On Sale Now: A Safe $11 Dividend Stock Yielding 19%

That’s right, Tim Plaehn shares one of his favorite and highest yielding stocks that can pay you almost 20% on your money. You can rest easy owning this stock as well because its dividend payments are rock-solid.

That’s right, Tim Plaehn shares one of his favorite and highest yielding stocks that can pay you almost 20% on your money. You can rest easy owning this stock as well because its dividend payments are rock-solid.

My research in the world of high yield stocks shows that it is very difficult to find shares that both pay a double-digit yield and provide a high degree of confidence that the dividend rate is safe. Very high yields in the stock market are a sign that the dividend is in danger of a reduction, and that observation applies to the majority of high yield stocks. I spend a lot of time digging out those double-digit yield investments where the market is wrong, and the dividend payments are actually safe.

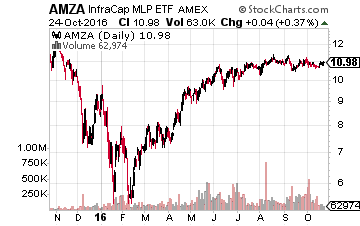

The InfraCap MLP ETF (NYSE: AMZA) is an actively managed exchange traded fund (ETF) that invests in energy infrastructure companies, with most of the companies in the fund organized as master limited partnerships (MLPs). You may think it is impossible for an MLP focused fund to be safe and also pay an 18% yield, but in late 2014 as the team was preparing to launch the fund, I was fortunate enough to be able to interview the AMZA fund managers and have become quite close with them. Since then, I have stayed in contact to see how well the fund is operating to meet their investment objectives.

The InfraCap MLP ETF (NYSE: AMZA) is an actively managed exchange traded fund (ETF) that invests in energy infrastructure companies, with most of the companies in the fund organized as master limited partnerships (MLPs). You may think it is impossible for an MLP focused fund to be safe and also pay an 18% yield, but in late 2014 as the team was preparing to launch the fund, I was fortunate enough to be able to interview the AMZA fund managers and have become quite close with them. Since then, I have stayed in contact to see how well the fund is operating to meet their investment objectives.

From my contact with the management team I can say that the eye popping high yield is real, and the organization and management of this fund make the yield sustainable.

The AMZA strategy starts with the companies in the Alerian Energy Infrastructure Index. The AMZI is a market-weighted index of the 25 largest and most stable MLPs. It only includes companies that provide necessary infrastructure services such as pipelines, storage facilities, processing plants and terminals. In practice, these should be some of the most stable stock market investments out of the entire group of energy sector stocks.

MLPs like those tracked by the AMZI pay a high current yield and have histories of regular dividend growth. According to the Alerian website, AMZI yields 7.1%. You may be asking how the AMZA tracks the AMZI and also pays an 18% yield. As I noted above, the AMZA managers actively manage the portfolio and are allowed to use several strategies to boost the earned yield. There are three main strategies that help turn AMZA into one of the highest-yield investments available in the stock market.

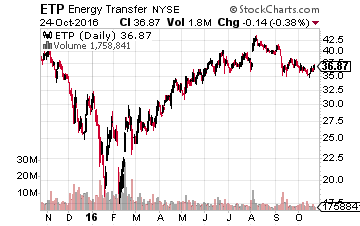

First, the portfolio managers are allowed to weight holdings differently than the market cap weighting of the AMZI. For example, the two largest AMZA holdings are Energy Transfer Partners LP (NYSE: ETP) and Williams Partners LP (NYSE: WPZ), which yield 11% and 9% respectively. The two largest MLP holdings in the Alerian index,

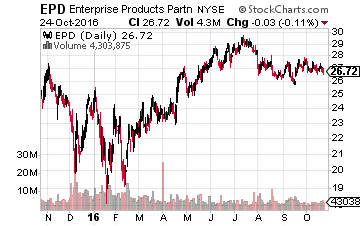

First, the portfolio managers are allowed to weight holdings differently than the market cap weighting of the AMZI. For example, the two largest AMZA holdings are Energy Transfer Partners LP (NYSE: ETP) and Williams Partners LP (NYSE: WPZ), which yield 11% and 9% respectively. The two largest MLP holdings in the Alerian index,  Enterprise Products Partners L.P. (NYSE: EPD) and Magellan Midstream Partners, L.P. (NYSE: MMP), yield 6% and 4.7% respectively. The AMZA management team overweight undervalued MLPs in the AMZI to boost the fund’s yield.

Enterprise Products Partners L.P. (NYSE: EPD) and Magellan Midstream Partners, L.P. (NYSE: MMP), yield 6% and 4.7% respectively. The AMZA management team overweight undervalued MLPs in the AMZI to boost the fund’s yield.

The AMZA charter allows the fund to use a moderate amount of leverage. The fund can use up to 33% leverage, which means that with $100 million of assets, it can own $133 million in MLP investments. The result is a 33% boost in yield, minus the small amount of interest paid on the borrowed money.

Finally, the AMZA managers are allowed to use options to boost the fund return. Selling call options on portfolio holdings can nearly double the income generated. Options can also be used defensively. When the price of crude oil was collapsing, the fund managers purchased put options on the price of oil, which produced profits as oil fell.

The bottom line result is that AMZA was able to continue to pay its high dividend right through the energy sector crash and the significant problems experienced by the MLP sector. Now that energy stocks and MLP values have stabilized, AMZA is poised to provide both a very high current yield and share price gains as MLP values continue to slowly recover to pre-crash levels. As I noted above, I have been following the AMZA fund since it launched two years ago and I am confident that the managers will produce above average returns for investors.

While the share value fell during the energy sector crash along with the rest of the MLP sector, the company’s income generating strategies worked through the worst period in the history of MLPs. This year, many investors and institutional investors have discovered this MLP and the assets in the fund have grown by eight times.

A stock like AMZA that won’t cut its dividend, pays a high current yield, and has the potential for dividend growth is an integral part of the income strategy for my newsletter, The Dividend Hunter. And the AMZA fund is a strong, stable dividend payer just like the 20 other high-yield stocks currently available through my Monthly Dividend Paycheck Calendar system for generating a high monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks every month and in some months up to 12 paychecks from reliable high-yield stocks built to last a lifetime.

The next critical date is Thursday, October 27th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $3,274.80 in payouts by November, but only if you’re on the list before October 27th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: ETFs