Own These Sector ETFs In May

It’s been an up and down month for the S&P 500. We’re also seeing the gyrations among different Sector ETFs in May.

It’s been an up and down month for the S&P 500. We’re also seeing the gyrations among different Sector ETFs in May.

Right now, we’re dealing with multiple issues creating uncertainty in the market… any given economic data point, Fed speech, oil price movement, US Dollar fluctuation, or earnings report can send the market sinking or soaring on a day to day basis.

At one point or another over the last month, each of these factors sparked a stock market rally or triggered a quick selloff.

On Friday, it was a rebound in hiring during April that helped spark a stock market rally. But here’s the thing…

It wasn’t an unbelievably good jobs report that sparked the rally.

In fact, it wasn’t even close… Over the last two months, the average job creation rate dipped below the 200k per month average.

Why the positive reaction from the market?

Remember, we aren’t looking at jobs numbers in a vacuum.

The solid, but weaker than expected, rate of job creation could have an impact on the Fed’s decision to hike interest rates this year. All indications are the US economy isn’t accelerating as many of the Fed’s so-called experts predicted it would.

As a result, the Fed will push out the date of the first interest rate hike. That’s good news for stocks because stocks are more attractive investments when interest rates are low.

Friday’s rally pushed the S&P into positive territory over the last 30 days.

But there were winners and losers among the individual sectors. And we can use these sector movements to generate strong investment returns.

Sector ETFs Leading In May

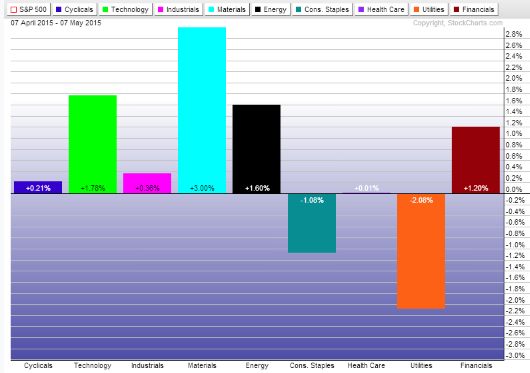

Over the last month, 6 of the 9 S&P sectors are up. And 4 of them are outperforming the S&P 500 during that time.

Technology, Materials, Energy, and Financials are the 4 sectors that have outperformed the S&P 500 over the last 30 days. And each of them is moving higher for a different reason…

Technology stocks are moving higher because of solid Q1 earnings.

Materials stocks are moving higher because the US Dollar has weakened over the last month.

Energy stocks turned in a decent performance as oil prices rallied.

And financial stocks have done well as investors anticipated an interest rate hike later this year.

Sector ETFs Lagging In May

There are two sectors down over the last 30 days… consumer staples and utilities.

These are two sectors that are traditional safe haven investments.

But they are subject to interest rate sensitivity. Both sectors pay a solid dividend and offer steady but undersized growth opportunities.

These dividends lose some of their appeal when interest rates go up. All else being equal, an investor that’s looking to generate income from their investments will opt for the safety of a fixed income investment over an equity investment.

What Sector ETFs Will Lead The Rest of May?

As you can see, many different factors have played a role in the up and down market action over the last month. Unfortunately, there’s still a lot of uncertainty surrounding oil prices, interest rates, and economic data.

Right now we’re seeing materials and health care sectors take the lead. And I believe we’ll see them continue to lead the markets higher throughout the rest of the month.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis