2 Retirement-Killing Mistakes Investors Make (And How To Avoid Them)

I know I don’t have to tell you that risk management is one of the keys to successful long-term investing.

I know I don’t have to tell you that risk management is one of the keys to successful long-term investing.

But here’s the strange thing: most responsible, risk-conscious investors underperform the market—and not by a little.

Why?

Because the reality of risk management is not the conventional wisdom frequently peddled by financial advisors. They warn that taking on too much risk will threaten your life savings, so you need to choose an extremely conservative fund and invest for the long term.

That’s close enough to the truth to sound convincing—but unfortunately it’s wrong. (I’ll show you two funds that upend the “conventional” wisdom—and deliver consistent market-beating gains—in just a moment.)

Here’s the real secret to growing wealth by investing: understand the markets, understand the mistakes retail investors make and avoid them.

There are two obvious mistakes: gambling and opting out. You may have a friend who loves to day trade and swears they make a huge profit from it. But then you should ask yourself why they’re still day trading, why they’re still working and why they don’t live near Richard Branson.

Because the reality is, these people aren’t raking it in—they’re gambling—and probably losing a lot of money. But because of pride, they only brag about their wins.

The “opting out” mistake is another familiar, but more boring, one. You probably have co-workers who fear the stock market, so they keep all their money in their house.

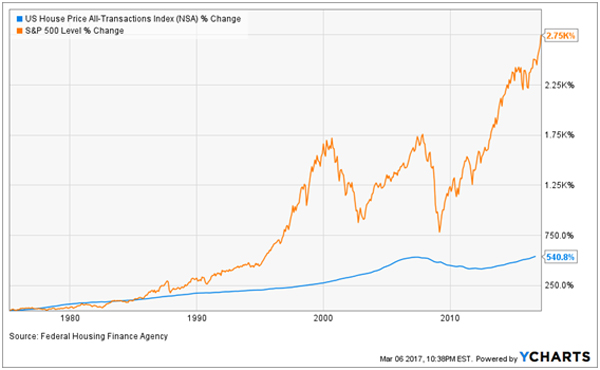

There’s just one problem with that—gains from housing are terrible:

A Secure Retirement from Housing? Yeah, Right!

When I talk to friends, family and non-financial professionals about how they plan on using their home equity to secure their retirement, I feel a mix of pity and frustration. Look at that chart! A 540% gain sounds good, but that’s an annual growth rate of 4.2%. Stocks get you an 8.4% return—double that of housing! Betting on your home for your retirement is sheer folly.

Smarter people who understand math realize this and look beyond their homes. But then, there are thousands of funds and many thousands more stocks to choose from. Where does one put the money?

This is where the financial-advisor mistake comes into play.

Many advisors urge conservative allocations with a mix of U.S. Treasuries and stocks. Many also overcharge to help you “balance” your portfolio to allocations that make sense for your age.

Why do I say “overcharge”? Because there are very cheap target funds that do this automatically for you, and usually for much less money. Vanguard has some of the most popular ones, with the lowest fees, making them the best of this product line.

Sadly, the best choice from a selection of bad choices is still bad.

Target funds notoriously underperform over long time horizons because a portion of their assets are locked up in essentially non-performing U.S. Treasuries. To make matters worse, you’re paying fees to money managers who keep your money in U.S. Treasuries! Vanguard is great at keeping fees low, but paying for someone to do something as easy as buying Treasuries is worse than paying nothing and doing it yourself.

But that’s not the worst part.

The worst part is how much money investors lose by choosing these lower-risk funds.

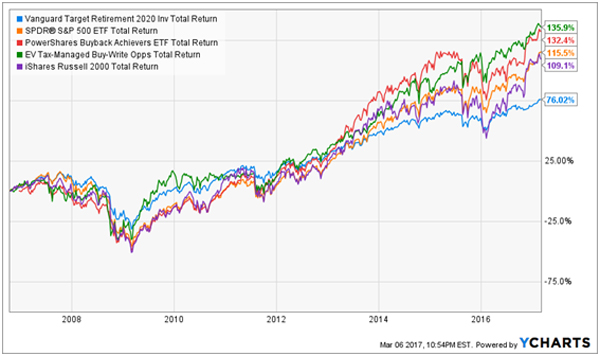

Consider the Vanguard Target Retirement 2020 Fund (VTWNX), which is designed for people who plan to retire in or around 2020 (the fund’s asset allocation shifts away from stocks and toward bonds over time).

The fund has done what it promised—provided a decent 89% return since 2006. Yet the SPDR S&P 500 ETF (SPY) and the iShares Russell 2000 Fund (IWM), which are much riskier 100% equity funds, have massively outperformed the “safe” mutual fund:

ETFs Trounced This “Safe” Fund

Besides a few months in the darkest days of 2009 and 2010 and a while in 2011–12, the Vanguard fund has massively underperformed the stock funds. But these funds aren’t for short-term trading, and short-term rises in price aren’t relevant to the fund’s goal: to provide strong growth over the long term. Vanguard provided growth in this fund, for sure, but to call it “strong” would be simply false.

So the long-term, retirement-focused investor would be better off with SPY and IWM. And this makes sense for people who think you can’t beat the stock market and should just buy a broader index fund and wait for your money to grow.

But these people are wrong.

There are funds that stuck to 100% stocks and trounced both SPY and IWM. They didn’t take on more risk (in fact, the two I’m thinking of are both much safer than IWM and a bit safer than SPY), but they still beat the index funds.

I’m talking about the PowerShares Buyback Achievers ETF (PKW) and the Eaton Vance Tax-Managed Buy-Write Opportunity Fund (ETV). Both funds focus on large cap stocks, but they avoid the riskier small cap stocks in IWM and use a value-driven strategy to beat SPY. Yet they have earned investors more money than the more popular options, let alone the “low risk” Vanguard mutual fund:

“Uncool” Funds Deliver Big Gains

There’s a psychological explanation for why this happens—and it happens a lot. It’s called risk aversion. Human beings are very afraid of what they may lose, and that fear causes them to make mistakes. This is the unfortunate case for people who have chosen Vanguard’s target mutual funds.

And the Best Fund to Buy Now Is…

Of these two, the Eaton Vance Tax-Managed Buy-Write Opportunity Fund is by far the better bet: it yields an outsized 8.8%, so you’re beating the S&P 500’s average return—every year—in cold, hard cash!

Plus, ETV historically trades at a premium to its net asset value (NAV, or the value of its underlying holdings), and even traded at a 9.5% premium just a few weeks ago. If ETV trades again at that premium, which is looking more likely thanks to the market’s never-ending hunger for high yield assets, you’re looking at 3% in capital gains on top of your 8.8% income stream!

That’s the beauty of investing in closed-end funds like ETV: unlike ETFs, CEFs can’t issue new shares after their IPOs, and that sets up weird situations—like this one—that you and I can jump on for some quick profits.

This is precisely why we’ve made CEFs the beating heart of our “8.0% No-Withdrawal Retirement Portfolio.” The best part? Three funds in this portfolio pay even higher dividends than ETV: I’m talking payouts up to 10.1%!

And these 5 funds are even more mispriced than ETV—so you’re set up for even bigger gains!

I can’t wait to show you all 6 of the unusual high-yield investments in this powerful new portfolio. Simply click here to get their names, tickers and our full retirement-investing strategy now.

Category: ETFs