3 Safe Dividend Stocks To Earn Double-Digit Yields Forever

Take advantage of the market’s mistake that has lifted these stocks’ yields to new highs and lock in double-digit yields forever. With plenty of free cash flow, these three stocks are secure and will be great bargains if the market slides this summer.

Take advantage of the market’s mistake that has lifted these stocks’ yields to new highs and lock in double-digit yields forever. With plenty of free cash flow, these three stocks are secure and will be great bargains if the market slides this summer.

Recently, I gave several presentations to rooms full of investors at the Las Vegas MoneyShow. My presentations covered various aspects and strategies of investing in high-yield common stock shares. One of my talks covered how to determine the security of the dividend payments from high-yield stocks, and I explained the analysis and steps I do to evaluate the dividend paying ability of a particular company. The bottom line is that if a company meets my cash flow requirements, the dividends from a double-digit yielding stock can be as safe as the dividends from a stock with a much lower yield.

The analysis strategy I discuss involves digging into the income statement of a company to find the actual free cash flow the business produces. For many high-yield stocks, the bottom line earnings per share (EPS), is not a good metric to use when evaluating dividend coverage and safety. I show investors how to find or calculate free cash flow per share, which is the money a business actually has available to pay dividends.

If you are familiar with income focused stocks you may be familiar with metrics such as funds from operations (FFO) or cash available for distribution (CAD); these metrics are better indicators of dividend paying ability. For me to recommend a stock, the cash flow per share must provide adequate coverage of the current dividend rate and also be trending higher. I look at quarterly cash flow results with the goal of finding steady quarterly and year-over-year growth.

One type of high-yield stock that I discussed during my presentations I call “diamonds in the manure pile.” The diamonds are companies with high-quality cash flow streams, but these stocks operate in market sectors where the majority of the companies have much less stable business models.

The association with these market sectors (the manure piles) has the effect of the market pricing the diamonds to have high yields similar to their less stable sector mates. The result is stocks that have growing cash flow per share and double-digit dividend yields. Here are three stocks that have much more stable cash flow business models than their yields indicate.

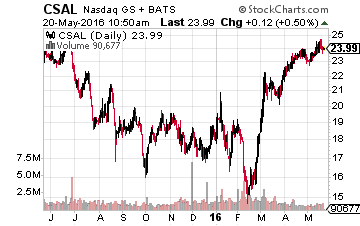

Communications Sales & Leasing Inc. (NASDAQ:CSAL) is a one-year-old REIT that owns telecommunications infrastructure assets – fiber and copper wire lines. CSAL was spun-off by telecom services provider Windstream Holdings, Inc. (NASDAQ:WIN) as a strategy to monetize some of their fixed assets. The new REIT has a 20-year triple net lease agreement with Windstream, so the cash flow stream to pay dividends is secure. The market prices CSAL to yield 10% because of its dependence on a single customer. The diamond side of CSAL is that the company can acquire similar assets to diversify the customer base. In its first year as a public company, the dependence on Windstream has been reduced by 10%. CSAL currently yields 10%, and cash flow growth should allow steady future dividend increases.

Communications Sales & Leasing Inc. (NASDAQ:CSAL) is a one-year-old REIT that owns telecommunications infrastructure assets – fiber and copper wire lines. CSAL was spun-off by telecom services provider Windstream Holdings, Inc. (NASDAQ:WIN) as a strategy to monetize some of their fixed assets. The new REIT has a 20-year triple net lease agreement with Windstream, so the cash flow stream to pay dividends is secure. The market prices CSAL to yield 10% because of its dependence on a single customer. The diamond side of CSAL is that the company can acquire similar assets to diversify the customer base. In its first year as a public company, the dependence on Windstream has been reduced by 10%. CSAL currently yields 10%, and cash flow growth should allow steady future dividend increases.

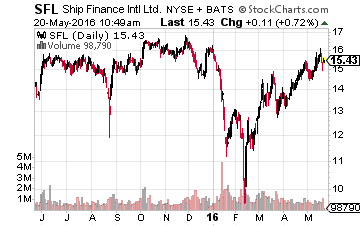

Ship Finance International Limited (NYSE:SFL) gets lumped in with the entire shipping industry market sector. Over the last decade, a lot of investor wealth has been destroyed by the chasing of high-yield shipping stocks. While many of the 2005 – 2006 high-flyer shipping stocks have gone bankrupt, the Ship Finance business model has allowed the company to survive, grow cash flow, and steadily increase its quarterly dividend rate. The company has increased its dividend by 5% in the last year, and is only paying out 68% of free cash flow, yet the shares are priced to yield 11.8%.

Ship Finance International Limited (NYSE:SFL) gets lumped in with the entire shipping industry market sector. Over the last decade, a lot of investor wealth has been destroyed by the chasing of high-yield shipping stocks. While many of the 2005 – 2006 high-flyer shipping stocks have gone bankrupt, the Ship Finance business model has allowed the company to survive, grow cash flow, and steadily increase its quarterly dividend rate. The company has increased its dividend by 5% in the last year, and is only paying out 68% of free cash flow, yet the shares are priced to yield 11.8%.

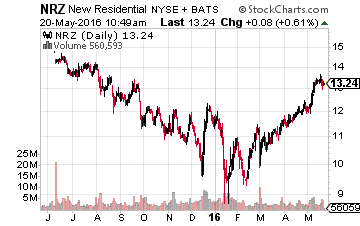

New Residential Investment Corp (NYSE:NRZ) is a finance REIT, so it gets lumped in with the manure pile that is the group of agency mortgage-backed securities (MBS) REITs. The agency mREITs use massive amounts of leverage to turn the low interest rates paid by government guaranteed MBS into double-digit yields. These companies can suffer massive losses when interest rates change even modestly. In late 2012, a modest 1.2% increase in average mortgage rates led to dividend cuts and 40% share price declines for the agency mREITs.

New Residential Investment Corp (NYSE:NRZ) is a finance REIT, so it gets lumped in with the manure pile that is the group of agency mortgage-backed securities (MBS) REITs. The agency mREITs use massive amounts of leverage to turn the low interest rates paid by government guaranteed MBS into double-digit yields. These companies can suffer massive losses when interest rates change even modestly. In late 2012, a modest 1.2% increase in average mortgage rates led to dividend cuts and 40% share price declines for the agency mREITs.

In contrast, New Residential owns targeted, specialty investments that support the mortgage servicing industry. These investments pay high yields, and will get stronger if interest rates increase. The company has grown its cash available for distribution per share by over 20% in the last year. NRZ currently yields 14%.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

Category: What's Going On?