This “3-Buy” Portfolio Protects Your Loved Ones And Yields 8%

Our Contrarian Income Report mailbag served up an important question from a reader this week. What are the perfect retirement dividends to buy and hold forever?

Our Contrarian Income Report mailbag served up an important question from a reader this week. What are the perfect retirement dividends to buy and hold forever?

Our subscriber is retired and manages investments for him and his wife. He asked me how to build a portfolio that will give her reliable income, with little maintenance, if he can no longer look after their investments himself.

It’s a great question, and one that’s likely occurred to you, too. So let’s tackle it.

3 “Autopilot” 8% Dividends You Can Buy Now

While we always feel you should at least check in on your investments from time to time, let’s go ahead and piece together a portfolio we’d feel pretty comfortable buying and tucking away for the long term.

We’re going to do it with just three buys.

When we’re done, our three-fund portfolio will hand us a diverse collection of investments built to hold up in any market, throw off a steady 8% dividend and pay dividends monthly, to boot.

A monthly payout that large gives us four critical advantages:

- The ability to live on dividends alone: with a $500K nest egg, our portfolio would pay $40,000 in yearly dividends, more than enough for a healthy retirement for most folks—especially for a single person.

- No daily ticker parade, because as long as your dividends are secure (and covering your bills), why would you want to stay glued to the market’s daily gyrations?

- Faster reinvestment: With monthly dividends and a dividend reinvestment plan, our portfolio will automatically reinvest our payouts faster than with quarterly dividends, enhancing our return further.

- A legacy: With your principal intact, you can leave more cash to your kids (or grandkids) to pay for education, for example, or maybe help buy a first home.

We’re going to add one “safety valve” to keep our “autopilot” portfolio off the rocks: professional management.

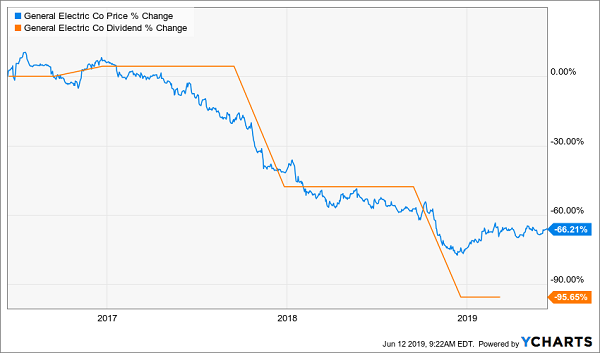

Because if we’re not around to manage our investments, we risk our portfolio running into a “dividend dumpster fire” like General Electric (GE) and not being able to bail out!

GE’s Dividend Death Spiral

So how are we going to hire our “managers”?

Simple. By investing in actively managed closed-end funds (CEFs). These funds are famous for their high yields, with payouts of 7% and up common in the CEF space.

Today I’m going to show you three of the most established CEFs in the business. All are run by smart money minds, and all trade at serious discounts that lock in our upside (and hedge our downside, too).

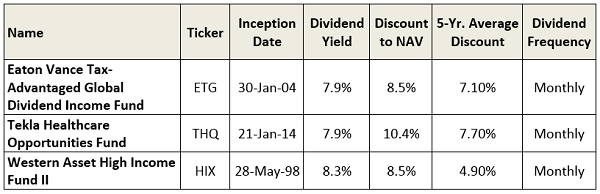

Here they are:

Our Monthly 8% Dividend Portfolio, By the Numbers

Now let’s take a look at each of our picks individually:

CEF Pick No. 1: A 7.9% Dividend Backed by 95 Years of Experience

Despite the “global” in its name, the Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG) holds a large portion of its portfolio in the US (41.5%), with most of the rest in Europe (53.2%) and the Asia-Pacific (4.4%).

Management firm Eaton Vance, which traces its roots to 1924, has loaded ETG with solid US companies—tech stalwarts Alphabet (GOOGL), Amazon.com (AMZN) and Microsoft (MSFT) make the top-10 list.

ETG also holds “megatrend” stocks like France’s Veolia Environnement SA (VEOEY), which helps companies cut pollution and boost efficiency—a business that will never go cold, particularly in these climate-obsessed times.

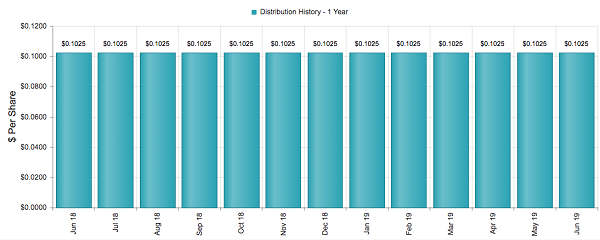

Another thing that makes ETG perfect for our “autopilot” portfolio: one of the steadiest CEF dividends out there. This fund yields 7.9%, and its dividend has held steady for more than a decade.

A Monthly Payout You Can Set Your Watch To

Source: CEF Connect

Finally, ETG trades at an 8.5% discount to net asset value (NAV, or the value of its portfolio), well below its five-year average of 7.1%. So we’ve got plenty of upside ahead as its discount reverts back to its normal level.

CEF Pick No. 2: A (Cheap) One-Stop Pharma Buy Yielding 7.9%

The Tekla Healthcare Opportunities Fund (THQ) is our youngest fund—barely five years old—but its bench strength is as strong as you can get.

THQ is run by Tekla Capital Management, a Boston firm with a team of medical doctors and boots-on-the-ground researchers. Dr. Daniel R. Olmstead runs Tekla, which he joined nearly 20 years ago. His researchers come from big players, like Merck & Co. (MRK.B), as well as tiny biotech firms.

If you’ve been investing in pharma stocks for a while, you know that success here is all about a company’s drug pipeline. And THQ’s savvy crew gives us the closest thing to inside knowledge of these firms’ pipelines we can get.

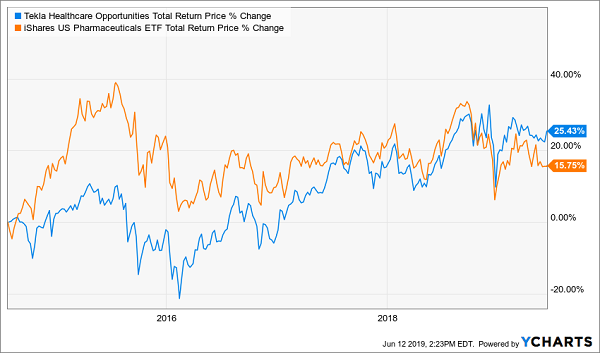

Their approach has paid off: check out how THQ has pummeled the iShares US Pharmaceuticals ETF (IHE), including dividends, since the CEF’s launch in January 2014:

The Power of Expert Management

And thanks to THQ’s mammoth 7.9% dividend (compared to just 1.2% for IHE), most of that return was in cash.

These days, our pharma all-stars are honing in on some of the biggest companies in the space, with the most robust pipelines, including Pfizer (PFE), Amgen (AMGN) and Gilead Sciences (GILD).

THQ also holds a few non-pharma names, like health insurer Anthem (ANTM).

Overwrought fears of lower healthcare spending, driven by Democrats’ “Medicare for all” proposals, have weighed on pharma stocks. That’s made THQ a bargain, at a 10.4% discount to NAV, well below its five-year average of 7.7%.

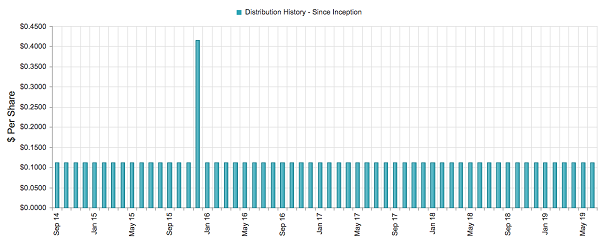

That’s way too cheap for a fund paying 7.9% today and whose monthly dividend has held steady (not to mention a one-time special dividend paid a few years ago) since inception.

A Steady 7.9% to Pay Your—or Your Loved Ones’—Bills

Source: CEF Connect

The time to move on THQ is now—then you can lock it up for decades.

CEF Pick No. 3: A Diversified Bond Fund Yielding 8.3%

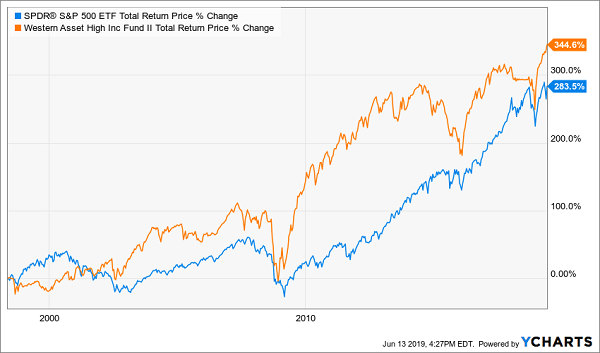

The Western Asset High Income Fund II (HIX) is a high-yield bond fund with a long history of strong performance. The fund, run by Legg Mason (LM), which has been in the fixed-income business for 48 years, has tripled in value (including dividends) since its IPO in the late 1990s, crushing the S&P 500.

HIX Shows Why It’s a “Forever Fund”

HIX gives investors that strong return while yielding 8.3%. Legg Mason generates HIX’s payout through a portfolio that includes high-yield corporate bonds (61.4%), emerging-market debt (22.2%), bank loans (6.5%) and investment-grade corporate bonds (5.9%).

And if you’re worried about rising interest rates hurting HIX, don’t be: the average duration of its bond holdings is a long 6.2 years, and long-duration bonds tend to perform well as rates fall.

We’ve already seen that in action since January, when Fed Chair Jerome Powell put interest rates on pause—and HIX’s gains have accelerated now that rate cuts—possibly starting as early as July—are on the table:

“Powell Pivot” Powers HIX

The fund’s historically high total return and consistent share-price performance make it a good fit for our “autopilot” portfolio. The fact that it’s trading at an 8.5% discount to NAV—well below its five-year average of 4.9%—makes it particularly compelling now.

Why an 8% Dividend Strategy Is Critical Now

Our subscriber’s question stood out to me because it’s something everybody wants: their money to last forever.

The beauty of an 8%-dividend portfolio is that it gives you just that: with, say, $500K, you can live on dividends alone, generating a $40,000 annual income stream on your nest egg.

A Smooth Income Stream

Even better if you’re getting your dividends monthly, because you won’t have to deal with “lumpy” quarterly payouts: using our $500K example, you can look forward to a smooth $3,333 dropping into your account, month in and month out.

The really nice thing is that this strategy is scalable: got $750K? Great! You’ll get $5,000 a month in income. A cool mil gets you $6,666.

Which brings me to …

My 3 Top 8% Monthly Dividend Plays Now

As strong as the CEFs I just showed you are, you can do even better if you go with my 3 very best picks in the 8%+ dividend world.

These 3 “monthly dividend superstars” also throw off an 8% average dividend, paid monthly. But they have one critical difference from the 3 funds above:

Bigger upside!

Thanks to my top 3 picks’ bargain valuations, they’re primed to hand you 10%+ price upside year in and year out, on top of their 8% income stream. Put it together and you’re looking at an 18% yearly return here—in just 3 buys!

I’ve put my complete research on these 3 timeless dividend plays in a new free report that’s waiting for you now. Click here to grab your copy and get the full story on these monthly 8% dividend-payers: names, tickers, my unvarnished take on their management and strategy—everything you need to know before you buy!

Category: Closed-End Funds (CEFs)