3 Hopeless ETFs Ranked From “Disastrous” To “Poor” (You Likely Own #1)

Is last week’s rate-cut temper tantrum the start of a bigger meltdown?

Is last week’s rate-cut temper tantrum the start of a bigger meltdown?

That’s the big question—and today we’re going to do what we have to do to protect our nest egg—and set ourselves up for big gains (and dividends) in the long run.

That means we may only have days to prepare—maybe even hours.

The one thing we’re not going to do? Sell and go to cash.

Because I know I don’t have to tell you that “money under the mattress” pays no dividend—and isn’t even safe, for that matter: you’re guaranteed to bleed money after inflation!

No way.

Instead, we’re going to play it smart—deftly pruning our portfolio of laggards and shifting into a set of low-key dividends that will balloon our income (and nest egg) for decades to come.

So let’s dive into three ETFs—ranked from “disastrous” to “poor”—you must sell now. Along the way, I’ll show you three fast-growing “forever” dividends that should be on your short list.

Disastrous: SPDR S&P Retail ETF (XRT)

You and I don’t normally chat about brick-and-mortar retail stores because, frankly, who cares about retail stocks? They don’t pay big dividends unless they’re in big trouble, like Macy’s (M) and it’s mirage 6.6% yield now.

But plenty of folks still feel they need to be in this dismal sector, under the impression that if they don’t hold at least some retail stocks, their portfolio won’t be diversified enough.

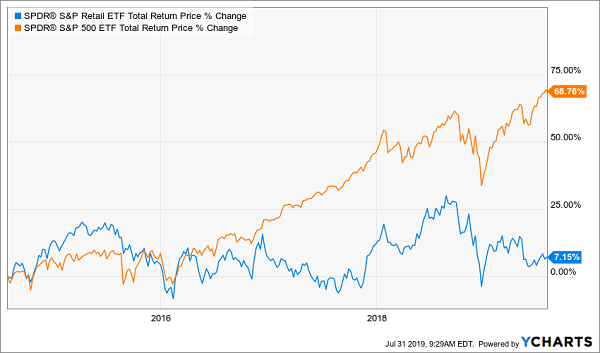

Trouble is, being too diversified is also risky! Because some sectors—like retail—are simply hopeless. XRT, for example, has gone nowhere for five years.

XRT: A Lead Weight on Your Portfolio

It takes a lot of wishful thinking to hold on to a fund like this, especially when you’re getting a pathetic dividend—just 1.6%!

Yet some folks do hang on. And with the trend still pointing to lower interest rates—no matter what Jay Powell says—you might think the skies will brighten for XRT, with more folks likely to break out the credit card.

Don’t take the bait!

Because any new spending will zip right past XRT’s old-school retailers: companies like L Brands (LB)—owner of the tired Victoria’s Secret chain—Abercrombie & Fitch (ANF) and Kohl’s (KSS), none of which have found the secret to beating Amazon.com (AMZN).

Which is my cue to introduce the stout income-and-growth play I want to tell you about now.

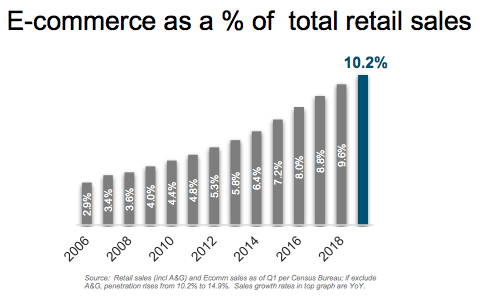

It’s a “landlord” sitting on 156 million square feet of warehouse space across the US. Who’s renting it? Online retailers—who are on a run that will continue no matter what Powell does.

Source: Duke Realty

I’m talking about Duke Realty Trust (DRE), a real estate investment trust (REIT) I told you about last week. Duke’s warehouses were as stuffed as they could reasonably be in the second quarter, at 98.2% occupancy.

Duke has also crushed XRT over the last year, three years, five years and 10 years. It also boasts a higher yield (2.6%) and has a wonderful habit of dropping special dividends on shareholders, which also attract more investors and bump up the share price:

Special Dividends Inflate Duke Shares

So forget XRT—invest in surging online shopping through warehouse REITs. Put Duke at the top of your list.

Lousy: SPDR Bloomberg Barclays High-Yield ETF (JNK)

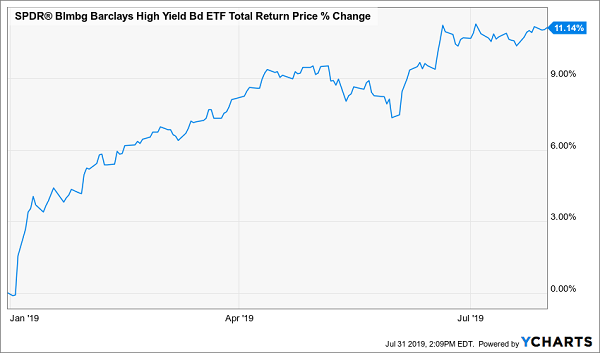

Stocks aren’t the only thing that’s been snapped up since the Fed’s pivot from rate hikes in January. High-yield “junk” bonds—so named for because they carry higher default risk—have taken off, too.

That’s sent the passive JNK, which is shackled to an index of high-yield bonds, on a double-digit run:

Junk Bonds Soar

There’s good reason for that: the strong economy means companies are having little trouble repaying their debts. According to Moody’s, the high-yield default rate fell to 2.4% at the end of March, and is set to plunge to 1.7% by March 2020.

That’s great news for JNK, which yields 5.6% and is about as “junky” as you can get, with just 0.31% of its portfolio rated BBB (the cutoff for investment-grade bonds) or higher.

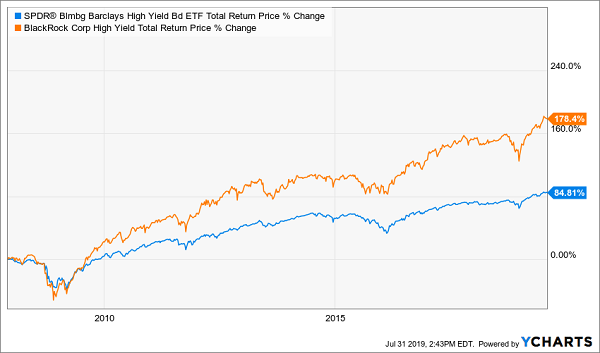

Trouble is, junk bonds and ETF investing simply don’t mix. That’s why junk bond–focused closed-end funds (CEFs) regularly crush JNK over just about any time period you can imagine.

Case in point: the BlackRock Corporate High-Yield Fund (HYT), payer of an 8.1% dividend. It’s manhandled JNK over the past year, three years, five years, decade and, yes, since inception:

HYT Doubles Up JNK’s Gain

There’s a good reason why: BlackRock’s massive size, with $6.5 trillion under management across the company, means the team running HYT is among the first to get the call when a company issues a new round of high-yield bonds.

JNK’s poor “robot” has no hope against a “first-mover” advantage like that!

This human touch really shines in a bear market: when things get rough, HYT’s team can change things up—while JNK, locked to its index, goes down with the ship.

Finally, there’s the discount to net asset value (NAV), a CEF feature ETFs can’t match: right now, HYT’s market price is 9.8% below its NAV (or the value of its portfolio). That discount builds in downside protection (and upside) for us.

Poor: Health Care Select Sector SPDR ETF (XLV)

Here’s another megatrend you’ll want to have some exposure to: our aging population (with 10,000 baby boomers turning 65 every day).

Too bad most folks pick the wrong way to do it—looking mainly to pharma stocks and the “one-click” pharma ETF: XLV.

This is a terrible move for so many reasons it’s hard to know where to start, but they all come back to the dividend. As I write, XLV yields a pathetic 1.6%. You’d be far better off cherry-picking XLV’s top holdings, like Johnson & Johnson (JNJ), with a 2.9% yield, Amgen (AMGN), at 3.1%, or Medtronic (MDT), at 2.1%.

But even that isn’t the best way to squeeze a decent payout from this megatrend. Because there are fatter dividends in an often-ignored corner of the healthcare space: senior-care centers.

A great example: Ventas (VTR), a senior-care “landlord” yielding 4.7% now. It’s also demolished XLV this year, particularly when you include its healthy dividend:

Ventas: 1, Pharma Stocks: 0

Despite that run, Ventas is reasonably priced, at 17.2 times normalized per-share funds from operations (FFO, the REIT equivalent of earnings per share). And yes, this payout is safe, accounting for just 81% of normalized FFO, easily sustainable for a steady REIT like Ventas.

Finally, if you’re looking for bear-market insurance, Ventas is for you: it sports a “beta” rating of just 0.28. In English, that means when the S&P 500 moves 100 points, we can expect VTR to move around 30 or so.

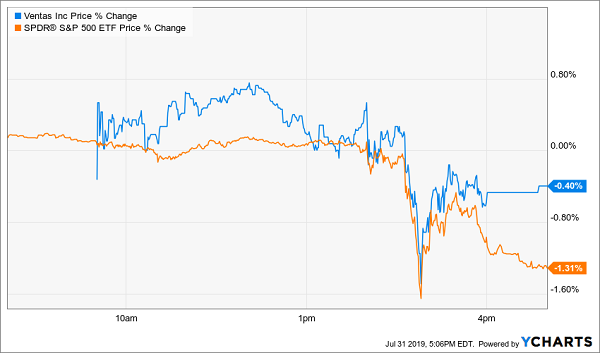

You could see that after Powell’s announcement last Wednesday: while the S&P 500 plunged 1.3%, Ventas shareholders hardly noticed! The stock slipped a barely perceptible 0.4%, a decline it quickly took back the next day.

Ventas: Portfolio Ballast

The bottom line? When it comes to tapping the aging-population trend, individual senior-care REITs are the way to go.

And Ventas is far from the highest yielder I want to show you today. Let’s move on to …

The 2 Best “Fed-Proof” REITs Now: 8.9% Dividends, 139% Payout Growth

A 4.7% dividend is great, but I’ve uncovered 2 other REITs whose payouts are double that—and they’re growing, too.

Everyone should own these 2 stocks because…

- They’re “Powell proof.”

- Their dividends yield up to 8.9%.

- Their payouts are set to jump.

- They’re cheap! I’m forecasting 25% price upside in the next 12 months.

You don’t want to hold off here, because every day you wait means missing out on gains (and dividends). Click here and I’ll share everything about these 2 incredible income plays with you: names, tickers, buy-under prices and my complete analysis of each one.

Category: ETFs