3 Buys For Windfall Gains (And 6% Dividends)

Remember the panic selling in February? It all seems silly now—the economy is surging, companies are beating high earnings expectations and American consumers are more confident than ever.

Remember the panic selling in February? It all seems silly now—the economy is surging, companies are beating high earnings expectations and American consumers are more confident than ever.

And the stock market is finally catching on—the S&P 500 is up a solid 5.9% in 2018, and the momentum for stocks to go higher is clearly there.

You’re Not Too Late for the Biggest Profits

The good news? You can get into this raging bull market and still see a lot of upside.

Since the market is still a sliver off its all-time high (which it hit in January, before the plunge), we are nowhere near a top—especially since earnings have soared since then.

Of course, you can buy in with a “dumb” index fund and wait for the market to rise. But you’re better off offsetting some of the market’s latest rise by purchasing those same stocks at a big discount.

I know that sounds like a pipe dream, but you can do it easily through a group of overlooked investments called closed-end funds (CEFs).

Right now there are 3 CEFs that invest in the same mid-cap and large-cap stocks that are driving this booming stock market. Plus they pay dividends up to 5.8%, or over triple the S&P 500’s measly 1.8% payout. And that’s not even the best part.

How CEFs Let You Buy Stocks Cheap

CEFs trade at a price set on the open market, but these prices often diverge from the liquidation value of CEFs’ portfolios (known as the net asset value, or NAV) for one simple reason: CEFs cannot issue new shares to new shareholders.

This means that if demand for a particular CEF is too low, regardless of the CEF’s fundamental performance, the market price will be less than the CEF would be worth if it were liquidated tomorrow.

This is basically free money!

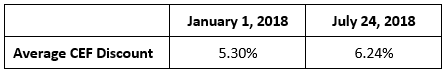

And CEF discounts have been widening this year, for one reason: overwrought investor fear. Check out the difference between the typical CEF’s markdown at the start of the year compared to now:

Today’s bigger discounts are handing us contrarians a golden opportunity: the market has been selling off shares in CEFs, but the CEFs’ actual portfolio value hasn’t gone down by as much. In some cases (approximately 44% of all CEFs), their portfolios’ values have actually gone up since the start of the year.

3 Perfect CEF Buys for a Soaring Market

So our next step is simple: target the funds with the strongest discounts and the most promise, thanks to their portfolio makeup.

I’ve already gone ahead and found 3 such funds, and I want to share them with you now, starting with…

CEF No. 1: A Second Chance to Get in on the Tech Rally

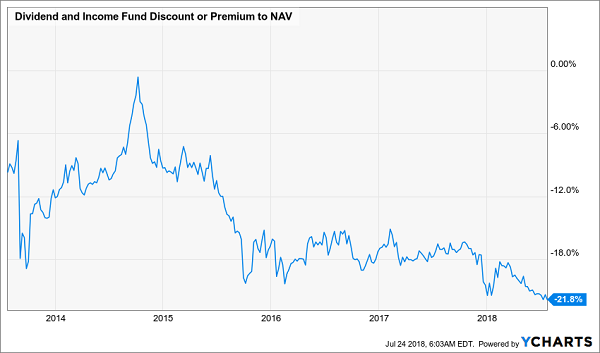

Our first standout CEF is the Dividend and Income Fund (DNI), a 4.8%-yielding fund whose value-driven approach has caused it to struggle, but that’s in the past.

Lately, the fund has made a big shift toward top-flight tech stocks like Apple (AAPL), Intel (INTC), Lam Research (LRCX) and eBay (EBAY), all of which are now top holdings. The real story is that the market has sleepwalked right past this change, leaving DNI trading at a whopping 21.8% discount, its widest in years:

An Oversold Turnaround Story

So if you’re kicking yourself for missing out on the big rally in tech stocks we’ve seen in the last couple years, this is your chance to rewrite history. Grab DNI and its trove of tech winners now, while you can still get them for 22% off.

CEF Pick No. 2: A Small Fund With Big Upside (and a 5.8% Dividend)

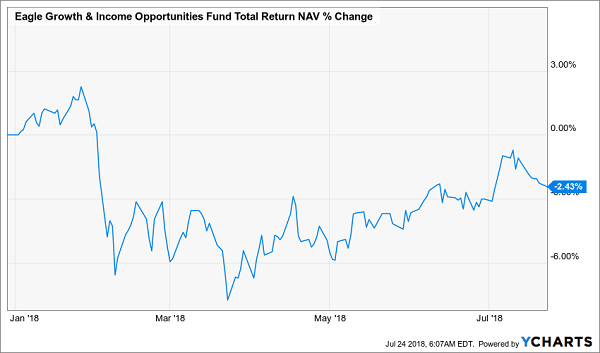

The Eagle Growth & Income Opportunities Fund (EGIF) is another fund that, like DNI, has undergone a shift that the market has missed.

EGIF is a small ($134 million in assets under management) fund that has underperformed, largely due to its focus on energy stocks and MLPs such as Energy Transfer Partners (ETP) and Enterprise Products Partners (EPD).

However, a bump in energy prices and a return of investment to the energy world mean that EGIF’s NAV has begun bouncing from the bottom, as you can see here:

EGIF’s Portfolio Starts to Climb Back

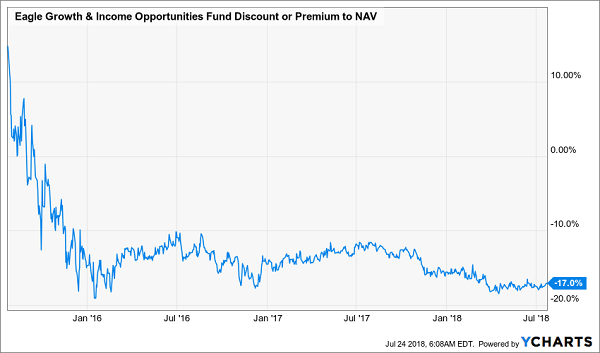

That doesn’t mean the market has recognized this fund’s potential, though. EGIF’s discount has plummeted for years, and it’s stayed close to its recent 17%, even after the fund’s turnaround began:

A Classic Buy-the-Dip Opportunity

One other thing about EGIF: its generous 5.8% dividend means you’ll be collecting a nice income stream while you wait for the fund’s market price to rise and start chipping away at that discount, bringing the fund back to the premium pricing it enjoyed as little as three years ago.

CEF Pick No. 3: A “Flash Discount” to Jump on Now

The third fund I want you to consider is a strong CEF that has been ignored for the silliest reason imaginable: its yield is low. While the average CEF yields over 5% and many yield as much as 10%, the General American Investors Fund (GAM) yields just 1.4%, based on its last two payouts.

But here’s the thing about GAM: it strives for top total returns and will lower its dividend when it thinks the market is ready to pop. That way it can reinvest that cash to boost shareholders’ total returns.

This is why GAM’s dividend was triple its current level in 2016. After making profits in last year’s bull market, the fund handed those profits to investors, and this year it’s keeping its gains to reinvest and boost investors’ profits even more.

Is this prudent dividend policy working? Absolutely.

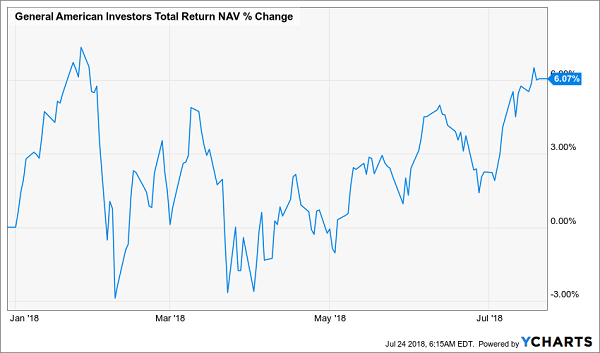

A Strong Showing

With a 6% gain on its NAV, GAM is one of the top-performing CEFs of 2018 (there are only 10 funds beating it on a total NAV return basis). It’s also the top equity-only CEF on the year.

But the market is actually punishing this fund’s sterling performance.

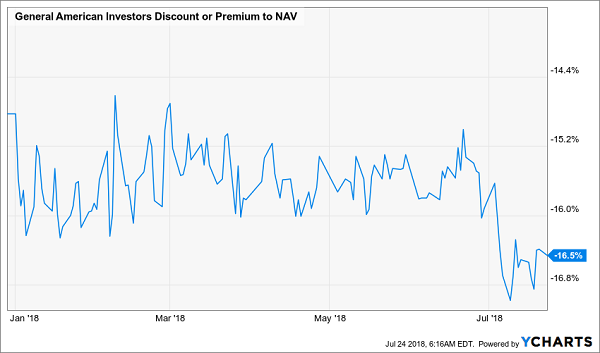

GAM’s Discount Grows for No Good Reason

Think about that for a moment: even though management has put up the best record of any CEF that invests only in stocks, the fund’s discount has actually been getting bigger!

It’s ridiculous.

One day the market will realize the mistake it’s made with GAM, as investors see the fund’s NAV increase and its price fail to rise to match. And as they buy in, driving its market price back up, anyone who bought ahead of time will be lined up for gains.

How to Retire on 8% Dividends Paid EVERY MONTH

My “8% Monthly Payer Portfolio” checks off every box investors need from retirement:

[X] Monthly income to use against your monthly bills.

[X] Dividends large enough to allow you to live off investment income entirely. That means no selling your stocks and shrinking your nest egg, which ultimately shrinks your regular dividend paycheck.

[X] Better returns on any dividends you choose to reinvest. If you don’t need the income from your portfolio right away, you don’t have to wait every three months to put dividends to work – you can sink them back into new investments just about every 30 days!

These monthly dividend payers include a few picks that have remained mostly under the radar despite their high payouts and general quality. For instance, this portfolio includes an 8.7% payer trading at a bizarre 5.3% discount to NAV, and an 8.5% payer that not 1 in 1,000 people even know about.

Because these big dividends compound quicker, they’ll turbocharge your net worth and allow you to enjoy the retirement you’ve worked so dearly to reach. Don’t delay! Click here and I’ll send you my exclusive report, Monthly Dividend Superstars: 8% Yields with 10% Upside, for absolutely FREE.

Category: Closed-End Funds (CEFs)