3 Big Energy Dividends Set To Grow

Energy is a dangerous sector. With declining profits and even dividend cuts hitting some companies, it’s becoming harder and harder to invest in energy and for a reliable income stream.

Energy is a dangerous sector. With declining profits and even dividend cuts hitting some companies, it’s becoming harder and harder to invest in energy and for a reliable income stream.

But this doesn’t mean we need to avoid energy altogether—we just need to choose our stocks carefully.

I don’t see oil climbing much above its current price anytime soon, considering the major output from America-based firms and plans in Iraq and Norway to increase output. But OPEC is also looking to control pricing by limiting output, so we may see a supply/demand standoff that will keep the commodity range bound. In fact, oil has been range bound for quite a while already:

Temporary Dips and Peaks

Although WTI crude oil futures dipped to below $30 per barrel earlier this year and climbed over $50 last summer, those volatile prices didn’t last more than a couple months. Compare that to the huge slide back in 2014 (which I called in April, within percentage points of the top):

A Slippery Slope for Oil

Down and down it goes—but when we put those charts together, it shows that we’ve now hit a period of price stabilization:

Oil Finds Its Bottom

Energy is stabilizing as a sector. But the “new normal” oil price means not all companies are going to survive—and many will struggle to stay afloat or increase dividends with prices at their current level.

That’s why we need to diversify. If we want income and energy exposure, we need to create a portfolio that includes hundreds of companies and is heavily weighted towards the larger companies where economies of scale ensure profitability over smaller, riskier players.

For diversification, we should start with funds. The Energy Sector SPDR ETF (XLE) is a good place to start.

A Decent Recovery

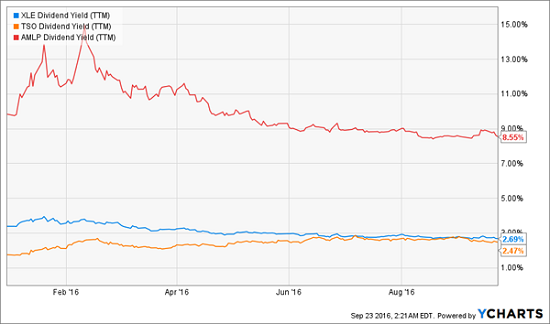

This ETF is up 9% year-over-year—a nice recovery, with a still-respectable 2.7% dividend yield.

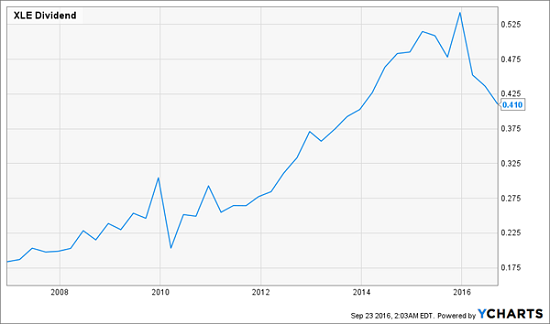

And about that dividend—yes, it’s been cut recently. The dividend is down nearly 17% from its peak at the end of 2015—but that’s after many years of dividend increases:

What Goes Up Must Come Down—But How Much?

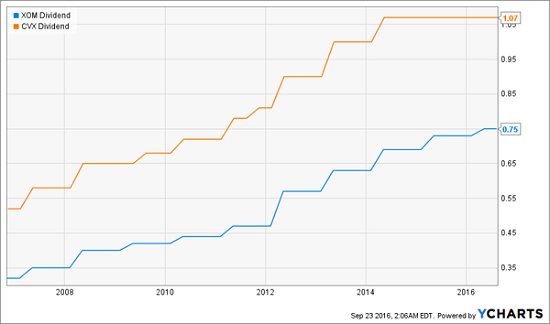

Still, this doesn’t mean dividends are going to keep going down. In fact, with the stabilization of oil and the fund’s weighting towards large oil companies like ExxonMobil (XOM) and Chevron Corporation (CVX), the fund gives exposure to the most responsible energy companies with the best dividend histories. In fact, these two companies—which are the fund’s two biggest holdings—haven’t cut their dividends at all even as oil prices fell:

Bigger is Better for Dividend Coverage

Of course, we can’t throw all of our eggs in one basket. Even if XLE is well diversified, it’s still a fund focused on energy production. So let’s diversify into energy transport.

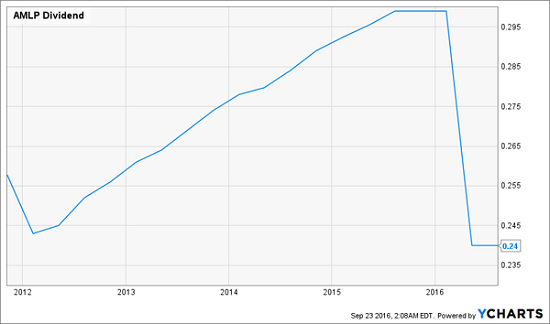

To do this, let’s consider the Alerian MLP ETF (AMLP). It pays a monstrous 8.6% dividend yield. And there’s good reason—the dividend recently was a 25% cut, which has startled investors:

Payouts Come Crashing Down

With the cut, the fund has also seen its share price fall by over 8%:

No Growth Here

But remember, oil prices are stabilizing. The likelihood of another shock to companies’ profitability in the energy sector is unlikely, making these current income streams more reliable than they were before oil prices collapsed.

Now AMLP’s 8.6% dividend isn’t completely safe, but the high payout means we’re getting well compensated for the risk. Even if a 25% dividend cut comes, the firm will still pay a dividend of 5.7%. Not bad for a worst case, almost impossible scenario.

With these two funds, we’re extremely well diversified, but let’s add an undervalued stock with very solid fundamentals that also has strong dividend growth potential. For this, we’ll buy Tesoro (TSO), a petroleum refinery company with a market cap of $10 billion.

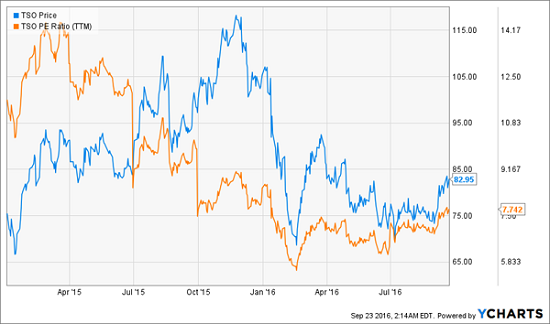

After the terror of oil, TSO held up fairly well—and is actually up 9.9% from the beginning of 2015. But at the same time, it’s actually become cheaper:

Higher Stock Price, But Lower P/E

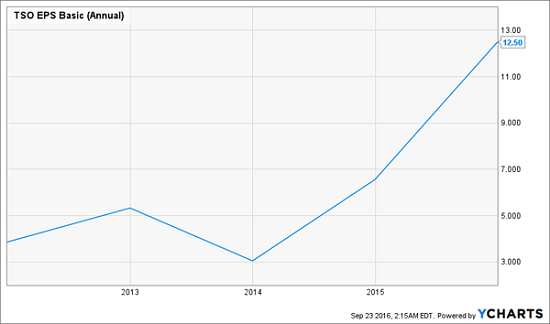

Note how the company’s P/E ratio has fallen in half even as its price went up, and now its P/E ratio is a tiny 7.7—about a third of the S&P 500. That’s because Tesoro’s EPS is in an upward spiral:

Earnings Soaring Despite Oil’s Fall

Note how the EPS growth happened even while oil was falling. TSO clearly can make money no matter what happens to oil prices, which is why its dividend kept going up even when oil was plummeting:

Dividend Growth Keeps Going

Now we’ve got energy production, refining and distribution. We’ve covered the entire energy industry and have exposure to hundreds of companies.

Putting it all together, what income can we expect?

Dividends From Hundreds of Companies in Three Stocks

On average, the portfolio yields 4.6% with potential for growth thanks to XLE and TSO.

But Who Wants to Risk Retirement on Oil Prices?

The dream of a full income stream from dividends is unfortunately only available to rich people today. These now-static yields of 4.6% just won’t get it done – that’s only $46,000 in income on a million bucks!

And who wants to gamble their nest egg on oil prices anyway?

Instead, I’d consider a lesser-known subset of funds with durable dividends and yields of 8%. These funds achieve “alpha” to power their high yields as they don’t just buy common stocks—they take a more comprehensive approach to the market and diversify into bonds, preferred stocks and other assets that most people can’t easily get their hands on. When you diversify into these asset classes and across sectors, you build a robust portfolio that can withstand a fall in the stock market.

That is important for retirees, because it means you don’t have to sell off your holdings in a market downturn to get an income to live on. In fact, you can use these funds to create a no withdrawal portfolio where you never have to touch your capital and only spend the dividends thanks to the high yield of these funds.

The No Withdrawal Portfolio is one of the best ways to diversify in a volatile market and protect yourself from market downturns, and it’s easy to build if you know where to look. Click here and I’ll explain how to build this portfolio to invest in every sector of the market and get a big, reliable income stream at the same time.

Category: Sector ETFs