXF is loaded with preferreds from utilities (29%), REITs (28%) and telecoms (15%).

But the real draw of PFXF is its low 0.4% expense ratio, tiny beta of 0.2 and 5.9% yield — the best combination of the three in the space.

*Includes an 8-basis-point fee waiver

The Best Index Funds to Buy for 2017: Direxion Daily S&P Biotech Bull 3x Shares (LABU)

Type: Leveraged Industry (Biotech)

Expenses: 0.95%*

I have no doubt that a Democratically controlled Washington, D.C., would’ve cracked down hard on drug pricing — not just because Hillary Clinton telegraphed her intentions with a famous biotech-crushing tweet in September 2015, but also because of the subsequent pressure put on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Mylan NV(NASDAQ:MYL) after subsequent brouhahas over gouging.

Thus, I believe pharmaceutical and biotechnology companies were given a stay of execution with the election of Donald Trump and a Republican Congress.

But while I’m long both pharmaceuticals via the Health Care Select Sector SPDR Fund(NYSEARCA:XLV) and biotechs via the SPDR S&P Biotech ETF (NYSEARCA:XBI), I think the best healthcare opportunity will be found by traders who tango with the Direxion Daily S&P Biotech Bull 3x Shares (NYSEARCA:LABU).

The LABU is a 3x leveraged index fund that aims to provide triple the daily returns of the S&P Biotechnology Select Industry Index — the same index the XBI is based off. Note the term “daily returns” — the longer you hold onto leveraged funds, the more your returns can skew from the movement of the index. But, if you’re simply looking to make a trade over the course of a few days or even a couple of weeks, LABU can rip off insane returns, such as the 33% it returned in just the first day after Clinton was defeated.

I think biotechs could still be in for a bumpy ride in 2017 and beyond, as popular outcry over sky-high drug pricing isn’t going away. Moreover, there’s still the issue of pharmacy benefits managers (PBMs) increasingly siphoning pharmaceutical and biotechs’ profits. But aggressive traders will get the most bang for their buck trying to play dips with tools like LABU, while fiscal hermit crabs like myself are content to sit in XBI and enjoy the uneven crawl higher.

*Includes 12-basis-point fee waiver.

The Best Index Funds to Buy for 2017: Direxion Daily Gold Miners Index Bull and Bear 3x Shares (NUGT/DUST)

Type: Leveraged Industry (Gold Mining)

Expenses: 0.94%/0.95%*

The last of the best index funds for 2017 are actually a pair of funds that you can use to trade gold. (Sort of.)

The Direxion Daily Gold Miners Index Bull 3x Shares(NYSEARCA:NUGT) and Direxion Daily Gold Miners Index Bear 3x Shares (NYSEARCA:DUST) are actually leveraged plays on the NYSE Arca Gold Miners Index — an index of gold mining companies that powers the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX).

Why gold miners?

Gold miners have certain all-in costs of mining gold, and so they move heavily based on the price of the commodity. In fact, they tend to be more volatile than gold itself. Just take the first half of 2016, in which the SPDR Gold Trust (ETF) (NYSEARCA:GLD) returned a robust 25%. GDX doubled in that same time frame. And NUGT? NUGT returned 420% — so, more than quadruple the GDX.

But if you timed the play wrong, you were sunk. If you bought NUGT in May and held through the end of the month, you were down 40% to GDX’s 14%.

I have no doubt that 2017 will provide a number of big drivers (in either direction) for gold, from U.S. dollar movements to interest rate hikes to renewed Brexit fears. NUGT and DUST are two lucrative ways to profit off those trends.

Just handle with care.

*Includes a 9-basis-point fee waiver for NUGT and a 2-basis-point fee waiver for DUST.

This article originally appeared at investorplace.com. For more information about ETFs, click here…

Kyle Woodley is the Managing Editor of InvestorPlace.com. As of this writing, he did not hold a position in any of the aforementioned securities.

Category: ETFs