5 REITs With Fast Growing Dividends

Increasing dividends over time will pull up the share price of a stock. High yield and regular dividend growth gives income investors the most consistent gains out of any strategy. REITs like the five in today’s article can play a key role in those consistent returns.

Increasing dividends over time will pull up the share price of a stock. High yield and regular dividend growth gives income investors the most consistent gains out of any strategy. REITs like the five in today’s article can play a key role in those consistent returns.

I receive a lot of communication from individuals interested in dividend stocks, but they are worried about buying in at a market top and then losing money when share prices go into a decline. My typical reply is that I cannot predict the next market drop, but that with a dividend focused investment strategy, we need to own shares to earn income and waiting to buy does not generate any income. In a record setting market like we have now, I focus on income stocks that I expect to significantly grow their dividends over the next several years.

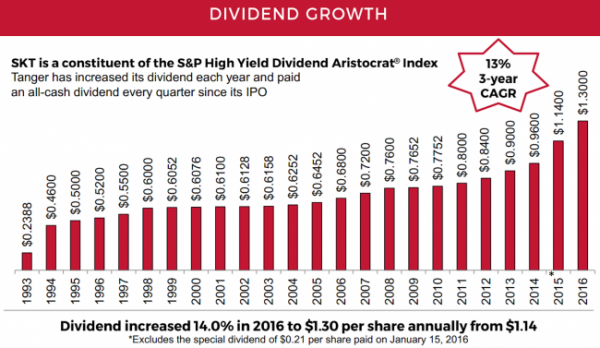

The strategy of buying shares of companies that will produce above average dividend growth rates should produce above average total returns through both the up and the down cycles in the stock market. When I make presentations at investor conferences I use the example of Tanger Factory Outlet Centers Inc. (NYSE: SKT), an outlet shopping center owning real estate investment trust (REIT). Tanger has increased its dividend every year since it went public in 1993. Over the last 10 years, the SKT dividend has been increased by an average of 7.4% per year, and the growth has accelerated to 11% per year over the last five years. Here is the full history of the SKT annual dividends.

Dividend growth will produce, over time, share price appreciation to match the growth rate and then you add in the dividend yield to get an above average total return. To illustrate the return potential, here are the Tanger Factory Outlet average annual total returns for the last five years, 10 years, and since its IPO compared to the return investors earned from the SPDR S&P 500 ETF Trust (NYSE: SPY).

Five years: SKT: 11.3%, SPY: 13.4%

10 years: SKT: 13.4%, SPY: 7.7%

Since IPO (5/28/1993): SKT: 15.1%, SPY: 9.0%

The market experienced severe bear markets in 2000-2002 and 2008-2009. As you can see, when we move through and past down turns in the market, the return advantage of a dividend growth strategy accelerates away from the broader stock market average returns.

The higher the annual dividend growth rate from income stocks like REITs, the greater your expected total return. The challenge is to find those companies that will generate cash flow and announce large dividend increases over the next three to five years. One group to start with is companies that have announced significant increases in the past year. This can be an indication that management believes the growth is sustainable. Then you can dig into current financials and management guidance to make your own judgement concerning future dividend increase rates. Here are five REITs that have announced big dividend boosts over the last 12 months.

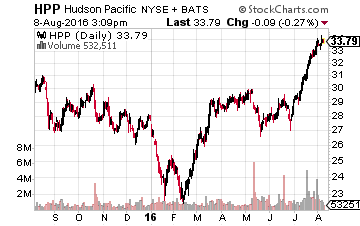

Hudson Pacific Properties Inc. (NYSE: HPP) owns office, media and entertainment properties in the major cities of California and in Seattle. After more than five years without a dividend change, Hudson Pacific Properties announced a 60% increase to the dividend rate in December of 2015. The current dividend rate is just 45% of the funds from operations –FFO– being generated by the company. HPP yields 2.4%.

Hudson Pacific Properties Inc. (NYSE: HPP) owns office, media and entertainment properties in the major cities of California and in Seattle. After more than five years without a dividend change, Hudson Pacific Properties announced a 60% increase to the dividend rate in December of 2015. The current dividend rate is just 45% of the funds from operations –FFO– being generated by the company. HPP yields 2.4%.

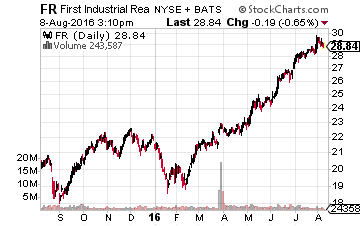

First Industrial Realty Trust, Inc. (NYSE: FR) owns, manages, acquires, sells, develops and redevelops industrial real estate. The company stopped paying dividends during the financial crisis and restarted payments to shareholders in March 2013. The dividend has been increased in each of the last three years, including a 49% jump in the rate early this year. The current dividend is 53% of the ongoing FFO per share run rate. FR yields 2.6%.

First Industrial Realty Trust, Inc. (NYSE: FR) owns, manages, acquires, sells, develops and redevelops industrial real estate. The company stopped paying dividends during the financial crisis and restarted payments to shareholders in March 2013. The dividend has been increased in each of the last three years, including a 49% jump in the rate early this year. The current dividend is 53% of the ongoing FFO per share run rate. FR yields 2.6%.

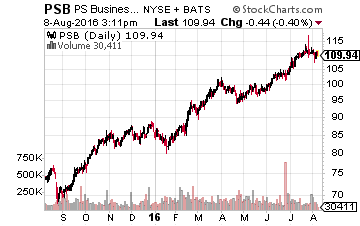

PS Business Parks Inc. (NYSE: PSB) owns, operates and develops commercial properties, primarily multi-tenant flex, office and industrial parks. It focuses on owning concentrated business parks. PS Business Parks has a history of regular dividend increases, including a 25% increase announced early this year. the current dividend is 57% of FFO, which is growing at more than 10% per year. PSB yields 2.7%.

PS Business Parks Inc. (NYSE: PSB) owns, operates and develops commercial properties, primarily multi-tenant flex, office and industrial parks. It focuses on owning concentrated business parks. PS Business Parks has a history of regular dividend increases, including a 25% increase announced early this year. the current dividend is 57% of FFO, which is growing at more than 10% per year. PSB yields 2.7%.

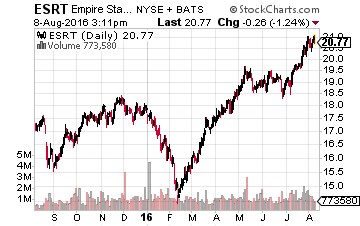

Empire State Realty Trust Inc. (NYSE: ESRT) owns and operates New York City retail and office properties. This REIT came to market with an October 2013 IPO and it just started to increase its dividend rate in June of this year. The dividend was boosted by 23.5%. The current dividend is just 44% of core FFO per share. ESRT yields 2.0%.

Empire State Realty Trust Inc. (NYSE: ESRT) owns and operates New York City retail and office properties. This REIT came to market with an October 2013 IPO and it just started to increase its dividend rate in June of this year. The dividend was boosted by 23.5%. The current dividend is just 44% of core FFO per share. ESRT yields 2.0%.

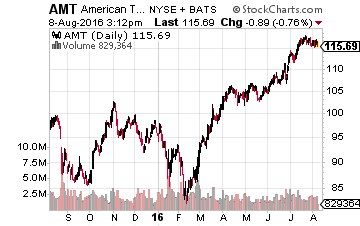

American Tower Corp (NYSE: AMT) owns and leases cell tower, radio, and TV broadcast sites. The company owns properties in Asia, Europe, and South America as well as North America. American Tower converted to REIT status at the end of 2011. The AMT dividend has been increased every quarter since the company became a REIT. Over the last year, the dividend grew by 20%. AMT yields 1.8%.

American Tower Corp (NYSE: AMT) owns and leases cell tower, radio, and TV broadcast sites. The company owns properties in Asia, Europe, and South America as well as North America. American Tower converted to REIT status at the end of 2011. The AMT dividend has been increased every quarter since the company became a REIT. Over the last year, the dividend grew by 20%. AMT yields 1.8%.

This type of research into high-yield income stocks has become a specialty of mine, and I make it a habit of only hunting down and recommending the most stable companies that regularly increase their dividends. This is the strategy that I use most often to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over 20 of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

Category: What's Going On?