How Far Will Gold Fall?

If you hadn’t already noticed, the price of gold is in a nose dive.

If you hadn’t already noticed, the price of gold is in a nose dive.

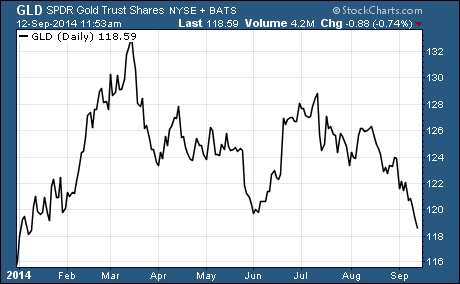

Just take a look at this chart of the SPDR Gold Shares (GLD). GLD is an ETF that replicates the performance of gold bullion.

As you can see, GLD has been moving lower since it made a high of $133.69 in March. At a current price of $118.59, gold prices have fallen 11.5% below the high of the year.

And the worst part is the selloff has picked up steam lately. GLD is down more than 5% in just the last month, it fell below the June low around $120, and it has been down five days in a row.

Needless to say, GLD’s recent performance is horrible.

What’s going on with the shiny yellow metal?

Simply put, gold is out of favor with investors.

Don’t forget that gold’s day in the sun came during the financial crisis and the years immediately after. But the dire predictions of the economic meltdown and destruction of fiat currency never happened.

Now, after years of underperformance, traders no longer speculate as much on gold prices and regular investors have gone onto chasing the performance of the next hot investment.

And it’s about to get worse for gold…

You see, charting the price history of gold over the last seven years shows a bearish technical breakdown in gold prices.

This chart shows GLD made its all-time high in mid-2011. But the uptrend didn’t end until closer to the end of 2012 when it broke decisively below the upward trending support (blue line).

During the first leg down, GLD shed $50 per share in 2013 in a dramatic freefall. Then it went through a consolidation phase in a symmetrical triangle (green lines) over the last year.

Now GLD is breaking below the support zone. There is a support zone at $115 that corresponds to the 2013 lows. But it doesn’t hold much weight.

If GLD breaks below this level, it will likely take the next big leg down. That means we could see GLD fall 15% or more to around $100.

Here’s the thing…

Gold has no intrinsic value. It doesn’t do anything. So it’s uniquely beholden to technical analysis in a way other investments that have fundamental data are not.

And right now the technical picture for gold is extremely bearish.

One way to profit from the coming decline in gold prices is with an inverse ETF. These ETFs are designed to move in the opposite direction of the investment that they track.

The most popular inverse gold ETF based on assets under management (AUM) is the ProShares UltraShort Gold (GLL). It has around $82 billion in AUM.

GLL is not just designed to go up in value as the price of gold goes down, it also uses leverage. This leverage causes GLL to move twice as much as the price of gold on a given day.

Right now GLL trades for $94.33. It has the potential to move 10% higher as gold prices test their 2013 low. And if gold retests the next major support around $100, then GLL stands to surge more than 30%!

Good Investing,

Corey Williams

Category: Commodity ETFs, ETFs, Inverse ETFs, Leveraged ETFs, Market Analysis