2 Stocks To Buy For A Lifetime Of Increasing Dividends

If you’re playing catch up in your retirement or are still years away, buy these two stocks to help you steadily build wealth. These safe investments have unmatched track records of increasing dividends regardless of bear markets or global recessions and will pay you a bigger dividend every year.

If you’re playing catch up in your retirement or are still years away, buy these two stocks to help you steadily build wealth. These safe investments have unmatched track records of increasing dividends regardless of bear markets or global recessions and will pay you a bigger dividend every year.

My research is indicating that the U.S. stock market bull market has run out of steam. Overall market gains were strong and steady from the bear market bottom in March 2009 through the end of 2014. In contrast, over the last 16 months the market has gone nowhere and volatility has been high. To make money in this type of market requires a different strategy.

Subsequent to the October 2007 to March 2009 Bear market (during which the major market indexes lost about 50% of their values) investors got a ride on a nearly six-year long bull market. From that March bottom through the end of 2014, the overall market, as indicated by the SPDR S&P 500 ETF (NYSE:SPY), gained 170% with only one meaningful correction along the way, in the fall of 2011.

Looking back, the bull market has produced two effects. First, anyone who bought shares at anytime from 2009 through mid 2014 has some nice gains sitting in their brokerage account. (Excluding energy sector stocks, which experienced a sector bear market from late 2014 through February 2016.) The second effect is that historical returns now show attractive numbers, which will attract individual investor money back into the market. For example, the SPY ETF now reports a 5-year average annual return of 11.4% and a 10-year average return of 6.9%. Even stronger, the Nasdaq 100 index as tracked by the PowerShares QQQ Trust ETF (Nasdaq:QQQ) has a five-year average return of 13.7% and the 10-year average is in double digits at 10.6%. It’s like the last bear market never happened.

However, just as those attractive historical return numbers will continue to pull investors back into the market, the bull has gone to sleep. This chart shows the SPY value from the end of 2014 through the present:

Over the last 16 months the market has basically gone nowhere with a couple of unpleasant and scary corrections along the way. While my predictions may end up as completely wrong, a flat market with higher volatility is the type of pattern I expect to see for an extended period of time. Out to a decade from now. I base that predication on information I have picked up from some very large money hedge funds and other types of funds managers. The basic reasons for an ongoing multi-year market that swings from correction to correction without an upward trend are these:

- The U.S. economy remains stuck in a slow growth pattern, with annual GDP increases remaining very close to that 2% number. Historically, GDP has increased by 3% to 4% per year during economic expansions. The current growth rate is one-third to one-half lower than in the past, so it’s hard to see how stocks are going to hit their historical high single-digit annual return average.

- S. corporate earnings have stopped growing. Over the last year, the S&P 500 aggregate earnings are down 14.8%, and minus the energy sector the rest of the S&P has increased earnings by just 1.8%.

- Over the long-term, the average annual stock market returns have been 3% to 4% greater than the no-risk government bond yield. With the 10-year Treasury at a 1.8% yield, this historical indicator points to 5% to 6% average stock market returns for the next decade.

From these facts, and barring an acceleration in the GDP growth rate, which would be good, or an economic recession, which would probably trigger another bear market, I come up with average stock market returns for the next decade in a range of zero percent up to a high end of 6% returns. These returns are well short of what the market has put up in recent history and the 9% average annual return for the last 80 years. Investors who own broad market ETFs or have portfolios that look like the market averages may not get to where their financial plans need them to be five or 10 years down the road.

Related: How to collect $3,870 on average for every month in 2016.

The good news is that a flat market will allow quality companies to stick out from the pack and produce decent to great returns for investors. It will be a stock pickers market vs. the index investors market we have experienced since 2009. So, you need to have a stock picking strategy, and I would like you to consider this one:

Higher yielding stocks combined with moderate to above average dividend growth potential.

This strategy takes advantage of a mathematical certainty that will lead to above average total returns. The math works like this: If a stock currently yields 5% and the company increases the dividend by 5% per year, for the yield to stay the same, the stock price must increase by the dividend growth rate. The result is a 5% share price gain plus the 5% in dividend yield for a 10% total annual return. In the short to intermediate term, the market focuses on other economic and financial factors, and you will not see linear share price gains to match the dividend increases. But in the longer term, with companies that have produced steady dividend growth, the mathematical forecast turns into real average annual total returns. Here are a couple of examples:

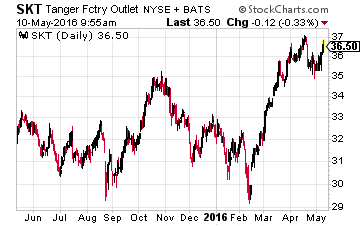

Tanger Factory Outlet Centers Inc. (NYSE:SKT) is a REIT that owns outlet style shopping centers. Over the last decade, the company has produced 10-year average annual dividend growth of 7.37% per year. Over that period, the average yield was 3.34%. Add them together and you get a mathematical annual return of 10.71%. To compare, the actual annual compound return earned by SKT investors was 12.81%.

Tanger Factory Outlet Centers Inc. (NYSE:SKT) is a REIT that owns outlet style shopping centers. Over the last decade, the company has produced 10-year average annual dividend growth of 7.37% per year. Over that period, the average yield was 3.34%. Add them together and you get a mathematical annual return of 10.71%. To compare, the actual annual compound return earned by SKT investors was 12.81%.

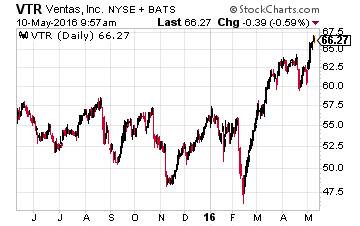

Ventas, Inc. (NYSE:VTR) is a healthcare REIT with similar long-term results. The VTR dividend has grown by an average of 7.76% per year over the last 10 years, and the average dividend yield has been 4.72%. Add them together and you get a mathematical return expectation of 12.48% average per year. The actual return to VTR investors has been 12.34% per year, almost right on the by the math money.

Ventas, Inc. (NYSE:VTR) is a healthcare REIT with similar long-term results. The VTR dividend has grown by an average of 7.76% per year over the last 10 years, and the average dividend yield has been 4.72%. Add them together and you get a mathematical return expectation of 12.48% average per year. The actual return to VTR investors has been 12.34% per year, almost right on the by the math money.

The power of this strategy is that you can expect returns like these from stocks like these as long as they keep increasing their dividend rates.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Thursday, May 19th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $4,151.80 in payouts by June, but only if you’re on the list before May 19th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: REITs