Staying Out Of The ETF Graveyard

The ETF industry is booming, with over $240 billion of net inflows to U.S.-domiciled ETFs since the start of 2017. Yet 36 ETFs have closed since New Year’s Day. It’s not the end of the world to have your ETF close; at termination, you get cashed out at the final Net Asset Value. Most of us would rather avoid the hassle, though. Nobody likes to pay capital gains taxes or to have to choose a replacement fund. For advisors, there is an additional issue: the embarrassing client conversation.

The ETF industry is booming, with over $240 billion of net inflows to U.S.-domiciled ETFs since the start of 2017. Yet 36 ETFs have closed since New Year’s Day. It’s not the end of the world to have your ETF close; at termination, you get cashed out at the final Net Asset Value. Most of us would rather avoid the hassle, though. Nobody likes to pay capital gains taxes or to have to choose a replacement fund. For advisors, there is an additional issue: the embarrassing client conversation.

You can avoid the ETF graveyard by sticking to giant funds, as no issuer has ever closed a fund with $1 billion or more in assets. But that approach can be limiting, as only 16% of today’s U.S.-domiciled ETFs are that big.

Not long ago, investors could feel secure in sticking to big issuers. Asset managers with more than $50 billion had the wherewithal to prop up struggling funds. Alas, some key asset managers have lost patience. BlackRock started actively pruning its lineup in 2014; State Street Global Advisors followed suit in 2016. Issuer culture has shifted.

Except where it hasn’t. Vanguard and Charles Schwab have never closed an ETF. PowerShares reversed course and has closed only 14 funds since 2014, after closing 44 in the preceding five years.

Predicting ETF Peril

This erratic behavior makes it imperative to keep up-to-date on each issuer’s business model. Although nobody outside the boardroom can predict an issuer’s strategy shift, investors can respond by increasing caution once an issuer has signaled that it will no longer protect every fund in its lineup.

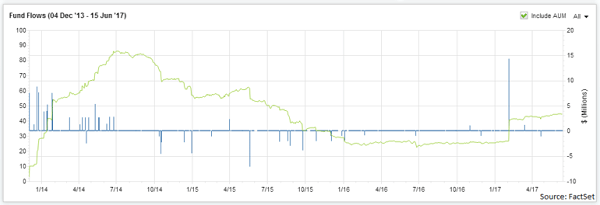

FactSet ETFs produces an ETF closure risk metric using inputs that evaluate each ETF’s business environment. The metric and its inputs evolve with the markets. Most recently, we began using net ETF inflows as a mitigating factor, gradually decreasing the risk level for funds that show recent asset growth. Net inflows will replace the issuer size factor, as issuer culture has shifted

Some inputs are worth keeping. Asset levels remain a significant factor in the ETF closure risk model. But asset levels don’t exist in a vacuum. Context is key, as we saw in the fund flows example. The ETF closure model raises the risk level when low-asset funds are subject to regulatory risk or corporate actions like mergers.

Issuer culture matters more than ever, so funds like the Cambria Foreign Shareholder Yield ETF (FYLD) score as low-risk because Cambria held on during the 2016 dry spell.

It pays to watch the competitive landscape, too.

In August of 2016, State Street Global Advisors threw in the towel on its $25.6 million SPDR Barclays International High Yield Bond ETF (IJNK-US), leaving the global ex-U.S. high yield bond ETF segment to the $130 million VanEck Vectors International High Yield Bond ETF (IHY-US). Yet SSgA left its developed ex-U.S. sector suite open for business, despite the fact that, as of August 1, 2016, the suite’s average asset level was identical to IJNK’s—$25.6 million. The difference? SSgA has no competition in the developed ex-U.S. sector space.

Finally, like most asset managers, the model give new funds a chance to establish themselves by rating all new launches as low risk for the first six months.

Every forecast has to balance between exaggerating risks and downplaying them. For our part, FactSet’s ETF Closure Risk tool keeps its forecast conservative and will continue to evolve as the ETF industry changes.

Note: This article was contributed to ValueWalk.com by Elisabeth Kashner, FactSet.

Category: ETFs