3 Things You Need To Know In Our May Stock Market Update

Investors are greeting the arrival of the month of May as they so often do… They’re selling stocks.

Investors are greeting the arrival of the month of May as they so often do… They’re selling stocks.

The old Wall Street adage goes, sell in May and go away.

But here’s the thing…

I don’t think investors will go away.

In order for the ‘sell in May and go away’ strategy to work, it assumes investors can make money in bonds or risk free accounts. But that’s not the case right now.

Bond yields are low… so low that they’re even negative in parts of Europe.

Right now we’re seeing some seasonal selling. But investors will be back quickly as they realize that they’re not making any money being out of stocks.

Simply put, there’s no better place for investors to be than stocks. So, investors will have a hard time staying away.

Seasonal selling isn’t the only thing weighing on investors at the moment.

Fundamental May Stock Market Update

US GDP growth unexpectedly stagnated in Q1.

GDP grew just 0.2% in Q1 after expanding 2.2% in Q4. This was well below expectations for a 1.0% increase. And to make matter worse, it was the weakest reading in a year.

The weakest parts of the economy were energy related.

The drop in oil prices triggered a massive slowdown in US oil and gas exploration and production as well as a slowdown in new drilling. The impact of the drop in overall energy infrastructure investment due to the slowdown in energy hit home in the 1st quarter.

The expectation is that increased consumer spending will make up for the slowdown in energy investment. But consumers aren’t cooperating. They’re opting to save the money instead of spend it.

And who can blame them?

Prices have been creeping higher while wages have been stagnant for years. The drop in oil prices is simply giving US consumers a bit of relief after being overextended.

Needless to say, we’re dealing with some serious headwinds right now.

Technical May Stock Market Update

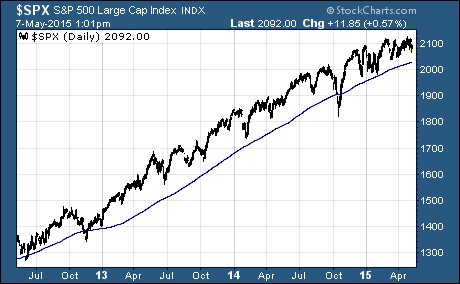

Take a look at this chart of the S&P 500.

Over the last three years, the index of US large cap stocks has relentlessly climbed up and to the right.

Notice the 200-day moving average line I’ve included on the chart?

This is a key technical support level that is followed by many investors. Even investors that don’t pay attention to more arcane forms of technical analysis pay attention to the 200-day moving average.

Simply put, when the S&P 500 is above the 200-day moving average, it’s considered to be in a long-term uptrend. As long as the S&P stays above this key level of support, there’s no reason to bet against US stocks.

Key Takeaway From May Stock Market Update

There’s one thing about the stock market that hasn’t changed even though technical and fundamental data seem to be at odds with one another.

It’s the reason I’m still bullish on stocks…

Large US corporations are still growing earnings.

Amazingly, 69% of the companies in the S&P 500 beat Q1 earnings estimates. And 46% beat sales estimates.

The bottom line is companies are still able to generate earnings growth even in a flat economy. And until we see a breakdown in earnings growth, stocks should continue moving higher.

Here’s how you can incorporate this information into a trading system.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis