OPEC Oil Prices Hit Energy ETFs

Last week, the members of Organization of Petroleum Exporting Countries (OPEC) met. They decided to continue pumping oil at a record pace and let OPEC oil prices fall as the supply glut widens.

Last week, the members of Organization of Petroleum Exporting Countries (OPEC) met. They decided to continue pumping oil at a record pace and let OPEC oil prices fall as the supply glut widens.

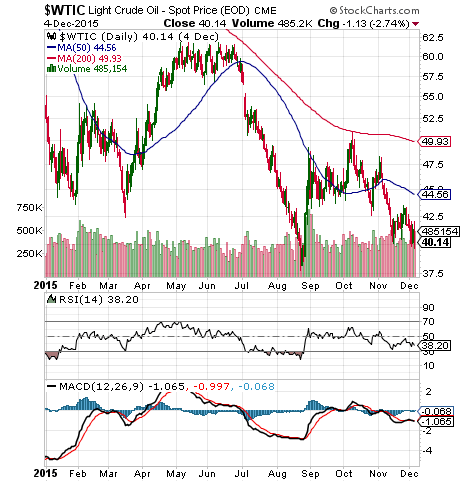

The immediate reaction to the decision had a negative impact on oil prices. The price of a barrel of WTIC crude oil plunged 5% to the lowest levels since 2009.

As a result, analysts are slashing earnings and valuations of oil and gas companies. And oil and energy ETFs that hold these assets are being taken down as well.

Why Does OPEC Want Lower Oil Prices?

OPEC’s decision to continue flooding the global market with more oil than it needs wasn’t unanimous. Many countries want the cartel to cut back production to support oil prices.

But the kingpin of the cartel, Saudi Arabia, wants to protect their market share from surging oil production in the US, Iraq, and Russia.

In short, they hope that keeping oil prices low will curb oil production from non-OPEC oil producers. Once they have forced these producers out of business or at least force them to halt expansion, then OPEC won’t need to cut back their production as much to support higher oil prices.

In short, this is a high stakes game of chicken… and they’re betting that they can outlast their upstart competition from US shale oil and other oil producers.

Impact of OPEC Oil Prices and US Oil Production

Low oil prices are having a big impact on US shale oil producers.

Many smaller US oil and gas companies have already missed bond payments or been forced into bankruptcy.

According to the former head of oil firm EOG Resources, Mark Papa, “We are about to see a pretty dramatic decline in U.S. production growth.” US oil production has peaked. It’s expected to fall from 9.6 mbpd to 8.6 mbpd in 2016.

Needless to say, a decrease in US oil production will be a major headwind towards the US achieving energy independence.

Who Benefits The Most From Lower OPEC Oil Prices?

In the long run, the big winner from the price war will be major oil and gas companies. Companies like Exxon Mobil $XOM and Chevron $CVX have the resources and financial stability to withstand a price war with OPEC unlike the smaller US oil producers.

What’s more, many of these companies missed the boat on the initial wave of US shale oil production. As small companies falter, the big boys will be there to pick up the pieces for pennies on the dollar.

Get started with you Oil ETF research.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Commodity ETFs