Revealed: 4 Fast Buys To Give You $48,000 In Retirement Income

On average, an American retiree spends about $4,000 per month. But few of those retirees are getting $4,000 from their nest egg—which is partly why bankruptcy rates among retirees have been soaring for years.

On average, an American retiree spends about $4,000 per month. But few of those retirees are getting $4,000 from their nest egg—which is partly why bankruptcy rates among retirees have been soaring for years.

But there is a way to get $4,000 a month (or $48,000 a year) from your savings—even if you aren’t filthy rich.

And that’s the problem with today’s low-yielding stock market. To get $48,000 per year from the S&P 500, you’d need $2.76 million to put in the market. That’s because the S&P 500’s dividend yield is a crummy 1.7%—far lower than US Treasuries and way below its long-term average!

We can do better—and with little effort. For example, the 4 funds below will give you dividends that average out around $4,000 a month and diversify you across multiple asset classes, like common stocks, bonds and preferred stocks.

That gives you an extra margin of safety without limiting your income through “dead-end” investments like low-yield US Treasuries, which pay a pathetic 2.8% if you buy 10-year notes, meaning you’re guaranteed about a 0% return after inflation!

And speaking of inflation, don’t forget it hits retirees harder, since costs for things like health care grow much faster than what you’ll pay for many other routine purchases.

The bottom line?

We need to get more creative. We’ll start by doing an end run around US bonds and into bonds from some of the world’s biggest cash-producing international corporations. Now that corporate profits are rising in the double digits and company bankruptcies are falling, it just makes sense.

A New Approach to Income

We’ll need to do more than just buy a couple corporate bonds from a broker, though. That’s because brokers often sell some of the worst-quality bonds to smaller clients, since the big institutions have already snapped up the best issues.

But don’t worry; we can easily invest alongside the big institutions. To do it, we’ll use funds that diversify across hundreds of bonds while still paying big dividend yields. And we’ll use “smart beta” funds that avoid many of the pitfalls of dumb index funds, which force investors into a lot of losers alongside the winners.

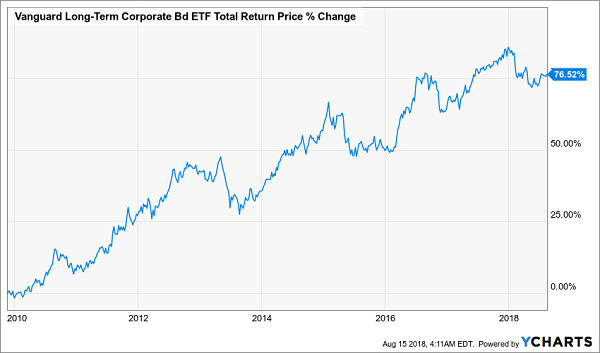

Which brings me to the first fund I want to show you today: the Vanguard Long-Term Corporate Bond ETF (VCLT), which pays a 4.4% yield that has helped this fund’s total return soar since its IPO nearly a decade ago:

High Yield Gooses VCLT’s Return

VCLT is attractive because it limits itself to investment-grade, high-quality companies and diversifies across 77 investments. Its biggest positions are in companies known for financial prudence and steady cash flow, such as Regions Financial (RF) and Dow Chemical (DOW), with the rest of the portfolio spread across other multinationals.

Big Dividends From Blue Chip Stocks

On top of bonds, our portfolio will need stock exposure, as well.

We all know the market has been on a tear since 2009, and while we can’t expect it to go up forever, we know that stocks have a tendency to rise steadily over the long term. We also know that dividend stocks tend to provide more reliable long-term growth and that we can count on the best ones to keep up their dividends in most market conditions.

So let’s get a piece of this action with two “smart beta” ETFs focusing on strong dividend-paying companies: the Global X SuperDividend US ETF (DIV) and the SPDR S&P 500 High-Dividend ETF (SPYD). With just these two funds, we’re getting a diversified portfolio of over 70 companies across different sectors, with exposure to everything from technology to real estate to health care.

You could get similar diversification with an index fund, like the SPDR S&P 500 ETF (SPY), but then you’d be stuck with dividends of 2% or less. No thanks!

Instead, DIV and SPYD can give us a diversified portfolio and an average dividend yield of 5.3%. And thanks to their stalwart portfolios, these funds have provided steady gains over the past year, in addition to their big dividend payouts.

2 “Steady Eddie” Picks

Even so, neither fund has fully caught the market’s attention to this point, but that’s not too surprising; both are relatively new, and many investors just don’t know they’re out there.

The Power of Preferreds

There’s one other secret that many investors aren’t really clued into: preferred stocks. They act like common stocks, but the market for preferreds is much smaller and tougher for everyday investors to get into.

That doesn’t mean they’re illiquid, though. Big institutional investors, such as hedge funds, love these things and buy them often. Back in 2008, Warren Buffett bought a ton of preferred stock in Goldman Sachs (GS), an investment that ended up getting him a 19% annualized return by the time he sold out.

So how can we follow the Oracle of Omaha’s lead? These aren’t the kinds of assets we can just buy through our online brokerage accounts; we need an insider’s help. Luckily, there are a few actively managed funds that give us just that. And they have big dividends, because preferred stocks tend to have much higher yields than common stocks.

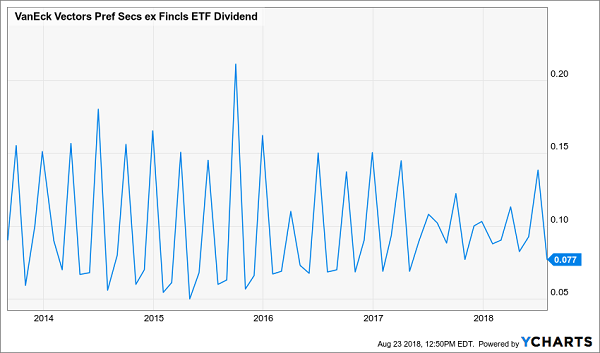

For instance, the Market Vectors Preferred Securities Ex-Financials Fund (PFXF) is paying a 6.0% dividend thanks to the 111 preferred stocks in its portfolio. And although the fund’s dividend is choppy because preferreds pay out at different times of the year, PFXF’s payout has remained around the same level, on average, over the last few years:

A Reliable Income Generator

Putting It All Together

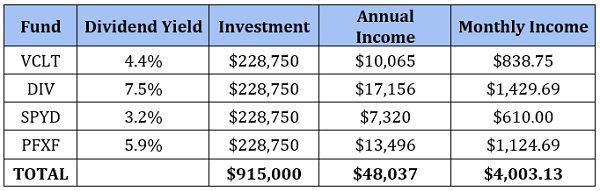

Combined, you can use only these four funds to get a bit over $4,000 per month in retirement income if you have $915,000 to invest. Here’s how the numbers break down:

With $228,750 in each fund, we’re getting a bit more than $4,000 in monthly income, thanks to the average 5.3% yield on these 4 funds. We’re also getting bonds, stocks and exposure to high-quality companies boasting familiar names and sterling profit histories.

The 8 Best 8% Dividends with Big Upside to Buy Today

Most Wall Street spreadsheet jockeys say we investors can’t have both the income and safety of bonds and the upside of stocks. We have to choose, or allocate, or whatever.

They’re wrong. My 8% “no withdrawal” retirement strategy lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out stocks and funds funds that:

- Pay 7%, 8% or better…

- Have well funded dividends…

- Trade at meaningful discounts to their intrinsic values…

- And know how to make their shareholders money.

If you’re an investor who strives to live off dividends alone, while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my no withdrawal approach – plus I’ll share the names, tickers and buy prices of my three favorite closed-end funds for 8.5%, 8.7% and 8.9% yields.

Category: ETFs