Leveraged Industrial Sector ETF Battleground

The battle between the bears and bulls over industrial stocks is heating up. Aggressive traders can use a leveraged industrial sector ETF to pick a side and profit.

The battle between the bears and bulls over industrial stocks is heating up. Aggressive traders can use a leveraged industrial sector ETF to pick a side and profit.

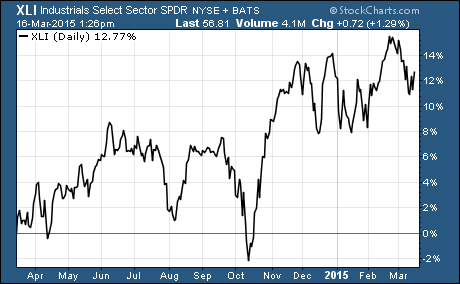

The Industrial Select Sector SPDR ETF $XLI is down about 1% so far this year. And over the last year, it has lagged behind the S&P 500 by nearly 4%.

In short, industrial stocks have underperformed relative to the large cap index.

Now the bulls and bears are making their case for what the future will bring to industrial sector ETFs.

Here’s what the bulls are saying about leveraged industrial sector ETFs…

The industrial sector is driven by confidence… or more specifically, business confidence.

When businesses are confident, they spend money. And they drive cyclical growth in the industrial sector.

Right now, two of the best indicators of business confidence show that businesses are confident and spending money.

First off, job growth is strong… in fact, the US could return to full employment sometime in the next 18 months.

The second indicator is durable goods orders. These are orders for long lasting products. These products are typically only purchased by confident businesses that expect the economy to improve.

Durable goods orders and employment are clear indicators that businesses are confident and willing to spend money.

This is the type of environment that should lead to a spike in cyclical growth. And industrials are sure to benefit from the faster growth.

Here’s what the bears are saying about leveraged industrial sector ETFs…

One thing that’s hurting the industrial sector is the strong US Dollar.

The industrial sector is full of large multi-national companies. Many of them make more than half of their profits overseas.

When the US Dollar is strong relative to other currencies, these profits are devalued when they are translated back into dollars.

In other words, even if business is picking up for industrials, their earnings growth is fighting headwinds from the currency market.

One thing’s for sure, weaker than expected earnings is one of the fastest ways to send investors out the door… and send the entire sector down.

If you think the bulls are right, take a look at buying the ProShares Ultra Industrial ETF $UXI. This ETF seeks daily investment results that are twice (200%) the daily performance of the Dow Jones US Industrial Index.

If you think the bears are right, take a look at buying the ProShares UltraShort Industrial ETF $SIJ. This ETF seeks daily investment results that are twice (200%) the inverse (opposite) of the daily performance of the Dow Jones US Industrial Index.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Leveraged ETFs