Sell These 6 mREITs Immediately

Real estate investment trusts (REITs) are an important component of a high yield portfolio for retirees or aspiring retirees. But there is one group of exotic, tantalizing REITs that must be avoided: mortgage REITs. Especially today.

Real estate investment trusts (REITs) are an important component of a high yield portfolio for retirees or aspiring retirees. But there is one group of exotic, tantalizing REITs that must be avoided: mortgage REITs. Especially today.

These so-called mREITs often offer high dividend yields—as high as 14% in some cases! That alone should tell you something is amiss. Unfortunately many investors get seduced by these short-term income streams, leading them straight into the arms of disaster.

What’s so bad about mREITs? Plenty, really. Let’s start with the income issue. mREITs are notorious for having uneven payouts, which means you cannot expect the next dividend to be higher or even the same as the one from last quarter or last month. In reality, mREIT dividends tend to go down a lot.

To demonstrate this, let’s look at six of the most popular issues: Annaly Capital Management (NLY), AGNC Investment (AGNC), ARMOUR Residential REIT (ARR), MTGE Investment (MTGE), CYS Investments (CYS) and Two Harbors Investment (TWO). The lowest yield of these is 9.3%, the highest over 14%. Why are the yields so high? Because the market knows these dividends are going to get cut—and the higher the yield, the sooner the cut is likely to come.

Want proof? Just look at the dividend history of these companies:

Payouts Go Down, Down, Down

Would you take a job if you knew you’d get less income from it in the future? Of course not. Then why would you take a stock if you know it will give you less income in the future?

Betting on mREITs is betting on falling payouts—dividends which will fall until the firm gets acquired by someone else or go bust. And, yes, plenty of mREITs have gone bust in the past.

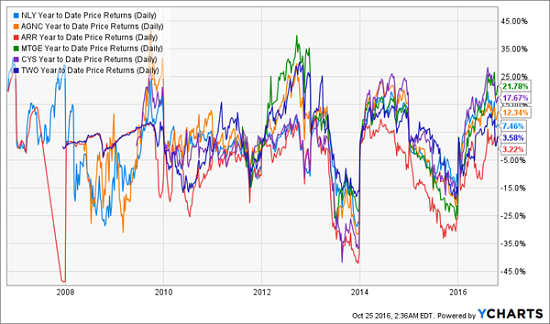

mREIT investors counter that they buy these stocks when they’re priced cheap. And it’s true that the price action here is incredibly volatile, meaning there are times to buy on weakness. Let’s take a look at price returns for these six mREITs over the last 10 years:

Wild Swings Make for a Wild Ride

If you bought mREITs at the end of 2013 when they were down 35% and waited a short time, you were in for a massive capital gains return very quickly. But that’s easier said than done.

In reality, mREITs are sensitive to a number of macroeconomic factors, including mortgage default rates, Treasury curves, bond yield spreads, the cost of leverage, and changes to management fee structure. They are especially interest rate sensitive – each tick up in rates makes their portfolios, which consist of fixed-rate issues, less valuable. This is the main reason why their dividends drop as rates rise.

Sure, if you’re an economic soothsayer who knows that the end of QE in 2013 would mean a massive spike in these mREITs in 2014, you could play a high-risk game of short-term swing trading, but are you in a position to do that with confidence and accuracy?

mREIT proponents will point to recent strength as proof that there are times when you can and should jump into these assets. And it’s undeniable that total returns for 2016 are impressive:

A Strong Year for mREITs

Of course, we need to remember it’s been a great year for REITs in general. We should also remember that low yielding Realty Income Corp. (O) has a year-to-date total return of 23.4%—putting it at the upper end of the group of mREITs. Also, O provided that return with significantly less volatility:

A Smoother Ride with O

In the darkest hours of the 2007-2009 financial crisis, O was down a bit over 25%, similar to the mREITs. But since then it hasn’t gone down more than 5%, meaning it’s given investors much less volatility and therefore risk but provided a comparable return in 2016. That demonstrates mREIT returns now only look good on the surface, but actually are just part of the wild volatility of the sector.

This doesn’t mean you should run out and buy O. REITs are an important component of a diversified high yield portfolio, but they aren’t the only part. Instead, it’s important to look at historical performance, dividend payout coverage, dividend history and the potential for future growth. On these metrics, mREITs do not look good. Some property REITs look much better, even though many remain overpriced.

So where should you look for meaningful yield today? That’s a big question, and there are many answers. REITs, high yield stocks, dividend growth stocks, and certain income funds with high quality management and good strategies are all ways that I create a No Withdrawal Portfolio that can provide me an income stream of 8% without the risk of falling income in the future that mREITs force on me.

I can also diversify across hundreds of high quality companies and various asset classes to protect me from shocks that occur from major economic forces.

This powerful combination of income and diversification results in a portfolio that never needs to be sold off, so if there’s a market downturn I don’t have to do anything—just keep collecting my dividends and wait for a recovery. Want to learn more? Click here and I’ll explain how the No Withdrawal Portfolio works, and how you can make one for yourself.

Category: REITs