3 ETFs With Exposure To Military And Defense Stocks

Aerospace and Defense ETFs have taken a hit in recent months. But following the recent terrorist attacks in Paris, we’re seeing investors gravitate toward these stocks.

Aerospace and Defense ETFs have taken a hit in recent months. But following the recent terrorist attacks in Paris, we’re seeing investors gravitate toward these stocks.

Military budgets have been cut back and the amount of money they’re spending on private contracts has slowed. But the truth is the need for a strong military and the spending with defense companies isn’t going to disappear anytime soon.

Tensions in the Middle East, Eastern Europe, and Russia have become even more aggressive in recent years. These conflicts could cause Western countries to ramp up their spending on military defenses.

Let’s take a look at 3 ETFs with exposure to U.S. companies that manufacture military aircrafts and other defense equipment.

3 ETFs with Exposure to Military and Defense Companies…

There are three major ETFs focused on military spending. They include PowerShares Aerospace & Defense ETF $PPA, iShares U.S. Aerospace & Defense ETF $ITA, and SPDR S&P Aerospace & Defense ETF $XAR.

Let’s take a look at the ETF with the highest exposure to military and defense companies…

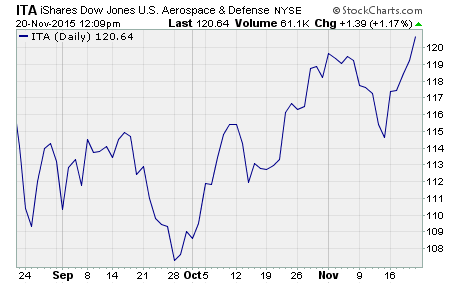

iShares U.S. Aerospace & Defense ETF $ITA has $568.8 million of assets under management (AUM). The ETF is trading at $120.66 and that is up 15 points from its price of $105.00 in October.

As you can see in the chart below, defense stocks have already begun moving higher in the wake of the recent terrorist attacks.

ITA operates with an expense ratio of 0.43% and has a dividend yield of 1.02%. ITA’s top five holdings include Boeing Company $BA, United Technologies $UTX, Lockheed Martin $LMT, General Dynamics $GD, and Northrop Grumman $NOC.

The ETF with the second most money in it with exposure to military and defense companies…

PowerShares Aerospace & Defense Portfolio $PPA is the 2nd most popular military and defense ETF with $271.3 million AUM. The ETF is trading at $36.87. PPA has a 52-week low of $15.27, so it is up 141.26% from that price!

The ETF has a dividend yield of 0.80% and operates with an expense ratio of 0.66%. PPA’s top five holdings include United Technologies Corp $UTX, Boeing Co $BA, Honeywell International Inc $HON, Lockheed Martin Corp $LMT, and General Dynamics Corp $GD.

The ETF with the third highest AUM with exposure to military and defense companies…

SPDR S&P Aerospace & Defense ETF $XAR comes in third on the list of military and defense ETFs with $163.9 million in AUM. It currently trades for $54.80. It’s up 84.79% from its 52-week low of $29.65.

XAR has an expense ratio of 0.35% and a dividend yield of 0.87%. The top five holdings of XAR include L-3 Communications $LLL, Northrop Grumman $NOC, Raytheon $RTN, Boeing $BA, and BWX Technologies $BWXT.

Is investing in the military and defense sector a good idea?

We’ve already seen an uptick in defense stocks following the attack in Paris. And it seems like the battle with ISIS is starting to escalate. This type of bad news is usually good news for defense stocks.

But the rally could be short lived. If the world puts a fully fledged military assault on ISIS, this radical sect won’t last long.

Killing civilians and dodging smart bombs while you hide under a rock is one thing. But they’ll crumble in the face of a true boots on the ground assault.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs