Here’s How I Pick The Best CEFs For 7%+ Dividends (5 Simple Steps)

Since launching my CEF Insider service in early 2017, the picks I’ve given subscribers have outperformed the broader CEF market—even through the recent market volatility that’s caused just about everything to go down.

Since launching my CEF Insider service in early 2017, the picks I’ve given subscribers have outperformed the broader CEF market—even through the recent market volatility that’s caused just about everything to go down.

The key to this performance is a process of analysis and selection that is both complicated and straightforward. I have a checklist of 52 points I go through to choose the right fund. I apply these one by one, first using some of the broader points to screen funds, then zooming in closer, using more complex analysis to bring you my very best buys.

While it’d take a long time to go through that entire checklist, I want to share with you a five-point system that I use as a springboard for picking winning CEFs.

Before I get to that, let me first answer this important question: why is it important to have a good system in the first place?

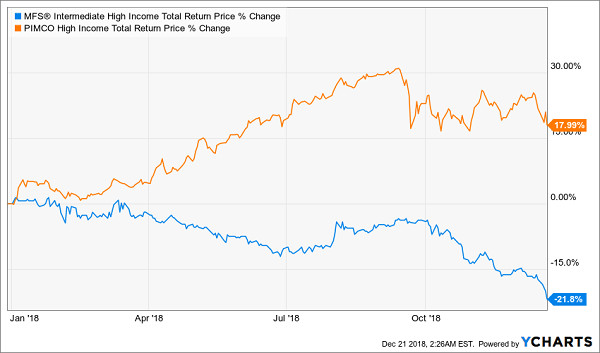

Because if you don’t, you could find yourself holding a very empty bag—like investors who bought the MFS Intermediate High income Fund (CIF) at the start of 2018 because they were seduced by its 9.7% dividend yield.

Sadly, that move resulted in a 21.8% loss by the end of 2018, even with dividend payouts:

The Perils of a High Yield

What’s even sadder is that there are plenty of funds that invest in the same assets as CIF that have done far better. Take the PIMCO High Income Fund (PHK), which also plays in the high-yield bond world and is up a whopping 18% for 2018.

A Far More Desirable Pick

This is one of many instances where blindly buying a CEF would have cost real money. And what makes things even more frustrating is that CIF was actually a better pick at the start of 2017—until it became a too-crowded trade by the start of 2018.

And CEF investors who aren’t diligent and bought CIF when it was good and held it when it became a disaster are facing massive losses, leading us to a really important question: how do you avoid this trap?

My 5-Point System

When choosing CEFs, I look at five crucial points that drive each buy call I make. And they can help guide you, too. They are:

- Management: How good is the team at the top, and has the fund changed horses lately (frequent management changes are an obvious red flag)?

- Discount: What’s the fund’s discount to its net asset value (NAV, or the value of its underlying assets), and what has that markdown been historically? We want a current discount well below the long-term average to drive our upside.

- Portfolio: What does the fund hold now, are there any big changes to the portfolio, what’s the rationale behind those changes, and how are those assets going to perform in the future?

- Dividend: How sustainable is the payout, what are the chances of a dividend cut, and how low can the payouts go? (Key here is to look at yield on price, yield on NAV, changes in NAV and total net investment income, or NII)

- Current Climate: How does the fund’s investment strategy fit within your broader portfolio and view of changes in the broader economy?

In other words, I combine a variety of bottom-up questions about the fund’s portfolio, strategy and management with top-down questions about the asset class and economy as a whole.

The System in Action

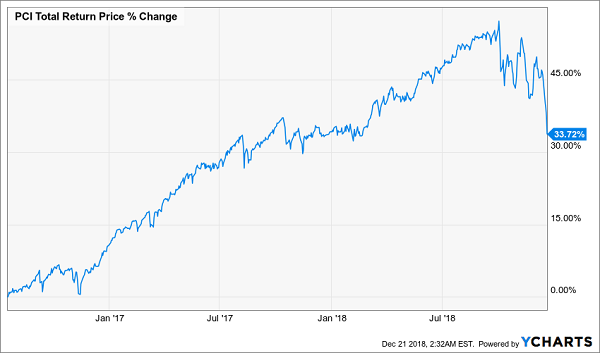

To show how this works, let’s look at an example: the PIMCO Dynamic Credit and Mortgage Income Fund (PCI).

Back in early 2016, my colleague and Contrarian Outlook Chief Investment Strategist, Brett Owens, and I worked together to figure out what the future held for PCI. You can read his original buy recommendation right here.

The first step was to look at the fund’s management.

In early 2016, the fund was changing its strategy away from high-yield corporate bonds to mortgage-backed securities. The complexity of these investments scared some, but we saw this as a positive for PCI. We also saw it as a sign that the fund was in the process of a transformation that would be good for its returns—and shrink its discount to NAV.

We were right.

In July 2016, PIMCO announced that it would change the fund’s name (it used to be called the PIMCO Dynamic Credit Income Fund) to reflect its new mandate. Fund manager Daniel J. Ivascyn, who has become a legend in finance, was largely behind the change as he took a more active role at the fund.

He had good reason to. At the time, PCI was the most discounted of PIMCO funds.

And while mortgage-backed securities sound scary to a lot of people because of their role in the Great Recession, PIMCO saw things differently (and so did we). Mortgage defaults were going down and the housing market was a lot stronger, which made the heavily discounted mortgage-backed securities a steal.

So PCI’s change in strategy, driven by top-notch management, and its portfolio quality indicated that its deep discount was a buy signal. It also showed that the fund’s 11.9% dividend yield was sustainable.

What’s happened since? A 33.7% total return, even after the recent market madness:

A Quick Ride Up

3 CEFs I’m Watching Now

Nowadays, I’m looking at a couple dozen CEFs that I think are getting to that perfect place where the fundamentals and the broader economic climate are combining to create a perfect storm for massive upside and sustainable high yields.

The first is the BlackRock Science and Technology Trust (BST), a tech fund with a 7.2% yield that has crushed the Nasdaq 100 since its inception and has held its own even during recent market struggles. It’s an example of a well-managed portfolio with a great management team—but while the bottom-up is good for BST, we’re not quite there from a macro standpoint yet. But we’re getting closer.

In the utilities world, there’s the 7.7%-yielding Gabelli Global Utility Fund (GLU), which is diversified and has the added bonus of going beyond the US to take advantage of currency fluctuations. I haven’t added it to the CEF Insider portfolio yet, for a simple reason: with the recent strength in the US dollar, buying abroad isn’t what we want to do quite yet—at least not until the US dollar has reached its peak, which may be just around the corner if the Fed makes it clear their rate hiking is going to slow down or stop.

Finally, another interesting fund on my watch list is the Boulder Growth & Income Fund (BIF), which has a massive discount despite its very strong portfolio of value stocks and focus on Warren Buffett favorites and Buffett’s own Berkshire Hathaway, which is a third of the fund’s portfolio.

In addition to the quality of the fund’s value investing focus, its 4% dividend yield squeezes income out of a Buffett portfolio, despite the Oracle of Omaha’s refusal to pay dividends, making it an income investor’s dream. The only problem? Its relatively low yield (many equity funds pay over 7% in the CEF universe) means a lot of investors give it a pass, which is why its 18%+ discount to NAV has persisted over the years.

Recent market volatility may drag CEF investors toward quality income options, which could result in capital gains for BIF shareholders. That brings BIF closer to being a buy, but we need to see the market itself strengthen a bit first.

Plus 8% Dividends, Paid Monthly, Make Retirement Even Easier

And by the way, you can even use my “no withdrawal” strategy to make sure you’re:

- Banking 8% annual dividends,

- Enjoying additional price upside, and

- Getting paid monthly to boot!

If this interests you, I’d recommend starting with my all-star retirement portfolio. It contains 8 of the absolute best preferred stocks, REITs and CEFs out there.

I’m ready to take you inside this “no-worry” retirement portfolio now. Click here and I’ll show you the 8 bargain investments inside it and give you their names, tickers, buy-under prices and much more.

Category: Closed-End Funds (CEFs)