ETF Asset Growth Balloons, But Are Signs Of Exhaustion Showing?

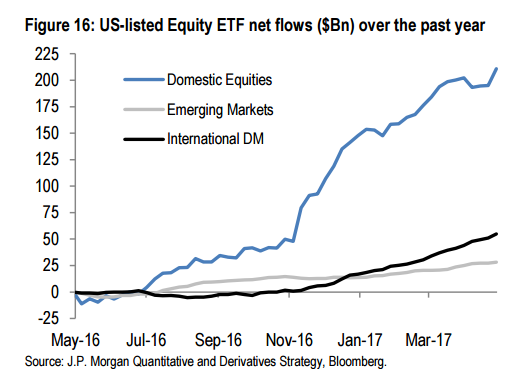

As the ETF revolution moves into a mature stage across the US financial landscape much in the way quantitative investing has, an 84-page JPMorgan report notes the growth but also points to a slowing in new offerings in 2017. The continued growth of ETFs come as active managers are even using the passive vehicles in noticeable numbers.

As the ETF revolution moves into a mature stage across the US financial landscape much in the way quantitative investing has, an 84-page JPMorgan report notes the growth but also points to a slowing in new offerings in 2017. The continued growth of ETFs come as active managers are even using the passive vehicles in noticeable numbers.

Passive ETFs started in Canada and have revolutionized an industry

It seems like ages ago that perhaps the most significant financial product to hit Wall Street was first launched in Canada. In 1990 when an exchange traded fund (ETF) first launched allowing low fee trading of the Toronto Stock Exchange’s most blue chip of companies, the TSE 35 was a revolution.

Unlike mutual funds, the Canadian developed ETF had much lower fees and was tradable intraday, whereas most mutual funds were, like many financial products at the time, high priced and illiquid.

The momentum for a truly innovative financial product that offered fee transparency was accepted on Wall Street three years later when the SPDR S&P 500 ETF (SPY) was brought to market by State Street Global Advisors. By 2000, a handful of funds offered low-cost access to a host of major indices, a trend that caught on in Asia in 1999 and Europe in 2000.

That industry has since ballooned, as the concept to access low-cost market beta has grown and become more specialized.

As the once broad-based ETF matures, the passive vehicle becomes more niche focused and active

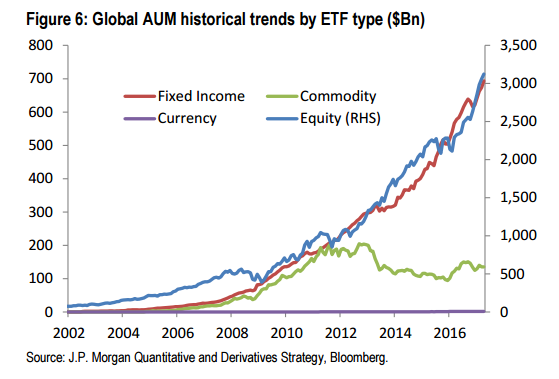

There are now 3,400 European ETFs and exchange traded commodities (ETCs) which manage $672 billion in assets. While commodity ETFs have been lagging their fixed income and equity counterparts since 2012, the overall growth of the industry has been stunning.

In Europe, international ETFs account for 28% of the assets, while 26% of AUM is held in broad-based ETFs and another 24% is devoted towards fixed income. The “smart beta” concept is not as prevalent as style-based ETFs manage only about 8% of assets.

Compare this to the nearly $2.9 trillion in US assets and the $353 billion in Asian assets to see a trend of US and European leadership in assets under management.

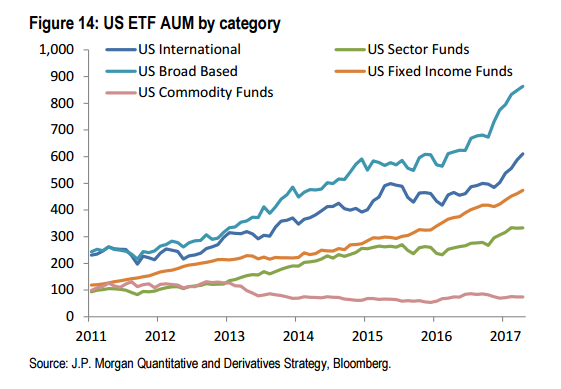

In the America’s region, the largest exposure is broad-based ETFs, which gobble up $866 billion in assets, while style and asset allocation tactics take in a respectable $517 billion with sector exposure only amounting to $335 billion. International ETFs manage $615, highlighting differing trends in allocation across regions.

In Asia, the most significant assets under management Japanese ETFs, followed by Hong Kong / China with a combination of sector / style ETFs only commanding near 15% of assets that flowed to Japanese ETFs.

The growth of the ETF industry, once considered passive in nature, has been noted by the recent launch of niche products, many focused on risk management.

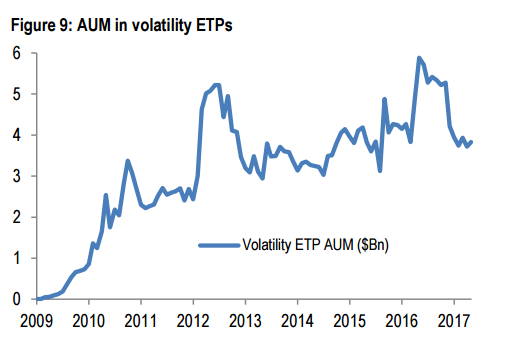

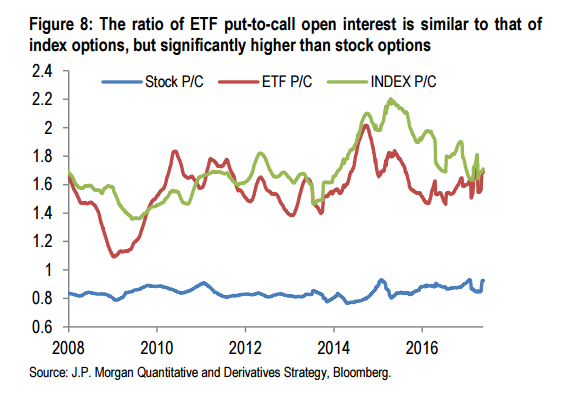

Volatility-based offerings, for instance, have grown from next to nothing in 2009 to represent over $4 billion under management at the end of 2016. This comes as options on ETFs flourish as do highly specialized and leveraged products, providing the look of a derivatives instrument at times but being offered in a securities wrapper.

While the growth has been stunning, signs of trend exhaustion are beginning to appear.

Is ETF growth starting to slow?

In 2015 and 2016 an average of nearly 250 new ETFs were conceived into the world in each of those years, for an average near 65 per quarter.

That torrent pace is beginning to slow, as in the first quarter of 2017 only 31 ETFs were launched. Furthermore, fund closures, a hedge fund issue, appears to be entering the ETF space. Since January 2016 there have been nearly 140 ETFs that shut their doors.

Of the new launches that did take place, many were focused outside the US or had a style or sector tilt: 32% were international equity funds, 25% were style-based ETFs, and 17% were sector ETFs.

Note: This article was contributed to ValueWalk.com by Mark Melin.

Category: ETFs