These 7,643 Funds ALL Crush The Market. Here’s The 1 To Buy Now

If you’ve been told it’s impossible to outperform low-cost index funds because the market’s too efficient, you’ve been lied to.

If you’ve been told it’s impossible to outperform low-cost index funds because the market’s too efficient, you’ve been lied to.

The truth is, there many funds out there that have been beating the broader stock market for years. And here’s something really surprising: there are more funds pulling off this feat now than there have been in a long time!

In fact, across ETFs, mutual funds, and closed-end funds (CEFs), there are 7,643 funds that have beaten the S&P 500’s 7.62% return over the past year.

So much for not beating the market!

Besides the fact that not choosing the low-fee passive fund will get you superior returns, you might be also be surprised by one other fact I just threw out there: a 7.62% return for stocks in general over the past year.

“But isn’t the stock market crashing?” you might say.

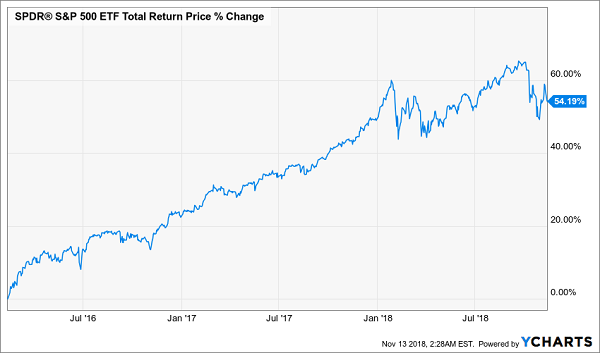

Well, not really; while we’re 6.7% off the market’s all-time high, reached a couple months ago, stocks have indeed gone up by that much over the last year:

A Totally Normal Year for Stocks

What’s more incredible is that the stock market’s long-term average return is about 7.5%, so this is pretty much in line with what you should expect from the market over the long haul.

Again, if this isn’t the message you’ve gotten from the mainstream financial press, you’re not getting the real truth.

So if stocks remain a solid bet for long-term gains, despite short-term volatility, does that mean it’s time to throw your money into the market?

The answer is yes, especially now. Because after the market’s recent selloff, it’s gone from an abnormally high short-term return to a more normal one, meaning you’re getting stocks much cheaper than if you threw your money in when the market was so euphoric.

Welcome to the world of contrarian investing.

Here’s an example of how timing can work for (and against) you: let’s say you bought the Invesco QQQ Trust (QQQ), an index fund that tracks the Nasdaq 100, in December 2015 and held until now—nearly a 3-year period. You’d have gotten a nice 38.8% return over that time, or a profit of about 13% per year:

13% Annualized Gains Are Nice …

But if you waited until the silly market panic of February 2016, your gains would be a whopping 54.2%—or a return of over 18% per year:

… But 18%+ Annualized Gains are Nicer!

There is just one snag with QQQ: the income is lousy. With a measly 0.79% dividend, QQQ is hardly the kind of fund you can retire on. And while you could buy and then sell when the market gets overhyped and use your gains for income, that’s tough to do: not only will you have to time the market by analyzing the technical and fundamental movements of the companies QQQ holds, you’ll also have to have the fortitude to sell when the market is euphoric, which is almost as hard as buying when the market is panicking!

Fortunately, there’s a better way.

There are a few tech funds out there managed by people with decades of experience who will do this work for you, all the while giving out regular dividends.

Closed-end funds are well regarded for their ability to do this, giving you a convenient way to cash in on the market’s average 7.5%-ish return with a steady income stream.

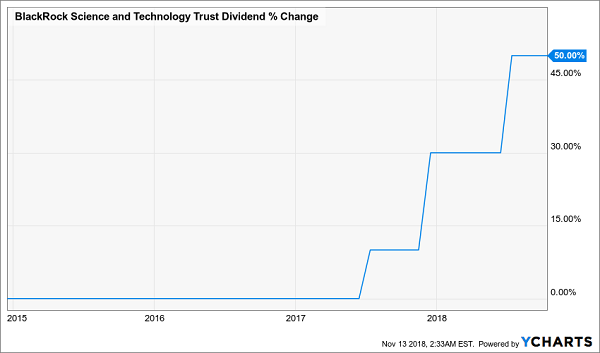

So instead of buying QQQ and stressing, you can buy the BlackRock Science & Technology Trust (BST) instead. This fund’s 6.4% dividend isn’t only secure, it’s been going up, making it a rare high-dividend and dividend-growth fund:

Payouts on the Rise

How is BST able to raise payouts? Simply put, its dividend yield is far below its average return. Since QQQ has gone up double digits per year, on average, for over a decade, BST has easily been able to match that return and more than cover its 6.4% dividends, since it invests in the same stocks that comprise QQQ.

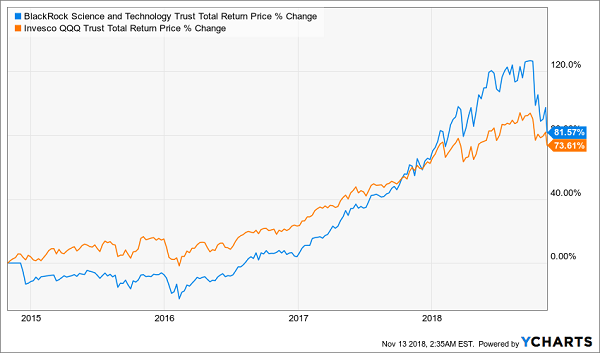

But what makes BST even better is that it’s been crushing the index for a long time—since inception, in fact:

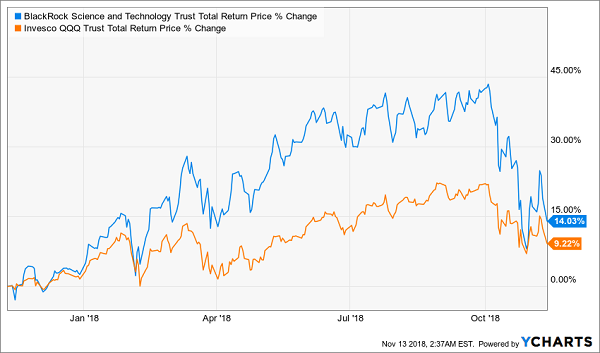

BST Tops the “Dumb” Index Fund

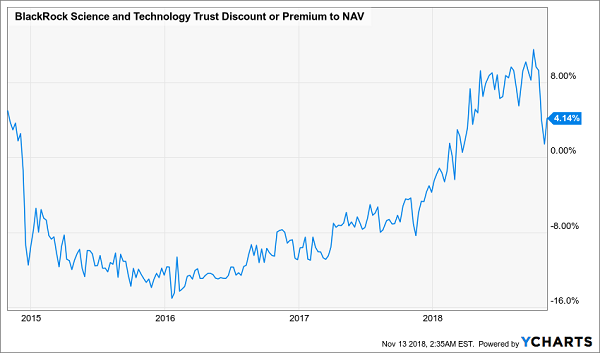

That has also attracted investor interest, causing the fund’s discount to net asset value (NAV, or the market value of its underlying portfolio) to turn into a premium earlier this year—but that premium has recently halved with the market’s volatility:

Premium Performance Attracts … a Premium

In almost all cases, I recommend investors buy CEFs when they trade at a discount. But I would make an exception for BST, thanks to its stellar track record, which is getting better. While QQQ is up less than 10% over the last year, BST is up 14%:

Crushing the Market

Also, note how the tech sector is still beating the broader market (remember, the S&P 500 is up 7.6% over the last year).

That might come as a surprise if you’ve read headlines about a bloodbath in the tech space. While there has been a big correction lately, tech is still leading the pack. And with strong earnings from the sector so far in 2018, expect investors to realize that the tech correction is overblown, causing both QQQ and BST to soar.

Think You Can’t Retire on Dividends Alone? It’s Easy. Here’s How.

I’m talking an 8% CASH dividend—enough for you to retire on dividends alone with a $500k nest egg.

And we won’t have to wait another minute to do it! We can tap this cash deluge right NOW. The key? The 6 breakthrough investments in my 8% “No-Withdrawal” Portfolio.

As the name suggests, these 6 buys hand you what few other investments can: a safe—and growing—8% dividend. It couldn’t be simpler: just swap out the stale Dividend Aristocrats in your portfolio for these 8%+ cash machines.

Because as long as your income stream is safe, who cares what Mr. Market gets up to on a daily basis?

Many folks know this is the way to invest for retirement. They just don’t know where to find the ironclad 8% payers to get themselves there.

That stops today, because the answer is just a click away. Go right here to get full details—I’m talking names, tickers, buy-under prices and more—on the 6 rock-steady cash machines in my 8% “No-Withdrawal” retirement portfolio now.

Category: Closed-End Funds (CEFs)