Sector ETFs – Don’t Trust Labels

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Finding the best ETFs is an increasingly difficult task in a world with so many to choose from. How can you pick with so many choices available?

Don’t Trust ETF Labels

There are at least 39 different Financials ETFs and at least 178 ETFs across ten sectors. Do investors need 17+ choices on average per sector? How different can the ETFs be?

Those 39 Financials ETFs are very different. With anywhere from 21 to 401 holdings, many of these Financials ETFs have drastically different portfolios, creating drastically different investment implications.

The same is true for the ETFs in any other sector, as each offers a very different mix of good and bad stocks. Consumer Staples rank first for stock selection. Energy ranks last.

Paralysis By Analysis

We think the large number of Financials (or any other) sector ETFs hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many ETFs. Analyzing ETFs, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each ETF. As stated above, that can be as many as 401 stocks, and sometimes even more, for one ETF.

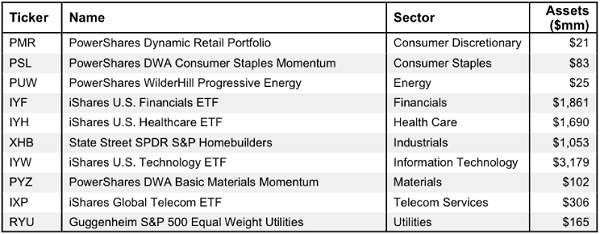

Any investor focused on fulfilling fiduciary duties recognizes that analyzing the holdings of an ETF is critical to finding the best ETF. Figure 1 shows our top rated ETF for each sector.

Figure 1: The Best ETF in Each Sector

Amongst the ETFs in Figure 1, PowerShares Dynamic Retail Portfolio (PMR) ranks first overall, iShares U.S. Financials ETF (IYF) ranks second, and iShares U.S. Technology ETF (IYW) ranks third. PowerShares DWA Basic Materials Momentum ETF (PYZ) ranks last. Sources: New Constructs, LLC and company filings

How to Avoid “The Danger Within”

Why do you need to know the holdings of ETFs before you buy?

You need to be sure you do not buy an ETF that might blow up. Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. No matter how cheap, if it holds bad stocks, the ETF’s performance will be bad.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

If Only Investors Could Find Funds Rated by Their Holdings

Our ETF ratings leverage our stock coverage. We rate ETFs based on the aggregated ratings of the stocks each ETF holds.

PowerShares Dynamic Retail Portfolio (PMR) is not only the top-rated Consumer Discretionary ETF, but is also the overall best sector ETF out of the 178 sector ETFs that we cover.

The worst ETF in Figure 1 is PowerShares DWA Basic Materials Momentum ETF (PYZ), which gets a Neutral rating. One would think ETF providers could do better for this sector.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, sector, or theme.

Article was contributed to ValueWalk.com by David Trainer and Kyle Guske II – New Constructs

Category: Sector ETFs