How To Buy Your Favorite Stocks At 14% Off (With Yields Up To 7%)

If you’ve read the headlines about tech’s woeful slump in the past couple weeks, you might think stocks are out of favor.

You’d be wrong—and this chart proves it:

Forget the Headlines: Stocks Are Rolling

After February’s gut-wrenching plunge, the S&P 500 has more than recovered and is up 6.2% year to date. If this trend continues, we’re looking at a 12.4% return on the year.

But look at the orange line above—that’s the tech-benchmark Invesco QQQ Trust (QQQ), which is up 13.2% year to date, even after this latest correction in tech. That adds up to a monstrous 26.4% return for 2018 if that trend continues.

And I see these trends continuing, for both the market as a whole and for tech, as investors come back to this beleaguered sector.

Economic Strength Won’t Be Denied

There are a couple reasons why I see stocks generally finishing up strong this year—and a little further on I’ll show you 2 great ways to pick up your favorite household names (and those of a certain Warren E. Buffett, too) at double-digit discounts.

Oh, and you’ll pocket cash dividends up to 7% while you do.

But first, back to where this incredible market run is headed from here.

One reason it’s set to continue is that last week’s report that US GDP rose a stunning 4.1% annualized in the second quarter is driving a lot of economists to raise their expectations for the full year, with 3% growth becoming increasingly expected.

This growth is largely thanks to two things: a stronger American consumer and increasingly profitable American companies.

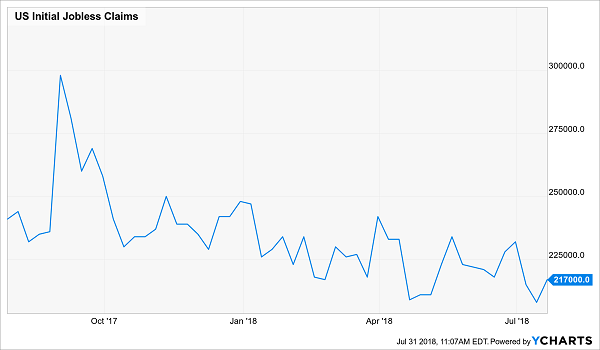

Americans Go Back to Work …

A tighter job market means initial jobless claims have been falling at a steady rate over the last year, cutting the unemployment rate from 4.4% to 4%. That’s helping sales soar.

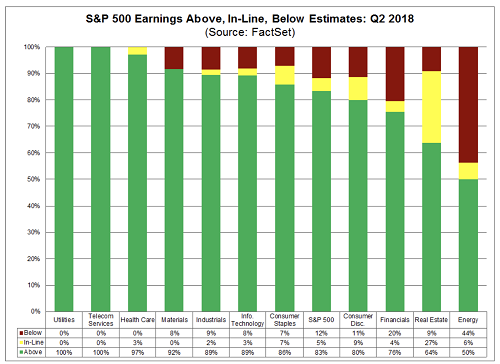

So far in the second quarter, 73% of S&P 500 companies are reporting sales above expectations, according to FactSet. That’s also boosting stocks’ earnings across all sectors.

… Sending Profits Soaring

In normal times, a widespread earnings bonanza like this would be impressive. But expectations were already high. Going into the second quarter’s earnings season, analysts forecasted a 21.3% profit increase from a year ago; so far, earnings for S&P 500 companies have risen by just that: 21.3%.

And the good times aren’t going to stop anytime soon—companies have boosted expectations for next quarter, and analysts have boosted their expectations, too. Now all of 2018 is expected to provide a 20% jump in earnings, far above the S&P 500’s still-impressive 6.2% price gain.

That’s another way of saying that stocks are actually cheaper in relation to forecast earnings than they were at the start of the year, despite their price gains—and that points to more upside around the corner.

Like Rewinding the Clock 1 Year

If you’ve been sitting on the sidelines watching this earnings surge, you might feel disheartened. But don’t worry, you’re not too late.

Because I want to show you 2 little-known funds—closed-end funds (CEFs) to be specific—that let you get into this strong stock market at a discount. Think of it as being able to buy today at prices we saw a year ago.

So let’s get going, starting with…

CEF Pick No. 1: Buy Like Buffett for 14% Off

Looking to get into the Oracle of Omaha’s favorite stocks—including his own company, Berkshire Hathaway (BRK.A)—at a big discount?

You can do just that with the Boulder Growth & Income Fund (BIF), a value-investing CEF that puts a third of its assets in Berkshire while allocating much of the rest to Buffett’s top picks, like JPMorgan Chase (JPM), Wells Fargo (WFC) and Caterpillar (CAT).

By using Buffett’s value-investing approach, BIF has provided these returns to investors in the last year:

The Master’s Strategy Delivers Nice Gains for BIF Holders

And here’s the best part—BIF is far cheaper than it should be.

Thanks to a quirk in the CEF structure, BIF trades for less than the net asset value (NAV) of its portfolio. In fact, it’s trading at a 13.9% discount to that NAV, which means you can buy every dollar of the shares BIF holds for about 86 cents if you buy BIF directly—where you’d get no discount if you bought those shares on the open market.

Plus, since BIF is diversified across dozens of strong large-cap companies, you get diversification on top of a share of the Buffett-style investing method that made the man famous.

And I haven’t even gotten to the best part: dividends.

An Income Stream You Can Count On

BIF, like many closed-end funds, pays out an attractive dividend to shareholders. Right now, BIF’s yield is 3.5%, or roughly double that of the S&P 500.

The fund can pay those dividends because of its strong portfolio. Since BIF has earned much more than 3.5% on its investments on an annualized basis, it’s able to maintain those payouts without being forced to sell stocks from its portfolio to do so.

And BIF isn’t even the highest-yielding CEF out there, which leads me to the next fund I want to show you now.

CEF No. 2: A 7.4% Dividend and Market-Beating Performance

Many CEFs pay 7% or more, and some of them even beat the S&P 500 while doing it. Take, for instance, the Nuveen Core Equity Alpha Fund (JCE), which trades at a small (1%) discount to NAV and currently pays out a 7.4% dividend to shareholders.

That is not a typo. JCE’s dividend is over 4 times bigger than that of the S&P 500!

And JCE has managed to pay this out while crushing the market. Over the last decade, this fund’s return has been nearly double that of the S&P 500:

JCE Crushes the Index

With market outperformance and a superior dividend yield, who wouldn’t want to get into JCE?

Yet a lot of investors bypass this fund, simply because they don’t know it (and CEFs generally) exist. Since JCE only has about $250 million in assets under management, it’s too small to warrant being aggressively advertised like ETFs, which make up over $4 trillion in clients’ money.

That means these smaller CEFs are one of Wall Street’s best-kept secrets—and a corner of the market I cover exclusively in my CEF Insider service. Because JCE, BIF and many other CEFs provide market-busting incomes and market outperformance that are impossible to find in the ETF world.

And now that stocks look set to soar even further from their current levels, it’s a great time to compound your profits with a discounted fund like BIF or JCE.

If you’re nearing retirement, or have already retired and are living off income from your investments, I strongly encourage you to check out the top 7 high-yielders from Brett Owens, Contrarian Outlook’s Chief Investment Strategist. All seven are key recommendations in his 8% No Withdrawal Portfolio and check both boxes for “dividend growth” and “high current yield”.

As a group, they pay an impressive 8.5% average yield today, which is downright outstanding in a 3% world.

Combine 5% to 10%+ dividend growth with these high-single-digit current yields, and we have a formula for safe 15% to 20%+ annual gains, with a significant portion of that coming as cash dividends.

And thanks to the new tax plan, there’s never been a better time to buy these issues and live off their dividends.

We’d love to share Brett’s seven favorite recession-and-rate-proof high-yielders with you – including specific stock names, tickers and buy prices. Click here and we’ll send our full 8% No Withdrawal Portfolio research you to right now.

Category: Closed-End Funds (CEFs)