These 2 “Silent Wealth Builders” Are Set To Soar (And Yield 6.8%+)

Real estate investment trusts (REITs) sound boring, but the truth is they’re the hottest investments out there. And today I’m going to give you two great ways to buy in: both are REIT-focused funds with big yields—I’m talking 6.8% and up!

Real estate investment trusts (REITs) sound boring, but the truth is they’re the hottest investments out there. And today I’m going to give you two great ways to buy in: both are REIT-focused funds with big yields—I’m talking 6.8% and up!

You’ve no doubt noticed that REITs get little attention in the financial press. That’s because the media is obsessed with stories of big growth or big failures, and REITs are rarely one or the other. Instead, they help you quietly build wealth by providing big income and gains year in and year out.

Today I’m going to give you three reasons why REITs are a great buy now.

Then I’ll show you those two REIT-focused funds I just mentioned. They get you into this often-overlooked asset class with even bigger dividends than you’d get if you bought REITs individually.

REIT Advantage No. 1: REITs Crush the Market

The simplest and most compelling reason to buy REITs is this: you’ll get richer faster with REITs than you will with other types of stocks.

You only have to look as far as one of the most popular REIT-focused ETFs, the SPDR Dow Jones REIT ETF (RWR). Since inception, RWR has easily beaten the S&P 500—shown in blue below by the SPDR S&P ETF (SPY)—and the Nasdaq 100, shown in orange by the performance of the Invesco QQQ Trust (QQQ):

Real Estate for the Win

Short-term thinking causes investors to miss out on REITs, however, because they often look at shorter periods, see that real estate is lower, and ignore the asset class. But if you’re in it for the long run, you’re looking at the potential for serious outperformance with just a simple REIT index fund.

But of course, we’re going to do even better than that, as I’ll show you shortly.

REIT Advantage No. 2: They’re Recession-Resistant

This might come as a surprise, but REITs were one of the best asset classes to hold during the Great Recession.

Even though that crisis was driven by plummeting real estate prices and a lot of bankrupt mortgage derivatives, REITs largely held strong: while the recession did put a drag on rents in some situations, just because everyone was suffering, relatively few REITs failed during the meltdown.

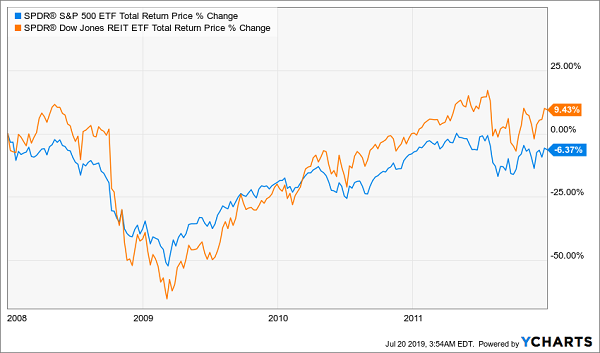

More importantly, the REIT market fully recovered faster than stocks did.

Real Estate Recovers Faster After Real Estate Crisis

While just about every asset class was down from 2007–09, real estate recovered by the end of 2010 and was in positive territory just a few months later, while stocks were still down from pre-recession levels.

And even during the recession, most REITs continued to pay their high income streams.

Which brings me to the best reason to buy REITs: income.

REIT Advantage No. 3: Their Dividends are Monstrous

As a whole, REITs pay much higher dividends (due to tax law: they have to in order to maintain their REIT status), which means RWR pays out double the dividends of the S&P 500, with a 3.7% yield.

And that’s not the best yield you can get. Not by a long shot.

Many REITs pay out dividends of 6% or more. That means more tactical REIT funds can pay out investors huge income streams, with 7% and higher incomes being common.

2 REIT-Focused CEFs With Outsized Dividends

A good way to invest in REITs is to find a fund that has done the work for you: pored over the income statements, looked into the properties the REIT owns and then decided to buy.

There are many closed-end funds (CEFs) that will buy a large number of REITs and pass on the income to you—and you can buy these funds on an exchange, just like any other stock or ETF.

And their payouts are huge.

Take, for instance, the RMR Real Estate Income Fund (RIF), which pays a 7% dividend and trades at a huge 20.2% discount to the total market value of the REITs it holds.

You can buy RIF, collect the income and sit back and wait for the market to buy in, too, giving you capital gains and a huge cash stream over the long haul.

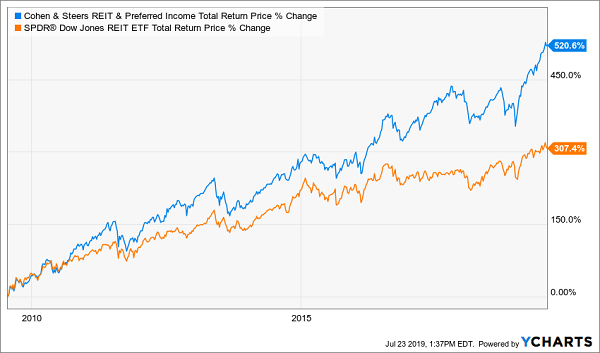

Want to diversify even further? The Cohen & Steers REIT and Preferred Income Fund (RNP) has a nice 6.7% dividend stream and balances its REITs with preferred shares in other companies; although its discount is smaller, at 6.4%, RNP has a solid track record of beating the index and adapting to changes in the market since the Great Recession:

Crushing the Market

The bottom line? If you’re in it for the long haul, 500%+ total returns and 7%+ dividends are entirely possible with REIT CEFs.

Revealed: The 4 CEFs You Must Buy Now (8.7% Dividends, 20% Gains Ahead)

As I just showed you, CEFs really do give you the best of all worlds: the huge dividends you need in retirement, plus price upside to grow your nest egg over the long haul.

And CEFs go well beyond REITs. Right now I’m pounding the table on four other incredible funds that could give you a balanced portfolio all on their own.

This quartet gives you high, safe dividends (8.7% yields, on average, with the highest payer throwing off an amazing 10.7%). Those reliable payouts are backed by stable utilities, bonds and, yes, REITs.

Here’s the real kicker: all four of my top CEF picks now trade at ridiculous discounts to NAV, setting us up for 20%+ price upside in the next 12 months!

If you think that kind of growth is impossible from a dividend fund, think again: one of these four cash machines, a 9.3% payer, has already outrun the market this year with a 27% return.

Here’s the surprising part: despite that gain, this fund is still a bargain, trading at a 7% discount to NAV. Which is part of the reason why I’m calling for another 20%+ gain in the next 12 months, to go with this fund’s rich 9.3% payout.

This is the beauty of investing in CEFs, and I can’t wait to share the name of this fund with you, plus my three other top CEF buys, too. Click here and I’ll give you full details on these four powerhouse income plays: names, tickers, buy-under prices and more.

Category: Closed-End Funds (CEFs), REITs