Inverse ETFs… A Simpler Way To Profit From A Market Downturn

Investors most often think of ETFs as ways to buy into certain markets or assets. After all, ETFs are used to invest in everything from the Russell 2000 to Central African stocks to sugar futures.

Investors most often think of ETFs as ways to buy into certain markets or assets. After all, ETFs are used to invest in everything from the Russell 2000 to Central African stocks to sugar futures.

However, one extremely important feature of ETFs is that they can be used to take bearish positions. In fact, investors can use ETFs to establish short positions on the market, specific sectors, certain asset classes, and more.

Why is this important?

One reason is that going short can be a lucrative trading strategy. Another is that a properly placed short position can be an effective way to hedge your long portfolio.

But while there are multiple ways to short the market, many of these methods simply aren’t appropriate for non-professionals.

For example, you can short sell stocks, but that requires a ton of margin and exposes you to potentially unlimited losses. There are futures and options that can be used, but derivatives products aren’t for everyone.

Fortunately, the ETF industry has made it easier (and cheaper) than ever to take a bearish position…

Introducing, the bearish or “inverse” ETF.

Inverse ETFs are designed to profit from the decline in value of an underlying index or benchmark. You buy them just like you would buy a stock. The only difference is that the ETF’s price goes up as the asset it’s tracking goes down.

But here’s the key…

While bearish ETFs provide many of the same benefits as a short position, they do so without the risk of unlimited loss. With an inverse ETF, the most you can lose is the amount you paid for the ETF.

That’s a huge advantage over a straight short position.

So, what kinds of inverse ETFs are available?

There are bearish ETFs for all the major stock market indices, from the S&P 500 to the Russell 2000, as well as specific economic sectors, like technology or healthcare.

You’ll also find inverse ETFs on international stocks and emerging markets. And there are even inverse ETFs for fixed income, commodities, and real estate.

But do inverse ETFs really work?

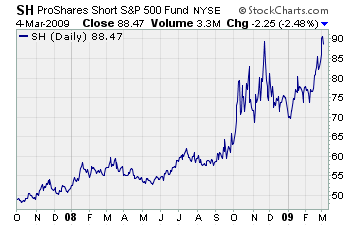

All you need to do to see the power of bearish ETFs is to look at this example from 2008-2009.

Remember, this was when the Financial Crisis was in full swing. Banks were failing. Real estate was plunging. Investors were running scared.

But, what if…

Instead of selling out your stock portfolio for a loss during that volatile period, you invested in a bearish market ETF?

Let’s say, when the real estate market started getting dicey in 2007, you decided to short the market. So, at the start of 2008, you allocated a portion of your portfolio to the most popular inverse ETF out there, the ProShares Short S&P 500 (SH), at $50 per share.

Just look at the profits you would have raked in had you held your position through the Lehman collapse in October. Or how about the gains you could have made when unemployment shot through the roof in early 2009?

At either point, you could have sold your SH shares at $90 for a stellar 80% gain!

And you would have made it during one of the most terrifying market free falls in history.

No question about it, inverse ETFs can be a powerful wealth building tool when used correctly. So, the next time you’re expecting a decline in a particular market, check to see if there’s an inverse ETF you can use to profit from it.

Profitably Yours,

Robert Morris

Category: Inverse ETFs