Here’s Where We’ll Find 20% Upside (And 5% Tax-Free Dividends) In 2019

There’s a rare opportunity bubbling up in an obscure corner of the market, and we need to act now, because with a quick hand, we can snag 5.9% tax-free dividends in 2019 and double-digit upside—in just 3 quick buys.

There’s a rare opportunity bubbling up in an obscure corner of the market, and we need to act now, because with a quick hand, we can snag 5.9% tax-free dividends in 2019 and double-digit upside—in just 3 quick buys.

I’ll reveal the names of these 3 surprising investments in a moment.

But for now, I’ll tell you that this time-limited shot at income and gains comes from the municipal-bond market—and specifically a shift in the interest-rate picture that “muni” investors have completely missed. But that won’t last.

Let me explain.

As everyone knows, 2018 has been a year of constant rate hikes. These increases have weighed on bonds, including “munis,” as bonds tend to underperform when rates go up.

The key, then, is to buy munis at the bottom of a rut like this—and all signs suggest we’ve reached that point.

The Interest Rate Story

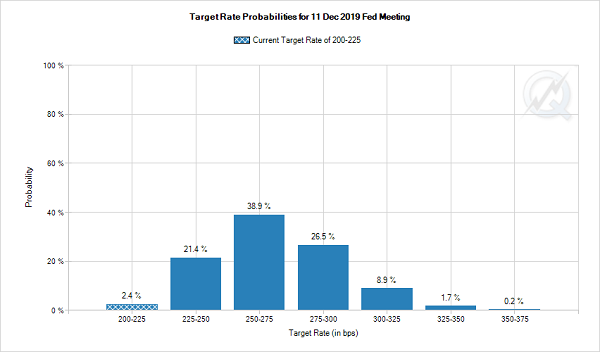

To explain why, I need to show you another chart. This is the probability of different interest rates by December 2019, as priced in by the futures market:

Rates Slam Into Neutral

Source: CME Group

This chart has changed a lot in the last two months and now basically shows the likelihood of a single rate hike in 2019. That’s way down from the summer, when the expectation was for 3 or even 4 increases.

Why the change?

The main reason is that the economy is strong, but not too strong; in short, we haven’t seen inflation spiral out of control, which would necessitate faster rate hikes. The Fed has hinted that this will lower its rate-hike plans in the near future.

This is where our opportunity comes in, because municipal bonds haven’t picked up on this signal and are still pricing in substantial rate hikes next year. Look at the performance of the iShares National Municipal Bond ETF (MUB) so far in 2018:

Muni Investors Living in the Past

With a year-to-date decline, municipal bonds have clearly priced in as many rate hikes in 2019 as we’ve seen in 2018. And even though the Fed recently changed its tune, the October/November market panic means munis still haven’t priced in this shift at the Fed.

The bottom line? We have a nice opportunity to get into the muni-bond market before other investors pile back in. Better yet, we can double our chances of strong gains.

These 5%+ Yielders Have an Overlooked “Double Discount”

While munis are discounted relative to their cash-generating abilities, some municipal-bond funds, called closed-end funds (CEFs), are doubly discounted thanks to the way they’re structured.

Here’s what I mean.

Because CEFs have a more-or-less fixed number of shares, their market price can diverge radically from their portfolio value, or NAV, if there’s too much (or too little) demand for the CEF relative to demand for the CEF’s underlying portfolio.

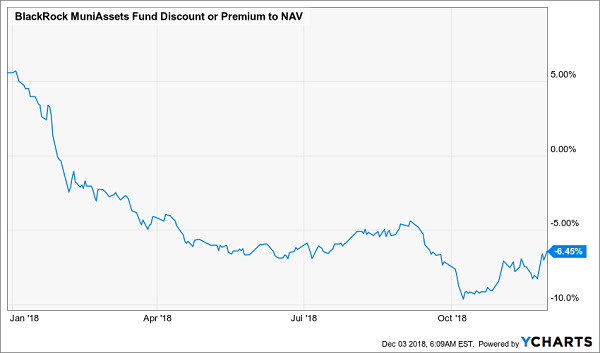

Let me use the BlackRock MuniAssets Fund (MUA), the first fund I want to show you today, to show you what I mean.

It’s a muni fund managed by the largest bond investor in the world, BlackRock, which manages over $4 trillion (yes, with a T). Here’s how MUA’s portfolio (in orange) has performed versus its market price (in blue):

An Oversold Fund

A couple noteworthy things here: first, remember that the index fund, MUB, is down year to date, while the BlackRock fund’s portfolio is actually up for 2018. This fund, like many other muni CEFs, has been posting NAV returns that crush the index for a while.

More important, though, is the market’s irrational punishing of this fund, despite its outperformance. The fund’s discount has expanded to 6.5%, although it was trading at over a 5% premium at the start of the year:

A Bigger Discount

Since muni bonds are oversold on their own, buying an oversold fund that holds oversold assets is a great way to compound your gains!

And you don’t have to stick with just MUA, although its discount and 5.1% dividend are compelling on their own.

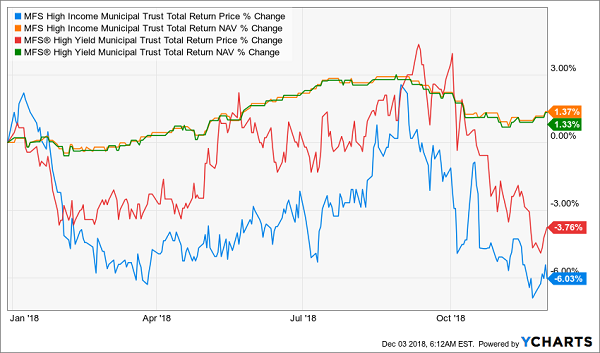

You could also go with one (or both) of a 2-pack of higher-yielding muni CEFs: the MFS High Income Municipal Trust (CXE) and MFS High Yield Municipal Trust (CMU), sister funds that invest in slightly different municipal bonds but deliver a similar performance. Plus CXE pays a nice 5.9% yield, while CMU yields 5.7%.

And like MUA, both funds have had a positive NAV return, despite the difficulty in the market in 2018:

Strong Portfolio, Weak Market

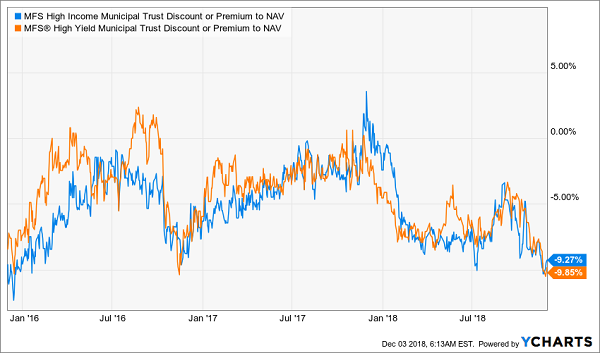

That doesn’t mean the market has rewarded them, as the blue and red lines showing these funds’ market-price returns demonstrate. This has resulted in unusually wide discounts to NAV of over 9%:

2 Deep-Discounted Muni CEFs

As you can see from this chart, both funds have had this wide discount only 3 times before in the last 3 years, and both funds actually sold at premiums to NAV in a period that has been particularly tough for muni funds.

The implication? Buy CXE and CMU now for outsized returns and a higher income stream, but also buy them for the 20% capital gains upside that’s likely to come when these funds’ discounts disappear and muni-bond prices rise over the next year.

This is the power of CEFs: compounding returns while providing a strong income stream that’s unmatched in more popular ETFs.

My colleague Brett Owens has created an “8% No-Withdrawal Portfolio” that generates steady income and impressive capital gains.

Brett’s system could hand you $40,000 a year on every $500,000 invested with under-appreciated income plays like:

- Closed-End Funds (CEFs)- We’ll share our top three CEF picks with you, each of which pay a monthly dividend. Many of these trade at a discount to net asset value; but unlike Oxford Square, actually can afford to pay their dividends.

- Preferred Stock- Brett lets you know two of the best active managers in this space to invest alongside with.

- Recession-Proof REITs- discover two REITs that actually benefit from higher interest rates; rather than being crippled by the Fed.

That’s 7 contrarian investment picks just to get started. Click here for instant access to the full 8%, No-Withdrawal portfolio.

Category: Closed-End Funds (CEFs)