Inflows Into Tech ETFs Hit Record Thanks To Amazon And Apple

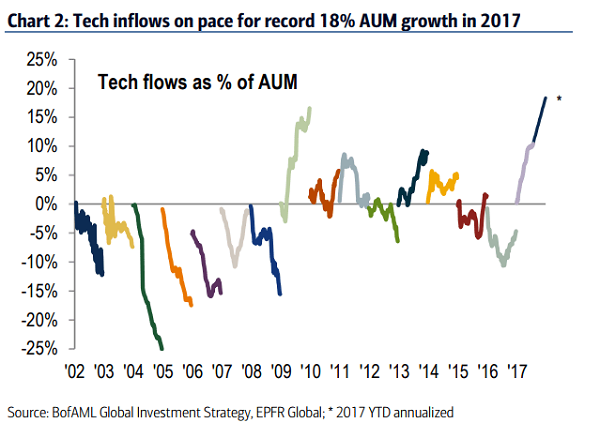

The success of Apple, Amazon, Alphabet, and Facebook has inspired investors to funnel billions of dollars into tech funds this year putting tech funds on track to be the most popular asset class, as calculated regarding a percentage of assets under management for 2017. These figures come from Bank of America’s latest Flow Show report, which reveals that year-to-date inflows into tech funds are on track to hit a record 18% of assets under management for the year, with tech ETFs the hot among fund vehicles.

The success of Apple, Amazon, Alphabet, and Facebook has inspired investors to funnel billions of dollars into tech funds this year putting tech funds on track to be the most popular asset class, as calculated regarding a percentage of assets under management for 2017. These figures come from Bank of America’s latest Flow Show report, which reveals that year-to-date inflows into tech funds are on track to hit a record 18% of assets under management for the year, with tech ETFs the hot among fund vehicles.

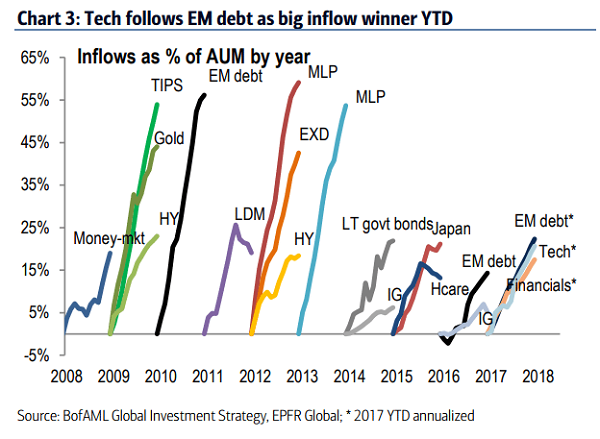

Still, even though tech ETFs and other funds have attracted a record volume of assets so far in 2017, emerging market debt funds have attracted more, although only just. Financial funds are coming a close third.

Year-to-date tech flows of the largest on record (data back to 2002) and comes off a weak year for the sector in 2016 when asset flows were negative. The only year that comes close to matching 2017 tech flows during the past decade is 2009.

Tech ETFs rule but flows broadly positive

Away from the tech sector, equities, in general, saw inflows for the week ending August 3, the eighth straight week of positive performance. According to Bank of America’s report, equity funds saw a positive inflow of $2.3 billion, of which $6.8 billion went into ETFs, and $4.5 billion flowed out of mutual funds, continuing the active/passive rotation that has been underway for the past few years.

All equity markets have seen inflows for the majority of this year. Emerging markets have seen 20 straight weeks of inflows with the latest weekly inflow amounting to $2.2 billion. In seven of the past eight weeks, flows into Japanese equities have been positive and in 18 of the past 19 weeks flows into European equities have been in positive territory.

On the fixed-income front, bond funds have attracted more cash than has been withdrawn for 20 weeks in a row. For the past week, bond funds attracted $7.3 billion of assets. Emerging market debt has recorded inflows for 27 straight weeks while investment-grade bond funds have seen positive flows for 32 weeks. For the week ending August 3, these two fixed income classes attracted $1.9 billion and $5.8 billion respectively. High yield funds have suffered as emerging market debt has captured investors’ attention. In six of the past seven weeks, HY debt has seen withdrawals. Overall, year-to-date equity funds have seen assets under management increased by 2.5%. Long only mutual funds have suffered significantly. With outflows of 1.2% of assets under management. ETFs have booked inflows amounting to 10.2% of AUM.

After this impressive run, Bank of America is warning against euphoria. The bank’s Bull & Bear Indicator, a measure of market sentiment now stands at 7.6, near the July 2014 highs and not far from the “sell” signal, which is issued when the indicator reaches the euphoric territory of eight.

Note: This article was contributed to ValueWalk.com by Rupert Hargreaves.

Category: ETFs