5 High-Yield Funds To Buy Before The Fed Hikes Rates

Today I’m going to show you a crystal-clear, highly predictable market pattern we can cash in on—and 5 safe, high-yield funds we can use to do it.

Today I’m going to show you a crystal-clear, highly predictable market pattern we can cash in on—and 5 safe, high-yield funds we can use to do it.

It’s all thanks to the Federal Reserve’s cat-and-mouse game with interest rates.

Let me explain.

Now that we’re past the days of quantitative easing boosting stocks, investors’ attention has shifted back to rates, with a quarter-point rise in December looking more likely after last Friday’s strong jobs report.

Fears of a rate hike pulled the rug out from under stocks, including six straight days of declines at the start of November. The financial press has fanned the flames with doomsayer headlines that have amped up investors’ panic.

I love it, because this is a predictable pattern of human behavior.

Last winter, investors were greedy for yield. Now they’ve reached the other end of the spectrum, and that means it’s time for us to jump on high-yield opportunities that are absurdly cheap, before the herd calms down again.

The best place to start: municipal bonds, or “munis.”

Why?

For one, you don’t have to pay tax on the income you generate from these assets. And unless you’re already in the top tax bracket, that has the knock-on effect of not bumping you up into the next one.

They’re also plenty safe, because American munis have some of the lowest default rates in the world.

But despite these advantages, there are funds offering these great investments at a huge discount to their market value—all because of panicked investors pulling their money out of the market willy-nilly.

Here’s what that means: right now, we can grab a tax-free 5.9% income stream by buying these funds, along with the potential for 7.9% in capital gains upside once the market comes to its senses.

And it will come to its senses. How do I know? Because this exact same pattern happened a year ago, for the exact same reasons.

Let’s take a look at the iShares AMT-Free Municipal Bond ETF (MUB), one of the biggest and most popular muni ETFs. Back in November 2015, right before the Fed raised interest rates in December, this fund fell in price and swiftly recovered:

A Small Dip … and a Rapid Recovery

Note how the rebound began a few weeks before the Fed made its official announcement. The market tends to anticipate these moves, and this will likely happen again this year.

Of course, history doesn’t always repeat, but it does rhyme, so things are a little different this year. The fall in munis has been far more extreme:

A Strong Downturn

Instead of the 0.8% decline last year, we’re seeing a 3.3% drop this year. That’s because munis rebounded steadily last summer, so there was more room for them to fall.

The bottom line? The buying opportunity now is even better than it was last year.

However, I’m not going to buy MUB, because it’s not trading at a discount to its net asset value (NAV).

Instead, I’m going to choose three Invesco funds that invest in similar munis but boast huge discounts to NAV: the Municipal Opportunities Trust (VMO), the Municipal Trust (VKQ) and the Municipal Investment Grade Trust (VGM).

I’d also add Dreyfus’s Municipal Bond Infrastructure Fund (DMB) and BlackRock’s MuniHoldings Quality Fund (MUS).

I want these funds because they’re run by sharp managers with access to high-quality bonds; they’re offering huge yields; and they’re priced at a discount.

Ready for Bottom Fishing

You can see how these funds’ massive year-to-date run up has ended, and they are swiftly correcting to be flat or up slightly year-to-date. That’s a great entry point for us, thanks to overblown interest rate fears.

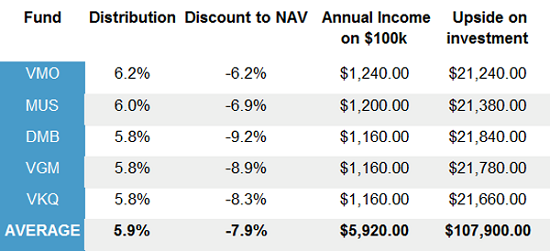

If I buy now, I’m not only getting these funds at a good price—I’m getting both a high rate of income and tremendous capital gains potential, thanks to those wide discounts to NAV:

Immediate Income and Upside

Let’s take a look at this in detail.

Off the top, we’re getting a 5.9% dividend on our $100,000 investment, so $5,920 in annual tax-free income, or $493.33 per month.

Then we have $7,900 in capital gains potential as the market’s hysteria over interest rates ebbs and these funds’ prices march closer to their NAVs.

That’s the power of buying municipal bonds at a discount. If we just went through a municipal-bond broker and purchased bonds straightaway, we’d lose out on that $7,900 upside potential.

That’s not the only disadvantage of buying munis direct. Retail municipal bond brokers also deal with far less capital than Invesco, Dreyfus and BlackRock, who combined manage over $2 trillion for investors. These three juggernauts also have special relationships with municipal bond issuers, letting them circumvent bond brokers entirely. This “cutting out the middleman” lowers their transaction costs and gives them access to higher-quality municipal bonds.

Big investment managers can also throw their weight around when it comes to leverage, which they use to boost returns, because their massive size lets them borrow capital at significantly lower interest rates than you could through a conventional broker.

Right now, for example, you’d be lucky to get a margin rate of 5% at retail brokers, where these institutions are borrowing for less than 1%.

And if the word “leverage” makes you a bit nervous, don’t worry, because these funds only leverage about 30% of their assets, so it would take a massive global catastrophe, causing municipal bond defaults to rise over 20%, for this borrowing to become a problem.

Since municipal bond default rates have never been above 1% in the history of the world—even during the 2008/09 meltdown—the chances of this happening are pretty much zero.

So where does all this leave us? With discounted bonds, cheap leverage, high-quality issues and tax-free high yields—all available at a massive discount. Let’s make our move now, before these funds start to rise and their attractive discounts and dividend yields narrow.

6 Better Rising-Rate Bargains to Buy Now

These 5 municipal bond funds are great buys right now—but they’re not the only bargains the interest-rate panic has served up.

We’ve got 6 other overlooked investments for you that are even cheaper than the 5 funds above—I’m talking discounts of up to 15%—so our potential upside is far higher than the 7.9% our muni funds offer.

Even better, they hand you an average yield of 8.0%—so you’re essentially taking our muni funds’ potential 7.9% gain and turning it into a sure thing (or at least as close as you can get in the investing world).

We like these 6 rock-solid high-yielders so much we’ve made them part of our No-Withdrawal Portfolio, which, as the name suggests, lets you retire and live off dividend income alone, without touching a penny of your capital.

And thanks to its safe 8.0% income stream, you won’t need a seven-figure upfront investment to do it.

Note: The author of this article is Michael Foster. He is the Senior Analyst at Contrarian Outlook.

Category: Bond ETFs