How To Wreck Your Retirement In 2 Buys

In my years in the markets, I’ve seen some dangerous financial products come on the scene, but the two I’m going to show you in a moment might be the most dangerous.

In my years in the markets, I’ve seen some dangerous financial products come on the scene, but the two I’m going to show you in a moment might be the most dangerous.

No, I’m not talking about Bitcoin—although cryptocurrencies are pretty risky, since, as I wrote on January 1, most people don’t understand just how big a failure Bitcoin really is.

I’m talking about two new funds that have recently been released by BMO Capital Markets in conjunction with REX Exchange-Traded Funds.

Before I go into just how terrible these two funds are, let’s do a bit of digging into who BMO and REX are. That may be enough to scare you on its own.

BMO is short for Bank of Montreal, and BMO Capital Markets is the Canadian bank’s investment-banking subsidiary. Nothing wrong with that, of course, and BMO Capital Markets is known for doing very responsible and diligent analysis for institutional investors, companies considering mergers and acquisitions, and so on.

They’re by no means the biggest investment bank doing this kind of work—they’re not about to dethrone Goldman Sachs (GS), Morgan Stanley (MS) or JPMorgan Chase (JPM).

BMO isn’t even the biggest Canadian bank. Royal Bank of Canada (RY) and TD Bank (TD) are much bigger, as is Bank of Nova Scotia (BNS). But BMO is a responsible and trustworthy bank when they do their own work.

And therein lies the problem: BMO is working with REX, a small, new company whose products range from okay to awful.

For example, a couple of REX’s current ETFs give investors a way to bet on stock volatility, either wagering on smoother sailing, through the REX VolMAXX Long VIX Weekly Futures Strategy ETF (VMAX), or rising volatility, with the REX VolMAXX Short VIX Weekly Futures Strategy ETF (VMIN). REX also has the Rex Gold-Hedged S&P 500 ETF (GHS), which gives investors exposure to stocks and gold at the same time.

There are already some problems with these funds—and we haven’t even gotten to the two I want to warn you about today yet!

First, GHS’s fees (0.48%) exceed what you’d pay using many investors’ go-to provider of index funds, SPDR funds (using the SPDR S&P 500 ETF (SPY) and SPDR Gold Shares (GLD), you’d pay fees, on average, less than half of what GHS charges).

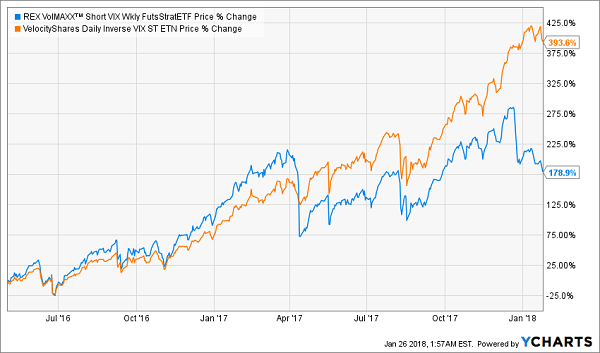

Second, the volatility funds have underperformed their competitors. Why use VMIN when you could use the VelocityShares Daily Inverse VIX Short-Term ETN (XIV), which does the same thing and has produced returns that double up those of REX’s offering?

REX’s Fund Isn’t Working

Now let’s move on to the perilous funds I really want to discuss.

These are two REX/BMO collaborations that give investors exposure to the famous FAANG stocks: Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Google (GOOG, GOOGL). One of these funds is long these stocks and trades under the FNGU ticker, and the other is short these stocks (FNGD).

Sounds convenient, right? If you think FAANG is underpriced or overpriced, trade these funds and make a bundle.

Except don’t do that. You won’t make a bundle—even if you’re right. Here’s why.

Problem #1: These Aren’t FAANG Funds

My biggest problem with these funds is that they aren’t what they claim to be.

Let’s start with the BMO REX MicroSectors FANG+ Index 3X Leveraged ETN (FNGU). The name is a mouthful, but there’s really just one part of it you should pay attention to—that little plus sign after “FANG.”

That “plus” refers to the fact that the fund “includes 10 highly liquid stocks that represent a segment of the technology and consumer discretionary sectors consisting of highly traded growth stocks of technology and tech-enabled companies,” according to REX’s description of the fund.

There aren’t 10 FAANG stocks, so what else is in here? The fund, as of the middle of December 2017, was equally exposed to FAANG stocks and non-FAANG companies Alibaba (BABA), Baidu (BIDU), Nvidia (NVDA), Tesla (TSLA) and Twitter (TWTR).

By buying FNGU, investors are getting a lot of exposure to China and Bitcoin (which is a big determinant in NVDA’s stock price these days) as well as the car industry and Elon Musk’s cult of personality. And did anyone at REX notice that Twitter is a competitor to Facebook?

Problem #2: Leverage and Going Bust

These aren’t just funds that buy and hold FAANG (and other) stocks—they use leverage to increase that exposure.

A lot of leverage.

These are 3x levered ETNs, which means two things. Firstly, since FNGU is an exchange-traded note and not an exchange-traded fund, it doesn’t technically own the stocks it’s tracking. That isn’t too important, but this next point is: for every dollar, the fund is using $3 of leverage, which means it will fall very hard when these highly volatile stocks fall.

Just how far could this fund fall?

Since some of these companies are fairly young, they haven’t suffered a bear market. But the NASDAQ 100 (QQQ) has. During the 2008 stock crash, QQQ did this:

Tech Gets Obliterated

If FNGU were around back then, it would have gone to zero. Investors would have lost everything.

The opposite is true for the short fund—FNGD (full name: the BMO REX MicroSectors FANG Index -3X Inverse Leveraged Exchange Traded Note). It’s already down 6.6% since its IPO on January 22, but if FAANG shoots up, as these stocks have in the past, expect much bigger losses to accrue very quickly.

That isn’t even taking into account the costs of leverage. You can’t borrow for free, and the costs of borrowing money to lever ETF returns is a famous problem for leveraged ETFs. It’s known as “leveraged ETF decay,” and it will eat into returns even more.

Sadly, many ETF investors don’t realize how dangerous this leverage is until it’s too late.

Problem #3: No Weighting, No Management, No Methodology

What I find most ironic about FNGU and FNGD is that they’re being marketed as products for sophisticated traders, but sophisticated traders have no use for these funds because they can lever their bets on FAANG much more easily and cheaply with things like call and put options and other derivatives. On top of that, there is nothing sophisticated about how FNGU and FNGD are constructed.

Unlike sophisticated tech funds, like the BlackRock Science & Technology Trust (BST), which is up 63.9% in the last year, FNGU and FNGD have no active management and no methodology for choosing how much of each stock to expose investors to.

Worse, FNGU and FNGD don’t even seem to be doing simple things like weighting exposure by market capitalization or through some other straightforward methodology. Apple has an $878.5-billion market cap, while Twitter’s market cap is just $16.5 billion. What possible reason would REX have to expose investors equally to these companies when one is over 50 times bigger than the other?

It’s hard to explain the lack of active management, or even smart asset allocation, in this fund. Even SPY, which is one of the dumbest (and cheapest) passive ETFs out there, weights its exposure to each stock according to market cap. This is not hard to do! But FNGU and FNGD don’t bother. Why? Laziness? We just don’t know.

How to Make an Easy 12% a Year Forever

Dividend growth is precisely what’s behind the portfolio I want to show you now: it’s a set of 7 ultra-conservative stocks I personally handpicked to deliver you 12% in safe, annual returns for life.

That’s 3 times more income than most retirement experts say you need!

So what stocks am I talking about?

- A stock that has already boosted its dividend payments more than 800% over the past 4 years and has at least another decade of double-digit growth left!

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is right now!

- A 9%-plus payer that raises its dividend more than once a year—and will double its payout by 2021 at its current pace!

This portfolio is perfect for retirement because it gives you the best aspects of numerous types of investment strategies—income, growth and nest-egg protection!

Let me steer you toward double-digit returns you can depend on. Click here and I’ll GIVE you 3 Special Reports that reveal how to earn 12% for life. You’ll get the names, tickers and my complete analysis of these 7 incredible dividend growers FREE!

Category: ETFs