2 Stocks To Buy Now That Gold Is Heating Up

After nearly half a decade of being shunned, gold is finally shining once again. Hedge funds are flocking to the asset in droves, but just buying this yellow metal isn’t enough, there are even better plays to buy today.

After nearly half a decade of being shunned, gold is finally shining once again. Hedge funds are flocking to the asset in droves, but just buying this yellow metal isn’t enough, there are even better plays to buy today.

Gold is back over $1,300 an ounce for the first time in sixteen months after its best quarter in 30 years. This has pushed the SPDR Gold Trust ETF (NYSEARCA: GLD) up nearly 20% this year, which comes after falling for three straight years.

Back in 2014, we said it was time to sell gold and buy regional banks and airlines. Things have changed a lot since then. Investors are losing confidence in central banks and their ability to keep the global economy growing. Thus, economic growth is less certain and interest rates could remain at record lows for even longer.

Economic growth wise, the U.S. gross domestic product was up just 0.5% in the first quarter. This was the worst performance in two years. There’s also the weakening dollar, which is further driving gold higher; given, Gold is priced in U.S. Dollars and is cheaper for foreign buyers when the dollar is weak.

The other tailwind for gold is the vicious cycle of low interest rates The Federal Reserve left rates unchanged again last month and it looks like their June meeting will go without a rate increase. As rates remain low, the dollar will continue to weaken.

In fact, hedge funds are betting the dollar will collapse. The last time hedge funds were making such an aggressive bet was against oil. Truly a vicious cycle that can continue pushing gold higher.

Gold has long been a great fear play and there’s plenty of fear mongering these days. This includes hedge fund managers Stanley Druckenmiller and Paul Singer.

Paul Singer of Elliott Management, which is known for his battle with the Argentine government, has said that the recent gold rebound is just the beginning. Meanwhile, Druckenmiller is taking a more direct approach, essentially telling investors to sell all their stocks and buy gold.

Druckenmiller has an impressive career as a hedge fund manager before shutting down his fund to manage family money. He generated annualized returns of 30% over his 25-year career and his Duquesne fund never had a down year.

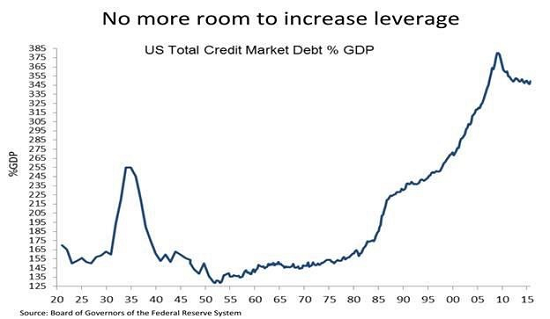

As Druckenmiller laid out at the Sohn Investment Conference earlier this month, the U.S. is already grossly over-leveraged, where corporate debt has climbed to record levels as companies opt to raise debt for buybacks and acquisitions, rather than investing in growth.

Source: Stan Druckenmiller Sohn Presentation

Druckenmiller has a track record of finding holes in the market. Back in 2005, he showed up at the Sohn Conference and called the housing market a massive bubble. Today, Druckenmiller says that the upcoming collapse will be worse than the financial crisis.

On his gold bet, Druckenmiller and Singer aren’t alone. Hedge funds net long positions in gold are the highest since 2011.

Yet, I’ve never been a fan of gold as a speculative investment. Warren Buffett has said of the yellow metal, “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Gold is just a piece of metal; however, there are economic ways to profit from gold – the gold miners. These guys can actually build a business around gold. After being on the defensive with divestitures, debt reduction, and dividend cuts since gold prices topped out at $1,900 an ounce in 2011, miners are ready to go on the offensive.

Goldman Sachs, which has been notoriously bearish on gold, is also coming around – saying that it’s not too early to start talking about growth for the miners, with the sector on the cusp of an upward cycle.

Here are the top two gold plays:

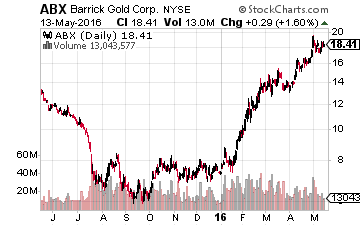

Top Gold Play No. 1: Barrick Gold Corp. (NYSE: ABX)

Barrick runs one of the cheapest mining operations around. All of its mines have an all-in mining sustaining costs well below the mining industry average. Just last quarter, Barrick managed to beat expectations thanks to lower costs.

Barrick runs one of the cheapest mining operations around. All of its mines have an all-in mining sustaining costs well below the mining industry average. Just last quarter, Barrick managed to beat expectations thanks to lower costs.

And, despite the upside from higher gold demand, Barrick will also benefit from monetizing its non-core mines. Barrick’s balance sheet is also improving, with the miner having reduced its debt by $3 billion last year and plans to cut $2 billion this year. What’s more is that Barrick can be cash flow positive even if prices fall to $1,000 an ounce.

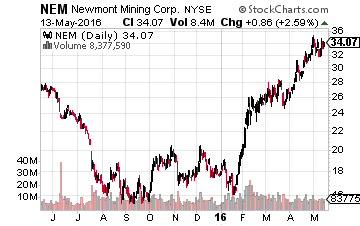

Top Gold Play No. 2: Newmont Mining Corp. (NYSE: NEM)

Newmont Mining is another miner that has been reducing debt and increasing efficiency over the last few years, all in preparation for this moment – a resurgence in gold demand. It has a gold-price-linked dividend that gives investors more leverage to gold prices.

Newmont Mining is another miner that has been reducing debt and increasing efficiency over the last few years, all in preparation for this moment – a resurgence in gold demand. It has a gold-price-linked dividend that gives investors more leverage to gold prices.

This miner can also break even if prices fall below $1,000 an ounce. For the last seven quarters, Newmont’s break-even gold price has been below $1,000, and for the most recent quarter, it was $830. In terms of sourcing gold, Newmont has a promising new mine in Africa and should benefit from a recovery in Nevada mining.

In the end, assuming we’re at the end of the road for stocks because the government has done everything it can to increase share values, it may well be time to take a closer look at gold. But, for investors looking for safe-haven assets, buying the gold miners might be more advantageous than simply buying blocks of the yellow metal. Unlike gold, which is at the mercy of the market, gold miners have the ability to cut costs and address inefficiencies to grow their bottom line.

Investing in gold miners could be an easy way to ride the next bull market sector higher, but if you’re looking to add some consistency to your portfolio, you should take a second to learn about a specialty bank paying 7% a year.

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

This specialty bank in America’s heartland is currently paying 7%.

He then shared with Tim exactly how his bank is able to pay so well and how everyday Americans (and Canadians!) can get in on this. Click here to find out.

Tim jotted down all of his notes and put them in this one report for you.

Click here for the full briefing that tells you exactly how and when to get started.

Category: What's Going On?