A 10.6% Dividend (With 156% Upside) Hiding In Plain Sight

We’re going to push aside overdone recession fears today, so I can show you one fund you can buy for triple-digit upside. And this unsung dividend play spins off a big income stream, too: a 10.6% yield.

We’re going to push aside overdone recession fears today, so I can show you one fund you can buy for triple-digit upside. And this unsung dividend play spins off a big income stream, too: a 10.6% yield.

It comes from a sector few people check for high yields: energy.

But this investor “blind spot” is why this 10.6% dividend opportunity exists. Read on and I’ll show you how to time your move (if you were to buy this fund or invest in energy generally).

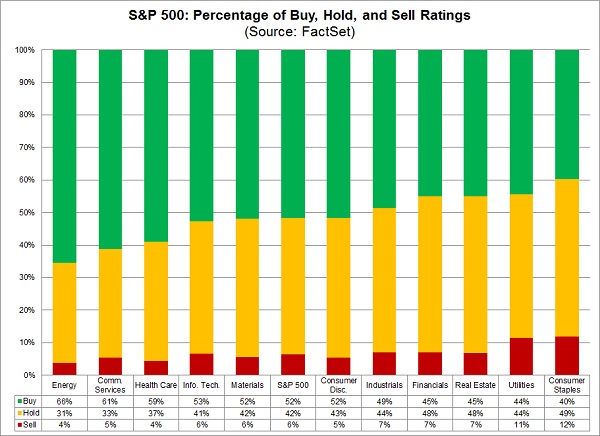

First off, forget the jarring headlines you’ve seen about a corporate-earnings slowdown in the US. When you dive into the sector level, you see that the outlook is rosy in plenty of places, with energy leading the way, according to the analyst crowd.

Analysts Bullish on Energy

Earnings declines are expected to be most dramatic in consumer staples and industrials, where changing tastes and rising production costs are reshaping those sectors. But the outlook for energy is the most rosy.

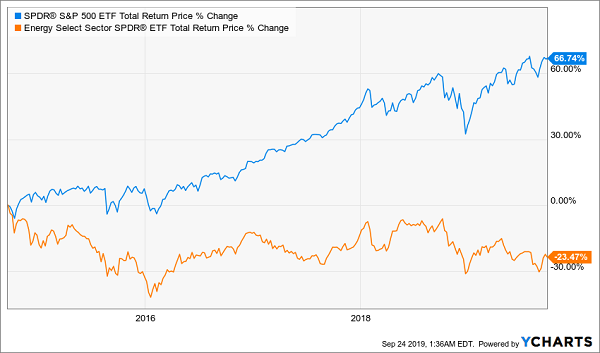

So why are we hearing little about energy’s upside? I’ll show you in one chart, comparing the benchmark Energy Select SPDR ETF (XLE)—in blue—to the S&P 500:

Oil-Crash Hangover Clouds Investors’ Vision

But if you combine that long bear market with a spark from rising energy-sector profits, you get an oversold sector that could be poised to jump.

And that’s not the only trigger.

There are other new developments, such as unrest in the Middle East following a missile attack on Saudi Arabian soil (which may have come from Iran). You also have growing demand from increasingly affluent emerging markets, particularly in East Asia, that isn’t being priced into oil prices because investors are looking at lower GDP-growth rates in the region.

But that lower GDP growth now masks a long-term trend: those countries are still seeing higher numbers of middle-class people who are spending more on goods that are either made of oil or consume it, most crucially, cars.

Then there’s the US, where GDP growth is still strong, but, more importantly, wages and employment rates are still rising. With 3% wage growth in recent months, Americans are also earning more, which is going to increase oil demand further.

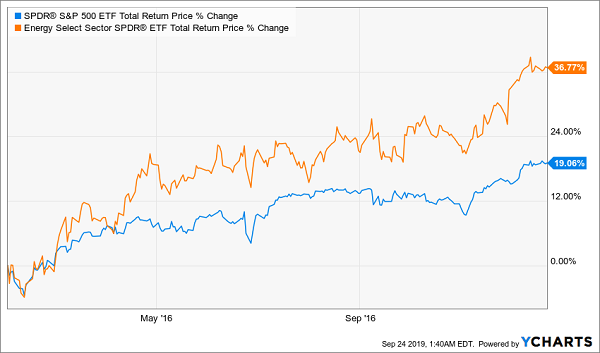

Energy Rewards Good Timing …

Commodity investing, at its core, is all about timing: if you make your move at the right moment, you can win big. The opposite, of course, is also true.

Take 2016. After the world had reset its expectations on lower oil prices, we saw a restructuring among many of the biggest oil firms that resulted in a huge one-year return, going by the performance of XLE:

36.8% Gains in Less Than a Year

… And Savvy Fund Selection

Timing is the first part of your success strategy in energy. The other? If you’re going to invest in oil through a closed-end fund (CEF), which I recommend over individual stocks, you’ll need to choose wisely, as energy CEF performance varies.

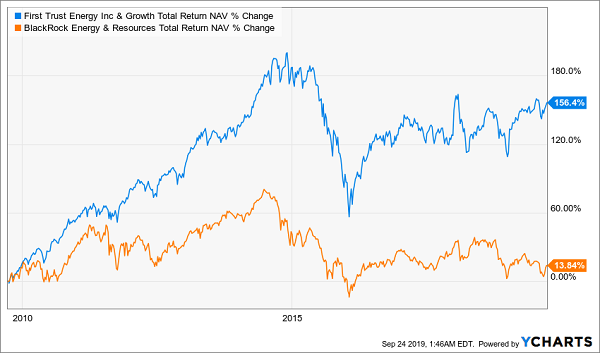

For instance, look at the fund I want to spotlight for you today, the First Trust Energy Income & Growth Fund (FEN), versus the Blackrock Energy and Natural Resources Fund (BGR).

FEN’s Strategy Pays Off

Both are energy funds, but FEN’s returns are 10-times those of BGR!

The reason? In addition to a 10.6% yield, FEN aggressively shifts its portfolio to where the profits are—an essential strategy in a fast-moving sector like energy. The fund also focuses on midstream pipeline operators like Enterprise Products Partners LP (EPD), Kinder Morgan Inc. (KMI) and Enbridge (ENB).

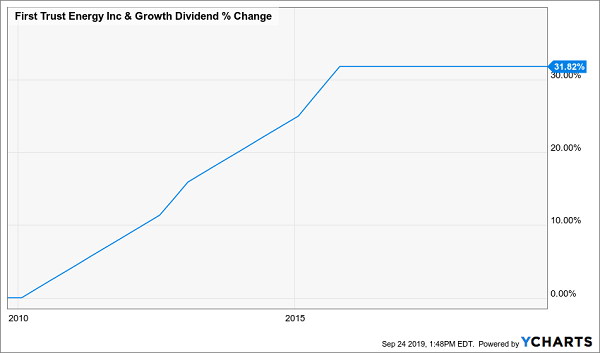

Moreover, management has done a great job of holding the fund’s dividend steady—and even growing it over the last decade—despite whipsawing oil prices:

A 10.6% Dividend, With a Side of Payout Growth

FEN’s strong track record hasn’t been met with a lot of investor demand—its market price is right around par with its net asset value (NAV, or the value of the stocks in its portfolio). That makes it a compelling buy now, if we’re on the cusp of a major oil boom, which would send this fund to a premium.

Yours Now: 4 Top CEFs With 8.8% Dividends, 20% Upside

Even though FEN looks primed for more upside, I still demand a discount to NAV when it comes to CEFs. That’s because CEFs trading at a discount can pay us in 3 ways:

- A huge (and growing) dividend (outsized dividends like FEN’s are common in CEF-land)

- Further market gains, and …

- A closing discount window, which catapults the fund’s market price higher as it narrows.

And yes, I’ve got a selection of high-yield CEF picks (4, to be specific) primed to hand you big gains, thanks to all 3 of these strengths. In addition to being perfect plays on America’s growing economy, they have:

- Wide diversification: Forget about staking it on oil! These 4 CEFs come from across the economy: stocks, real estate investment trusts, bonds, foreign shares—you name it, it’s in here.

- Massive discounts—poised to propel us to 20%+ price gains in the next 12 months while we collect these 4 funds’ …

- Huge 8.8% average dividends: And that’s just the average! One of these stout funds yields 10.7% now, and its payout is growing much faster than that of FEN, up 143% in the last decade.

These 4 funds’ big discounts are already starting to narrow, so you’ll want to make your move soon to grab the biggest price upside. Click here to get full details—names, tickers, buy-under prices and everything you need to know to get in on these big income streams (and gains) now.

Category: Closed-End Funds (CEFs)