ETF Trading Research Mailbag

Last week I wrote about ‘3 ETFs That Tanked In April’…

Last week I wrote about ‘3 ETFs That Tanked In April’…

As the name suggests, I highlighted three of the worst performing ETFs during the month of April. And then I gave you my opinion of whether or not the ETF was worth owning at this point.

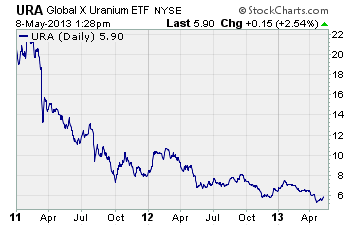

One of the ETFs I highlighted was the Global X Uranium ETF (URA). It was down 12% in April and a whopping 36% over the last year. And in my opinion, URA isn’t an attractive investment.

Apparently I touched a nerve!

Thomas T. wrote in to say, “Corey Williams is incorrect in saying nuclear power is being phased out of existence. Only in the U.S. Nuclear power plants are flourishing on a world-wide basis.”

First off, thanks for writing in Thomas.

Obviously, nuclear power’s a hot button issue. Some people love it and others hate it.

After digging through piles of research on the matter, here’s what I came up with…

Right now there are 437 nuclear power plants in operation world-wide. And there are 68 more that are under construction. In fact, in the late 2000s, there was talk of building new nuclear power plants in the US for the first time in 30 years.

Then on March 11, 2011, a large earthquake off the coast of Japan caused a tsunami that struck a nuclear power plant in Japan. The plant lost power and ended up causing the largest radiation leak since Chernobyl.

That effectively ended the short “nuclear renaissance”.

Today the vast majority of new nuclear power plants are being built in emerging economies. Countries like China, Russia, and India are where 49 out of the 68 nuclear reactors are under construction.

But nuclear power is being phased out in places like Australia, Germany, and many other European countries. And countries like the US and Japan are looking at every available alternative to get away from their reliance on nuclear power.

In short, the nuclear power debate isn’t the US versus the rest of the world. It’s more about developed versus emerging markets.

But it’s also clear nuclear power isn’t going to disappear anytime soon.

Based on the latest estimates, uranium demand is expected to grow by 3% per year through 2022. But those numbers can change if more nuclear power plants are taken out of operation sooner than expected.

Can uranium miners survive or even thrive when demand for uranium is growing a paltry 3% per year?

The evidence says no…

Uranium prices are at their lowest levels in a decade. And over the short life of URA, it has done nothing but fall…. from $20 to $5.90 today!

So again, stay away from URA. With so many other ways to make money in this bull market, this is one investment I don’t want to own at any price.

Good investing,

Corey Williams

Category: Commodity ETFs, ETFs, Sector ETFs